Bitcoin hash rate hits new all time-high as mining hardware continues to join the network

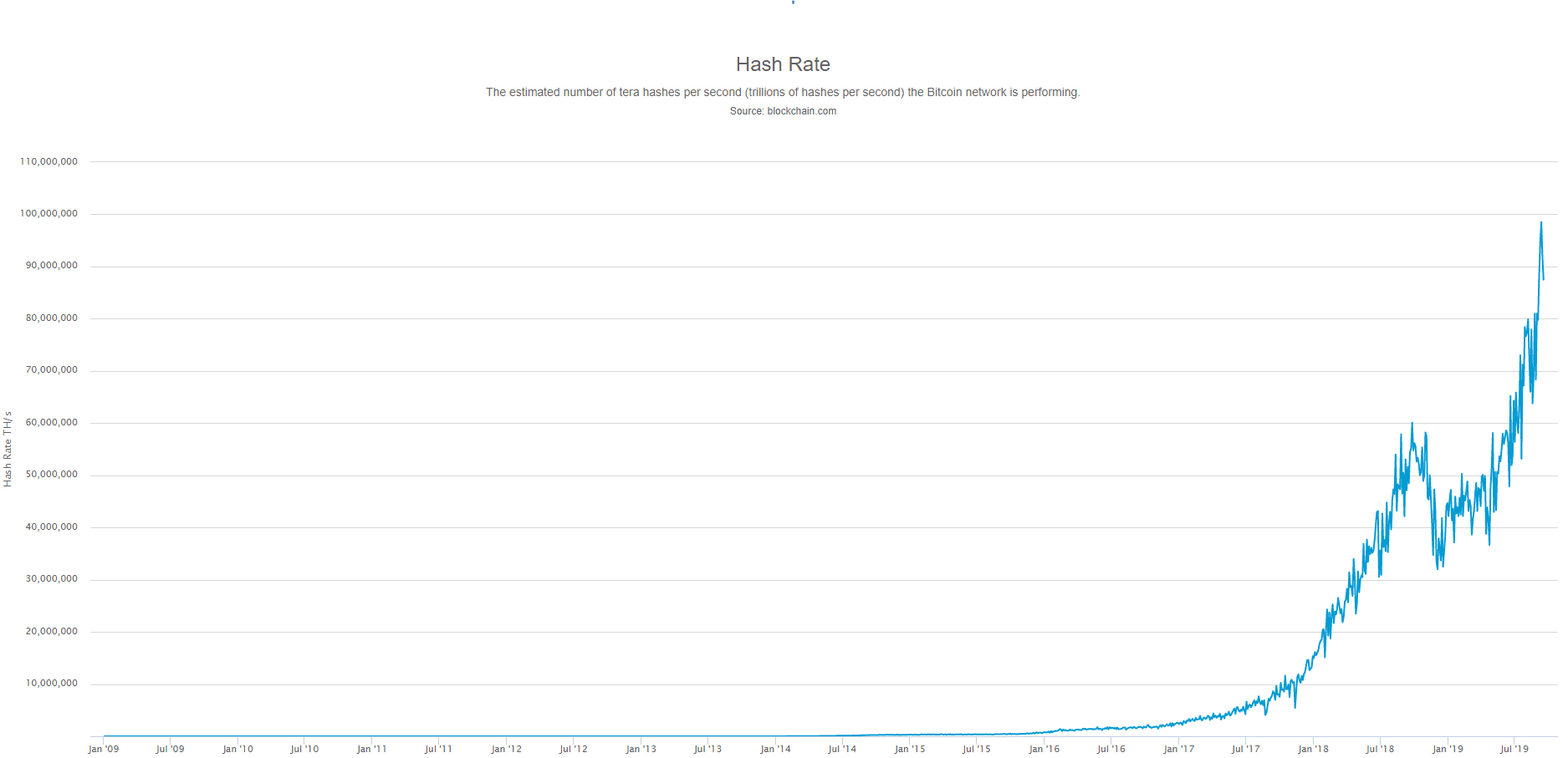

Fundamental indicators show strong growth on the Bitcoin network. The two-week average hash rate reached a record high of 99 exahashes per second on Monday, while the mining difficulty jumped to nearly 12 trillion.

