Bitcoin Price Analysis: Volume Decreasing

While debates over the Block Size issues appear to have died down, the problem has not yet been resolved. The most likely outcome will be an announcement that there will be a small block size increase, while a more permanent solution is being put together.

While debates over the Block Size issues appear to have died down, the problem has not yet been resolved. The most likely outcome will be an announcement that there will be a small block size increase, while a more permanent solution is being put together. The Lightning project seems like the most promising solution, but it will be interesting to attend the second part of the Scaling Workshop in Hong Kong to truly understand where things are headed.

In the meantime, following the crash in late August there has been a period of low volatility which has calmed down many speculators, but we are not expecting this to last. Volume has also been slowly decreasing which may be due to regulatory concerns, although this is yet to be proven. The simplest explanation is usually the correct one.

The continued debates, that have been dominating the headlines, now involve traditional financial institutions. At a conference in New York City this week there were two panels titled Bitcoin vs Blockchain. This has now become the primary debate, and what people need to realize is that Bitcoin will never be in direct competition with Private Blockchains. It would be like saying that private Intranets are in competition with the open public Internet.

Financial institutions need communication tools using the latest technology, and they would like to do so openly between each other, but with privacy from the general public. This is understandable, and is why many organizations are now funding projects that provide a solution. While it is too early to say who is in the lead, the top three funded groups are now Chain, R3CEV, and Digital Asset Holdings, following the purchase of Hyperledger. Ripple is also in this race, but having a token that anyone can speculate on may put them at a disadvantage, or perhaps give them a leg up. The truth of the matter is, no one really knows.

Meanwhile the Bitcoin Blockchain continues to strengthen unabated. Even with the recent Malleability Issues and the spam attack at the end of September, the honey badger keeps chugging along, while all the Alt-Coin competitors continue to be less and less relevant by the month. This is a good sign for the Bitcoin faithfuls.

As for opinions on where the technology might be headed, it’s easy to find people on both ends of the spectrum at any event. Some have taken to the stage saying that Bitcoin is on it’s last legs and will not last, while others like the CEO of Veritasium, Reggie Middleton, think Banks as we know them will not exist in the very near future. There is also talk about how there is a push to eliminate cash, which is a topic we have focused on here and in the Bitcoin Trader Reports.

So when the opinions are so diverse, we can look to Technical Analysis to help guide us.

Market Outlook

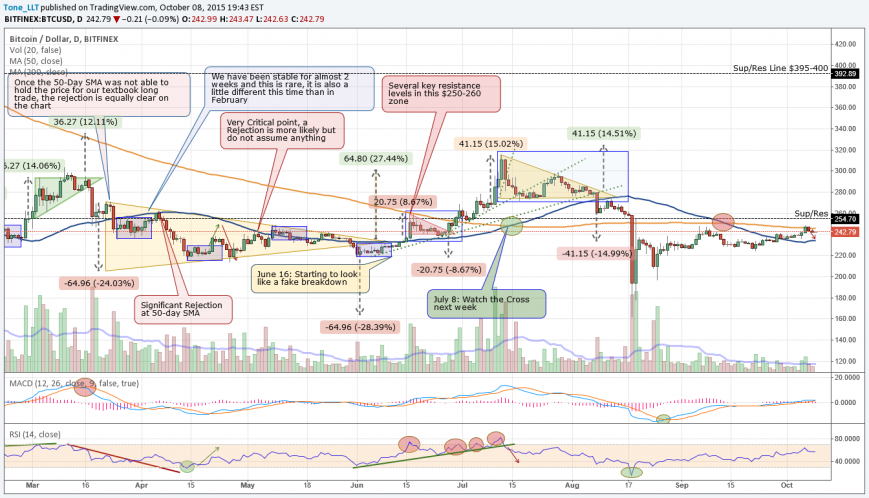

The technical picture has been Neutral for quite some time, but that is about to come to an end. The end of the year should bring some volatility. Here is the Short Term chart which was posted in the Trader’s Report a few days ago, when the price was hitting a 6 week high of $248.

The report explained what usually happens when we hit the 200-day Simple Moving Average (SMA), we should be expecting a fall in prices. We turned Bearish on the Short-Term outlook earlier this week and right now the odds favor continued downside to the 50-day SMA, which once again has a positive slope. The make or break point would be around $235, if indeed we do fall there as the technicals are suggesting.

The more detailed Explanation of the Short-Term chart above, as well as Intermediate-Term and Long-Term outlooks, are reserved for subscribers of the BraveNewCoin Traders Report. It also breaks down all the relevant weekly news, and its influence on Bitcoin’s price and general standing within the financial ecosystem. These last few weeks we have also been focusing on global economics, what kind of an affect market disruptions, including bank closures in Europe or the strengthening US Dollar, might have on the Bitcoin ecosystem.

Final Thoughts

The biggest issues about to hit the Bitcoin Ecosystem would be regulatory. Recent documents that have surfaced indicate that the most popular peer to peer Alt-coin exchange, Cryptsy, might be in serious legal trouble. The more troubling news is that they are just one company on a “top 10” list being investigated by a combination of US agencies including the SEC, CFTC and several others. Most likely any company that released a coin/token or engaged in a financial contract is now potentially in bit of trouble. The primary issue for Cryptsy appears to have been exchanging crypto currencies for bad actors. Once the subpoenas start coming down, Bitcoin will face another one of these critical moments, but just like the takedown of Silk Road, a technology useful in so many way will find a way to move forward.

This article was completed on Thursday October 8th 8:30 pm ET, when BraveNewCoins Index showed Bitcoin price at $243 USD.

Tone Vays will be a speaker at the following upcoming events:

LibertyFest New York City Oct 10 – 11.

Inside Bitcoins Seoul, South Korea Dec 9 – 11.

Inside Bitcoins San Diego Conference Dec 14 – 16.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today