2024: The Year of Cryptocurrency Evolution – Bitcoin ETFs, Halving, and AI Integration

With a Bitcoin Spot ETF expected tomorrow an ETH Spot ETF in Q2, and much more happening in a fast-maturing crypto ecosystem, we look at the key trends for 2024.

As we venture into 2024, the cryptocurrency landscape is witnessing pivotal transformations that are reshaping its future. This year promises to be significant in the evolution of digital currencies, with major developments spanning regulatory decisions, technological advancements, and strategic integrations.

Core to the hype around 2024 is the likely approval of a spot Bitcoin ETF tomorrow, a milestone that could redefine Bitcoin’s role in the broader financial ecosystem. Additionally, the anticipated Bitcoin halving event, the burgeoning synergy between crypto and AI technologies, innovative practices like re-staking in the Ethereum network, and the tokenization of real-world assets (RWA) represent the other key trends.

These developments not only reflect the dynamic nature of the cryptocurrency market but also signal its growing maturity and increasing interest from institutional investors. As we delve into these developments, it becomes evident that 2024 is set to be a watershed year for cryptocurrencies, marking a significant leap towards their mainstream acceptance and integration into the global financial landscape.

2024 Crypto Broad Market Trends

Speculation and Optimism Surrounding the Bitcoin ETF

Tomorrow, the market should finally know whether we are going to have an accessible retail spot Bitcoin ETF or not. The SEC has been backed into a corner by the courts and numerous insiders have said the SEC will finally make a definitive decision on whether an easy-to-invest in ‘paper Bitcoin’ will be released to the masses.

Most say this decision will arrive on January 10th, 2024. This is the final deadline for a decision on Cathie Wood’s Ark 21 Shares spot BTC ETF application. Many believe that the SEC will take this opportunity to approve or reject the 12 other major spot BTC ETF applications also waiting for a decision. Most expect the SEC to, after significant time and legal pressure, approve the Bitcoin ETFs.

In late August 2023, the DC Circuit Court of Appeals ruled that the SEC had acted “arbitrarily and capriciously” in rejecting Grayscale’s proposal to convert its Bitcoin Trust (GBTC) into an ETF that would track the price of Bitcoin directly. The court ordered the SEC to review its decision and provide a clear rationale for treating different types of Bitcoin-related products.

Grayscale won the case by arguing that the SEC had violated the Administrative Procedure Act by approving futures-based ETFs while rejecting spot-based ETFs without providing a reasonable explanation. Facing further lawsuits from ETF applicants it has been suggested by insiders that the SEC will be leaning towards approval for these ETFs which will likely trigger a price and fee war between spot BTC issuers.

So if it appears likely that a spot Bitcoin ETF will be approved, and soon, what does this mean for price in 2024? The approval of a spot Bitcoin ETF is viewed as a key bullish event for the asset. It signals a long journey for the asset to legitimize itself as an institutional-grade investment. It is a vindication of the asset’s resilience and the underlying demand to access it.

There may be some early speculators who will sell their positions if the ETF is approved, using a ‘buy the rumor, sell the news strategy’. There is a chance that the price of BTC may drop in the short term after the ETF is approved, as some traders capture profits built from positive speculation surrounding the ETF, exiting the market as the trade becomes crowded. This is only likely to be a possible short-term effect and overall spot ETF approval should be bullish.

While many may say that Bitcoin is a straightforward, lightweight asset that can be purchased on mainstream apps like PayPal and the Cash app, a spot Bitcoin ETF would still greatly widen the net of access. Bitcoin and the digital asset class are still emerging, so it is difficult for large investors with mandates to fit them into their allocations.

There are also regulators to consider. Bitcoin price exposure in the form of structured products built by major financial institutions like Blackrock and trading on noted, regulated ETF exchanges like the NYSE Arca and CBOE will be easier to add to institutional portfolios.

Pension funds, insurance funds, and others are reported to be waiting for vehicles like spot Bitcoin ETFs as tools to gain BTC exposure. The spot Bitcoin ETF promises to truly make BTC a mainstream investment option.

