Bitcoin Price Analysis — The weak hands are out

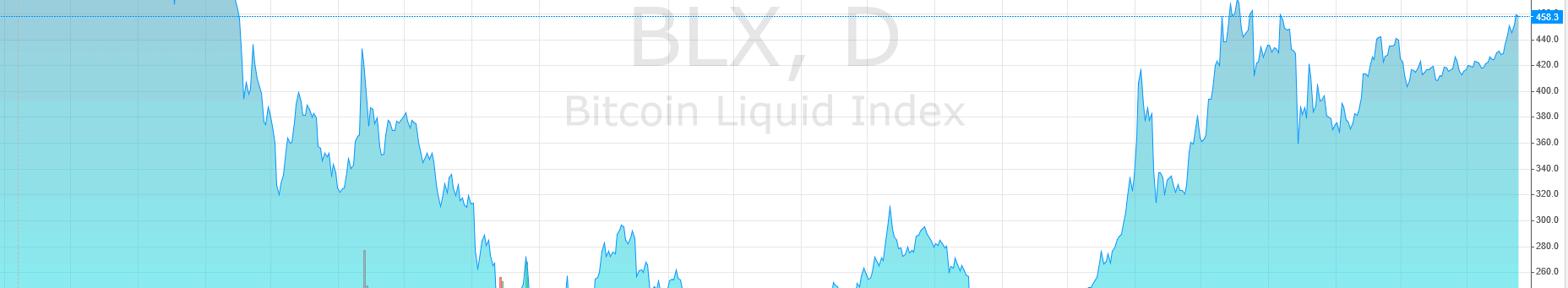

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy. The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes.

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candle analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy.

The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes.

Market Sentiment

This section is based on internal (anonymized) Whaleclub trading data and is published exclusively on BNC.

Current Active Long vs Short Volume Ratio: 4.65:1

Average Active Long vs Short Volume Ratio:2.4:1

We have a 265% excess in active long volume relative to the average! This signals massive bullish sentiment.

Prior to the price dump from $470 to $435, that ratio was even higher, 5.1:1 long vs short.

The average weighted long entry price is $453.32, which means that on average, active longs are in the red (losing). This entry price is relatively high and indicates that many players may have bought the top area around $470 in Fear Of Missing Out (FOMO).

Sentiment is highly bullish, like last week, almost exuberant. It seems that many players are looking at the $470 to $435 price dump as an opportunity to “buy the dip,” and capitalize on further upside.

The pullback, as outlined before the event in last week’s report, was the result of high volume long positions and almost inexistent short positions. This presented a perfect long squeeze setup.

Traders who went long at the top around $470, when exuberance was at its highest, were left either margin called or forced to close their positions at a loss, triggering a sort of “selling cascade.” Long position volumes are still high however, which signals that the risk of another brutal price dump is higher than average, should those positions be squeezed.

Macro Key Points

This section is an overview of news headlines or events that may affect BTCUSD.

-

Full blocks and network scalability issues are again in the news, with bitcoin investor Roger Ver and Coinbase CEO Brian Armstrong tweeting about transactions failing to go through, because block sizes have reached their 1MB limit. This once again brings the bitcoin scaling debate to the surface, which still has no concrete solution in sight.

-

The bitcoin block reward halving is estimated to occur on July 10, 2016, in about 10 weeks. The supply will halve – and assuming demand remains the same, the post-halving value per bitcoin is around $890. Extrapolating this based on the current market price, the present value of one bitcoin is around $220 – an attractive entry price.

Technical Analysis

4h+ Timeframe Setup

The strong breakout we predicted last week has occurred, with prices reaching as much as $475, which was a key target level. Since then, we’ve witnessed a pullback to the low $430’s with the market now trading in the $445 to $455 range.

Price retouched our green resistance trendline (above which it broke out) and promptly bounced. This is generally a bullish sign: bulls who missed the breakout were more than happy to buoy the market by buying at the breakout price.

Next, we chart our new key daily support and resistance levels.

The $440 to $480 area is riddled with heavy resistance levels. These are formed by historically attractive sell prices at $460, $470, $480, and the large candle wick formed at $500.

Now let’s switch to the 4h timeframe to dig a little deeper. Our daily trend lines, support, and resistance levels are preserved.

The strength of the breakout gives us confidence that, with time, this resistance will be overcome. Price pumped as much as 7% above the breakout level before pulling back and retouching our resisting trendline.

This heavy volume breakout is a good sign of bullishness. As long as price does not make new lows, or re-enter below our green resistance (now turned support) trendline, the trend remains bullish.

Our newly formed support in the $435-$440 area is strong and we see any price movement into this area as a buying opportunity.

The $470 to $435 dump may have scared many rookie players. But in the context of the market dynamics we outlined in last week’s piece, where long positions were stacking up at a very high rate) it was hardly surprising.

It only took a few large and smart players to sell at the top to start pushing price down, against a market that was literally out of buying power. All it could do was sell – which is why the dumps were so aggressive.

But although much selling occurred, no lower lows were made. This indicates that most of that selling was in fact just bulls closing their long positions – not bears stacking up shorts and expecting the price to continue falling.

Trade Ideas

So it seems we are in a likely buy-the-dip situation. Our $435-$440 buy zone should be bought, especially on low volume selling.

From there, price will gather the fuel needed to at least make swing highs, and perhaps new highs above $470.

In the same spirit as last week’s analysis, we deem it more likely than not that price will indeed break through resistance, albeit more slowly than what most would expect. We see the $460 – $500 area as a battleground between new “smart” money buying bitcoin and old “smart” money looking to take profit on their $400 area longs.

We expect a zig-zagging of pumps and pullbacks, with a bullish bias supported by aggressive retail buying.

In any case, the downside is limited, especially with the bitcoin halving event getting closer. Barring any bearish fundamental catalysts, a dip to $430-$440 is a high probability bullish setup and should be bought.

A more aggressive setup is to buy the current $445-$450 area. We expect a similar zig-zagging as the market drifts and takes a breather after two successive and brisk moves (the aggressive breakout above $440 and the violent dump from $470).

From a risk management perspective, entering half your position at these levels and waiting for an eventual dip to $440 to enter with the rest may make sense.

It’s also wise for us to consider the bearish scenario. Although we consider downside to be limited, price can “hug” our green resistance-turned-support trendline without breaking it. It could then make lower lows around $430.

If it does break down below it, our next buy zone would be in the low 400s.

We’d rather wait to buy those dips rather than risk playing the short side, the market’s bias and overarching trend is bullish.

Disclaimer: The information presented in this article is general information only. Information provided on, and available from, this website does not constitute any investment recommendation.

Petar Zivkovski has a Master’s Degree in Mathematics and Computer Science. He spent 10 years trading for BlackRock before assuming his current role as the director of operations at Whaleclub.

Don’t miss out – Find out more today