Brave New Coin Weekly Bitcoin halving countdown update: 3rd April

Brave New Coin has launched a countdown to predict the date and timing of the Bitcoin Halving. This weekly report summarizes the data provided by BNC's halving prediction models and analyzes the macro factors influencing the halving countdown.

What is the Halving?

Bitcoin is a decentralized digital currency that enables instant payments to anyone, with no central authority. The Bitcoin network is secured by miners which are specialized computers that use a consensus mechanism called “proof of work” to verify each block of bitcoin transactions.

The miner that verifies each block is rewarded for their work with newly-created bitcoins. This ‘block reward’ is how new bitcoins are released into the system. A new block of transactions is added to the Bitcoin blockchain approximately every 10 minutes. The current reward is 12.5 bitcoins per block.

An average of 144 blocks are mined every day which means approximately 1,800 new bitcoins are generated every 24 hours.

The number of new bitcoins that are created via the block reward is reduced by half every four years. This is known as the Bitcoin Halving. The next halving will be the third halving, and the current block reward of 12.5 bitcoins will reduce to 6.25 bitcoins.

This week in the halving countdown

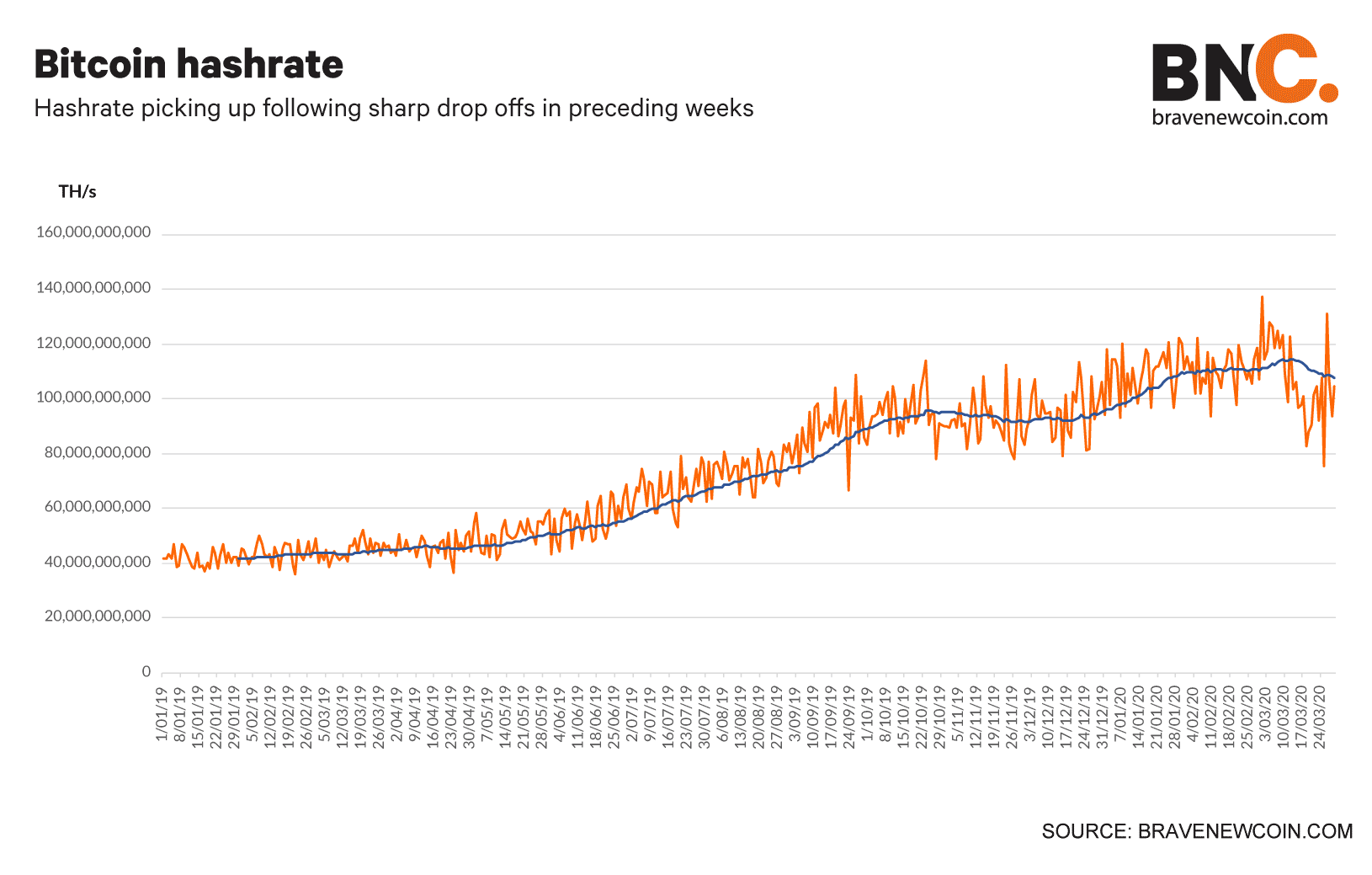

The Bitcoin network’s hashrate trended downwards again last week, pushing the halving prediction dates out to the second half of May.

This week’s consolidated (across all Brave New Coin prediction models) Bitcoin block reward having prediction date is 15/05/2020 0:07.

The consolidated prediction date from a week earlier was 17/05/2020 08:05. This week’s predicted date is 55 hours and 57 minutes earlier than last week. Each model is recalculated every day. The consolidated block halving prediction date is significanlty earlier.