A high hash rate is an indication of a healthy bitcoin mining environment. It means a growing number of miners are joining the network and competing with each other to process transactions and solve the block reward puzzles. This proof-of-work makes the Bitcoin blockchain secure and immutable.

Bitcoin Hash Rate. Source: blockchain.com

From an investor’s point of view, the hash rate is an interesting metric to follow as it shows that miners are investing in and deploying new equipment, possibly in anticipation of a rising BTC price.

As an over 500 percent increase in both metrics, this theoretically indicates the robust health of the Bitcoin network.

Assuming there is not just one entity responsible for the majority of the hash power, then a higher hashrate means a more secure network, as more hash power would be needed to carry out a 51 percent attack.

A new wave of powerful chips

Though hashrate could be expected to rise naturally over time as mining chips gain more processing power, the reasons behind the recent surge are not clear.

Many analysts have observed a correlation between rising hashrate, and the rising price of bitcoin — with some suggesting that miners invest in more equipment either in anticipation of a rally, or to make the most of higher prices after a rally.

The more direct explanation for the increasing hashrate, however, is a recent boost in the efficiency of mining equipment.

As a report from TokenInsight reveals, chip manufacturers struggled to cater to demand from miners in the first part of 2019, but have since released more sophisticated equipment that is allowing miners to step up their game.

Several new application-specific integrated circuit (ASIC) chips have hit the market in the last few months, and have been distributed across mining operations like those operating in the Southwestern provinces of China, where they have been taking advantage of cheap and plentiful hydroelectric power during the rainy season.

Bitmain’s Antminer T17 is one such chip. Launched in April, the miner has 73.9 percent more computing power, and 17.9 percent more power efficiency than the previous model — meaning it can compete to solve the equation needed to release new bitcoin blocks using less energy and at less cost to the mining company.

According to TokenInsight, cloud mining platforms like BitDeer and VeryHash may also have contributed to the surging hashrate.

Both platforms use a remote data center with shared processing power to mine bitcoin, offering investors an alternative method of acquiring the cryptocurrency. Instead of buying bitcoin through an exchange, they can purchase a plan to lease mining equipment and pay for ongoing operating costs. In the first part of 2019, these plans sold out on soaring demand.

"The cloud computing power mining has a certain cost advantage relative to buying coins," according to the TokenInsight analysts. "This cost advantage is obvious especially when coin prices are soaring. Because cloud computing power contracts are standardized products, their price is relatively stable. The contract product price will not be adjusted quickly as the coin price fluctuates. This creates a low-risk arbitrage opportunity."

More mining plants

Ultra-powerful chips might not be the only thing pushing up the bitcoin hashrate. Over the last six months, several countries have shifted their stance to accommodate the bitcoin mining industry, potentially increasing the hash power flowing through the network.

In the Canadian province of Quebec, the local energy regulator ordered Hydro-Quebec to allocate 300 megawatts (MW) power to the blockchain industry to attract miners and rejuvenate the local economy.

Some American nation-state adversaries appear to have legitimized and expanded mining operations, possibly as an alternative source of income, or as a strategic move.

After seizing mining equipment from mosques and abandoned factories, Iran officially approved cryptocurrency mining, making it a legal industry.

Russia invested 7.3 million in June to build a 4,000 square meter mining operation on the site of a former nuclear power plant in the Leningrad region and has followed China’s lead in Eastern Siberia by building an international mining hub in Siberia at the Bratsk hydropower station.

As mining chips continue to become more powerful and the industry is embraced by more countries around the world, the bitcoin hashrate may continue to rise.

According to TokenInsight, some of the latest Antminer models are still out of stock and are currently being sold for delivery in October and November this year. At an optimistic estimate, this new hardware could soon push Bitcoin computing power up 72 percent to reach 127 exahashes per second. This would suggest a bullish move from Bitcoin in Q4.

Don’t miss out – Find out more today