The Halving

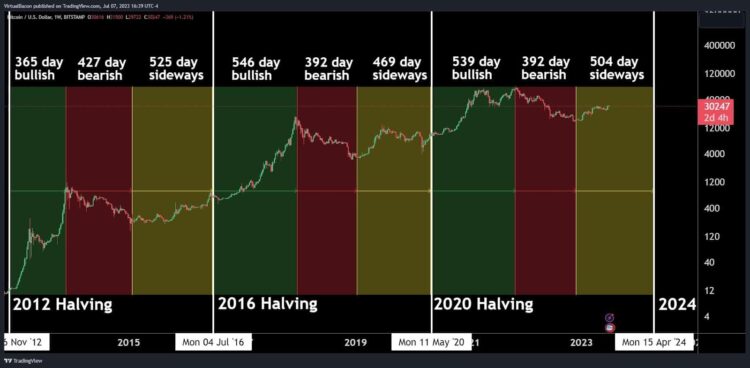

The halving is now estimated to be 100 days away. At block height 840,000, expected to occur in April 2024, Bitcoin’s block reward for successfully mined blocks, will halve from 6.25 coins to only 3.125. This will continue at the same rate for another 210,000 blocks. Roughly another four years. This system makes BTC a deflationary asset. It has hardcoded scarcity and new supply cannot be arbitrarily created to bail out the network. The halving occurs approximately every 4 years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

The Bitcoin halving is also a pivotal moment in crypto markets because of the strong positive effect it has on the price of BTC. Assuming demand stays constant, a cut in the emission rate and the rate of new BTC supply created should lead to an increase in the Bitcoin price.

Source: Twitter user, @TakeshisReturn

Historically price activity has been sideways or moderately bullish in the lead-up to the halving and then begins to hit macro cycle peaks 10-11 months post-halving. In the lead-up to the April 2024 halving, as expected BTC is enjoying a period of steady gains.

If the halving prophecy is to be believed and history repeats itself, then BTC should be expected to hit new all-time highs in 2024 and a price peak in 2025.

Blockchain and AI

There is undoubted market excitement surrounding the intersection of Blockchain and AIs. The two represent powerful technology paradigms that have already revolutionized and affected our views on big-picture concepts like money and automation. Crypto tokens that have an AI connection exploded in value in 2023, as tools like ChatGPT and MidJourney evidenced the powerful capabilities of AI to the mainstream market.

Bittensor (TAO) — US$71.58 – US$260.19, up ~264% (6-month price performance)

Render (RNDR) – US$2.14 – US$4.13, up ~93% (6-month price performance)

Fetch.ai (FET) – US$0.23 – US$0.69, up ~199% (6-month price performance)

SingularityNET (AGIX) – US$0.26 – US$0.28, up ~8% (6-month price performance)

While cynics expound that there is no real connection between Blockchain and Artificial Intelligence, there is an argument that AI needs to be more decentralized. With the current model for AI, there are concerns surrounding privacy and security. Currently, AI tools use large caches of data to train models. For example, the Chat-GPT3.5 model was trained using text databases from the internet. There was 570 GB worth of data from books, web texts, Wikipedia, articles, and other pieces of writing on the internet. 300 billion words are believed to have been fed into the system. All stored on OpenAI and stored internally.

Additionally, technology giants like Google and Microsoft are the builders and owners of the largest AI solutions. They are managing the data being fed into the models, a situation that many observers see as unfair and imbalanced.

There are several decentralized data storage and access solutions being built to support AI’s large data requirements, in a decentralized manner. This includes the two largest AI token projects Bittensor and Render. While these projects may not be able to wrestle market share away from the giants of tech, they do have a market and speculators adore them.

Decentralized Finance (DeFi)

ReStaking

Restaking is a new form of yield generation that is resonating with ETH stakers and network participants. This is the process of locking up Liquid Staking Tokens (LST) for extra yield. Users receive LSTs when depositing ETH for staking and consensus participation on a protocol like Lido or Rocketpool.