The Bitcoin network’s hashrate marginally recovered last week following apparent miner capitulation the week before. It now appears clear that the long term uptrend the Bitcoin network’s hashrate has been in was impacted by the far reaching economic consequences of the global COVID-19 outbreak.

Globally it appears that the demand to mine Bitcoin, or purchase Bitcoin mining hardware, is diminishing. The price of BTC has dropped heavily since mid-March and miners are seeing their spending capabilities fall away as the global economy faces long term unemployment and diminishing capital.

In Canada for example, oil fields which often choose to mine Bitcoin as a hedge are no longer experimenting with this option and choosing to protect resources instead. Steven Barbour of Upstream, a Canadian mining service that supports oil fields said this week, “Pretty much every Canadian oil producer is basically telling their staff to do nothing and spend no money, and we’re a service provider for those companies. “We were growing, month by month. This month is flat and I’m expecting next month to be down.”

The tendency for the hashrate and BTC price to drop off pre-halving is normal. Old miners choose to switch off machines before an eventual drop in mining profitability post halving, and there is an adjustment period where electricity output is reallocated amongst remaining miners. The popular stock-2-flow predictive model remains on track despite recent price drops. It is also acknowledged that scarcity effects and price gains in BTC markets tend to happen a few months post halving once block producers adjust to new mining profitability. It is still too early to suggest the bullish halving narrative is off the cards.

Halving prediction dates

Average predicted block halving date 22/03/2020 across the 8 different models= 16/05/2020 02:04

Average predicted block halving date the week before across the 8 different models= 14/05/2020 01:41

