Bitcoin Price Analysis – The trend is your friend

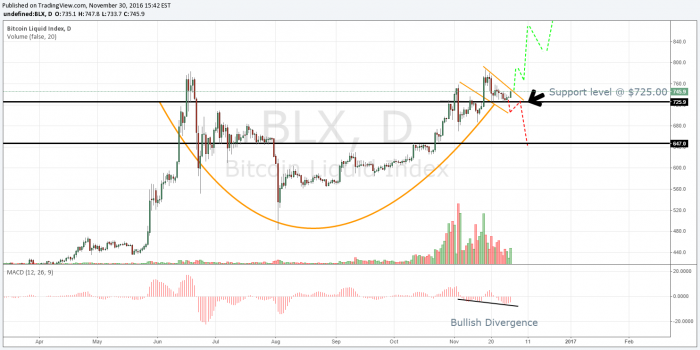

The larger bitcoin trend remains a bullish week, having touched $750 before closing at $745. The spot price is well within the uptrend channel, the MACD momentum oscillator has printed a bullish divergence pattern, and a cup and handle pattern appears to be forming.

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candlestick analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy. The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes.

Market Sentiment And Macro Key Points

-

The scaling debate is heating up. We have been seeing a steady rise in miners signalling for Segwit, while Big blockers are threatening to block the patch.

-

The San Francisco Municipal Railway (MUNI) has fallen victim to a ransomware attack. The hacker demands 100 Bitcoin to return control of computers.

-

EY outlines blockchain technologies ‘legal impacts’. EY has been extremely active in the bitcoin and blockchain space recently, including becoming the first of the Big Four accounting firms to accept bitcoin for their services in Switzerland, where they have installed an BTM machine in their lobby and gave bitcoin wallets to their employees.

Long Term Technical Analysis

The larger bitcoin trend remains a bullish week, having touched $750 before closing at $745. The spot price is well within the uptrend channel, the MACD momentum oscillator has printed a bullish divergence pattern, and a cup and handle pattern appears to be forming.

Long Term Trade Idea

There are two likely scenarios that could play out in the long and medium term. First, we see a push beyond $850.00, should the cup and handle formation complete. The second scenario is a pullback to $650.00, before a push higher. A retest of support at $725 may provide an opportune dip for long entries.

Short Term Trade Idea

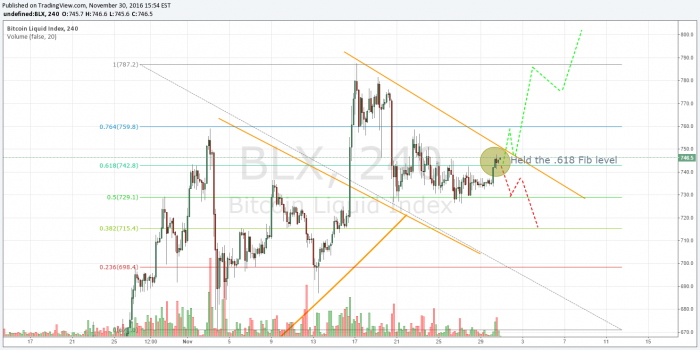

Zooming in to the 4hr chart gives us a better idea of what to expect. We can see that Bitcoin has consolidated above $725.00, which now acts as support. We can also see that it recently broke through the .618 Fibonacci level, a bullish indicator. $740 may be a alternative entry for traders working with shorter time frames.

Conclusion

We are still currently trending up with no indications of stopping at this point. Historically this type of uptrend will have an exponential rise before we see a trend reversal.

Disclaimer: The information presented in this article is general information only. Information provided on, and available from, this website does not constitute any investment recommendation.

Don’t miss out – Find out more today