These tokens like stETH and rETH, are certificates of staking and indicate a version of ETH that is staked. Users earn staking rewards by holding LSTs. LST holders do not have to worry about locking up their ETH and sacrificing potential DeFi profit generation. Instead of having to deal with a deposit and withdrawal process, they manage an asset like stETH, which is very similar structurally to ETH but grows in value based on how long a staker has held them.

Liquid staking has been a godsend for DeFi users on the fence about whether they should stake their ETH. Liquid restaking grows this paradigm and gives liquid stakers a new way to boost yield, and additionally boosts the security of apps on the Ethereum ecosystem.

Users receive LSTs by depositing tokens like stETH earned from protocols like Lido or Rocketpool into protocols like KelpDAO. Users already earning yield by staking by holding LSTs now have the opportunity to earn even more.

There is a purpose to Restaking, this is not a Ponzi-nomics scheme based purely on a promise of future rewards. Restaking supports the Eigenlayer, a middleware solution that boosts the wider security of Ethereum. Eigenlayer pools allow individual users to align their security with Dapps and layer-2s.

EigenLayer is designed to be a restaking marketplace, where users can choose the decentralized applications and layer-2s they wish to back and share security resources with. Users participating in liquid token restaking through the Eigenlayer are essentially powering layer-2 projects and apps seeking to boost their security by tapping into a shared pool of stake. More details here.

Real World Asset Tokenization (RWA)

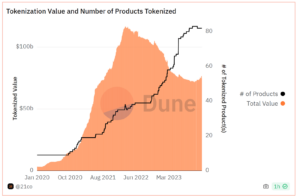

Real World Assets, in the context of the blockchain sector, refer to physical assets such as real estate, art, music, and commodities brought to the blockchain through tokenization. Tokenization is the process of creating a digital version of a physical real-world asset through a trustless smart contract. Developers generally create smart contracts that issue a token representing an RWA alongside an off-chain guarantee that the issued token is always redeemable for the underlying asset.

While 2023 was a strong year for this specific sector 2024, promises even more strong gains. RWAs have been considered a holy grail amongst crypto investors and product builders. The size of global real estate, carbon, gold, art, and music markets, to name a few potentially tokenizable RWAs, is enormous, dwarfing the crypto market itself. These physical asset markets are often noted for having high barriers to entry and inefficient trading systems.

Permissionless, decentralized blockchain systems have the clear potential to disrupt and improve those systems. Tokenization can make these assets more liquid and accessible to participants. Investment Bank Citi says that the Blockchain-based tokenization of real-world assets is the next “killer use case” in crypto. The bank forecasts that the market will reach between $4 trillion to $5 trillion by 2030.

Reports that major banks like JPMorgan are rumored to be exploring fund tokenization and public blockchain deployment are adding fuel to the RWA hype. This is a trend that will only grow as blockchain becomes more mainstream, something that is set up to occur in 2024.

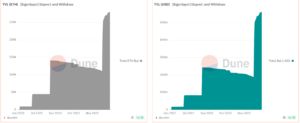

Source: Dune Analytics, user: 21.co

Source: Dune Analytics, user: 21.co

The number of users and RWA assets grew aggressively in 2023.

Conclusion

Underpinning the market optimism for 2024 is the likely approval of a Bitcoin ETF and the halving event. These are poised to catalyze a paradigm shift in Bitcoin’s valuation and adoption.

Other exciting trends include the fusion of blockchain with AI technologies to build decentralized data funnels. Practices like Restaking and the tokenization of real-world assets highlight the sector’s evolving sophistication and practical utility.

These developments collectively signify the growing acceptance of cryptocurrencies. 2024 is set to be the year when crypto breaks through the public consciousness. As we move forward, the cryptocurrency market continues to challenge traditional financial norms, paving the way for a more decentralized, accessible, and technologically advanced financial ecosystem.

Don’t miss out – Find out more today