Difference= 48 hours & 23 minutes later

Date Convergence charts

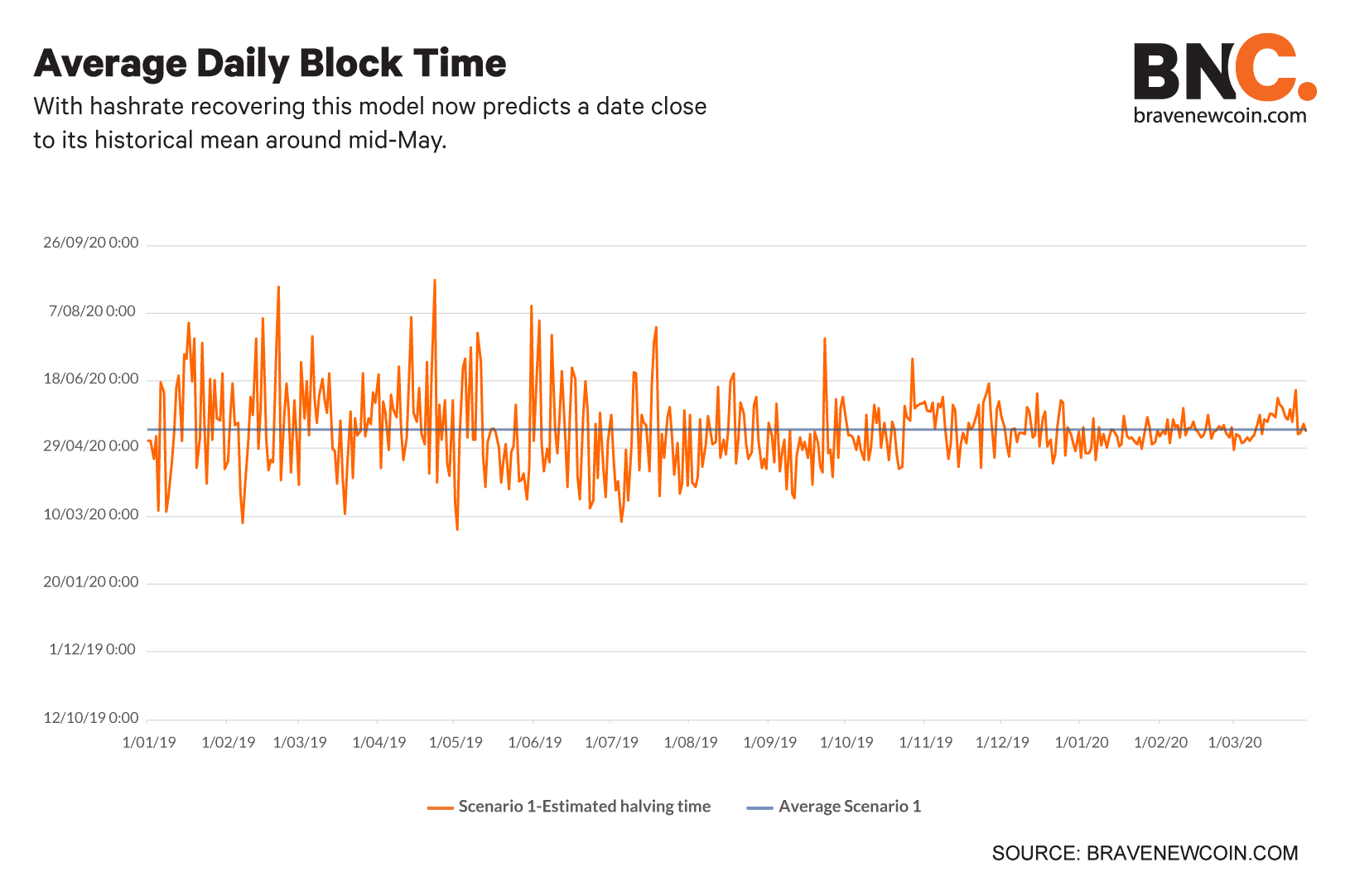

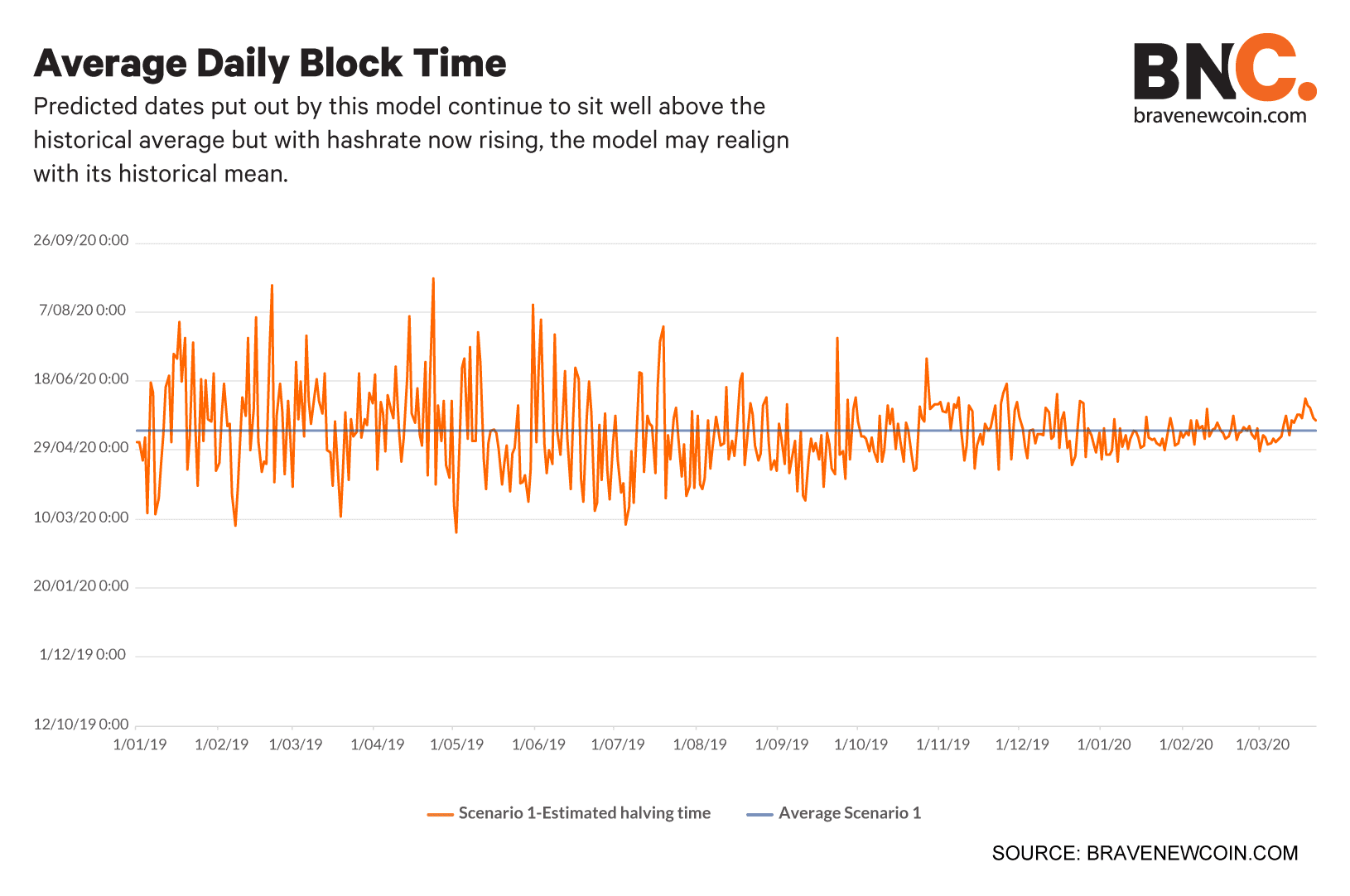

Scenario 1: Average Daily Block Time

This is the average execution time of all Bitcoin blocks mined the day before. This model estimates the number of days left until the next halving, by multiplying the average daily block time by the number of blocks left to be mined before the next halving. Using this measure we calculate the timestamp for next halving.

Average predicted halving date (first observation 01/01/2019)= 12/05/2020 20:59

Predicted halving date on 03/04/2020= 11/05/2020 20:58

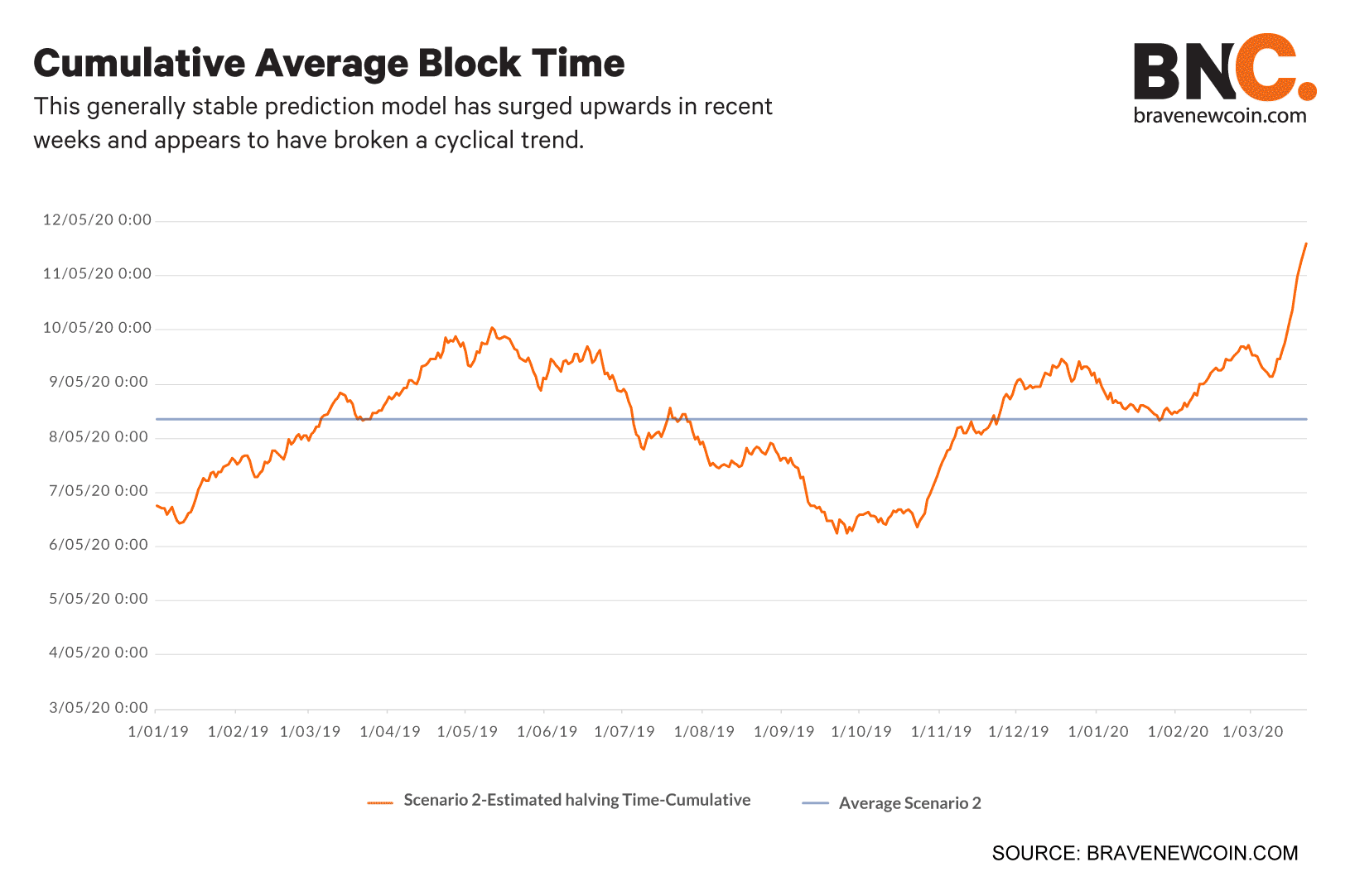

__Scenario 2: Cumulative Average Block Time __

This is the cumulative numerical average of execution time of all Bitcoin blocks mined till the present day. In order to remove the long gap between the initial block execution, the average block time between those blocks is taken as 600 seconds. We estimate the number of days left until the next halving, by multiplying the cumulative average block time with the number of blocks left to be mined before the next halving. By using this measure we calculate the timestamp for next halving.

Average predicted halving date (first observation 01/01/2019)= 08/05/2020 08:35

Predicted halving date on 22/03/2020= 11/05/2020 20:58

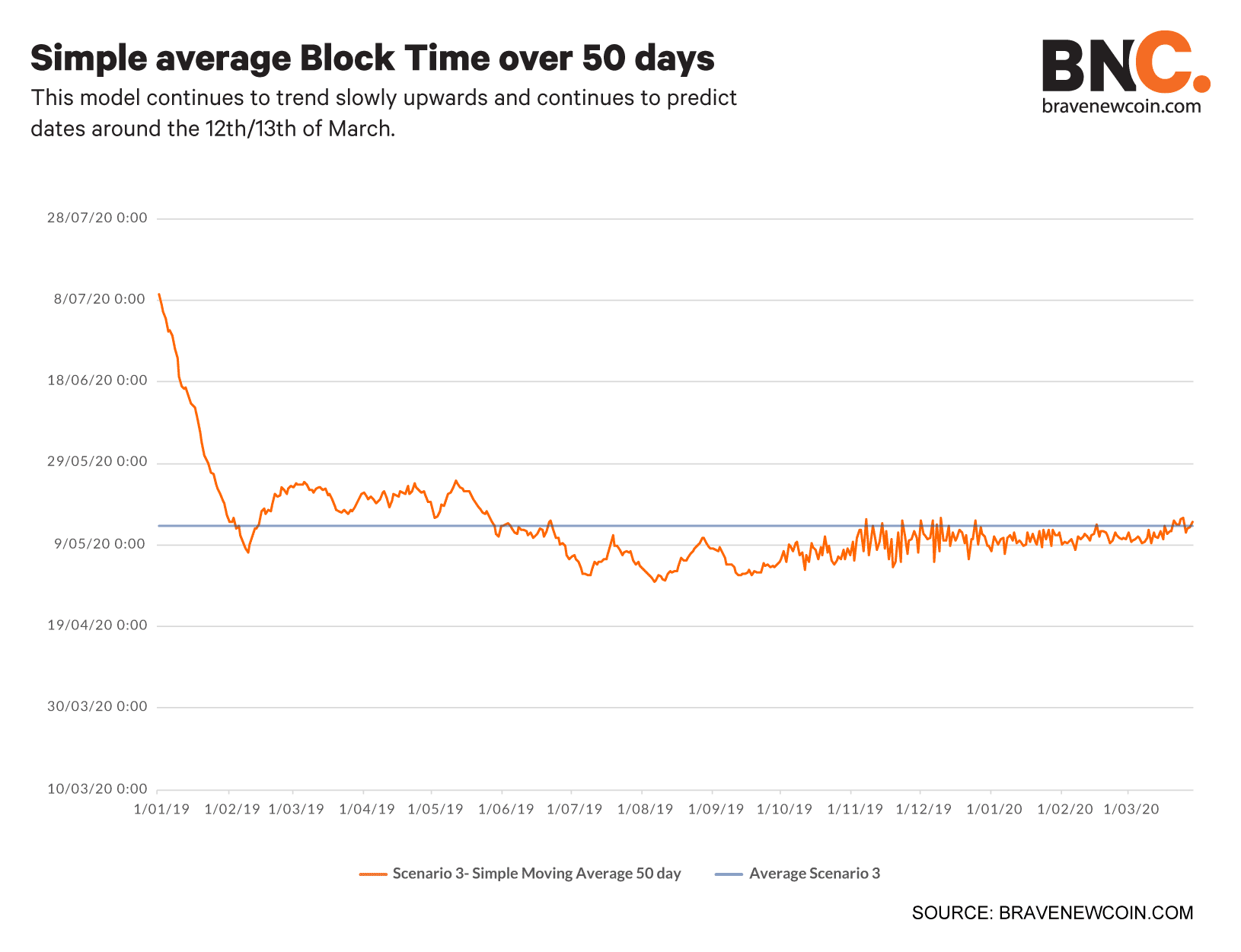

Scenario 3: Simple Moving Average Block Time 50 day

This is an arithmetic moving average of all block times calculated by adding the average block time of blocks executed each day for the last 50 days of the period. This is a lagging technical indicator which applies an equal weight to all observations over the period for determining if the block time will continue to have the same trend or reverse it. If the simple moving average points up, this will explain the increase in the number of blocks execution which means the halving date will arrive faster than expected. If it is pointing down it means that the blocks executed will decrease on a daily basis and the halving date can move further away.

Average predicted halving date (first observation 01/01/2019)= 13/05/2020 18:14

Predicted halving date on 01/03/2020= 14/05/2020 01:18

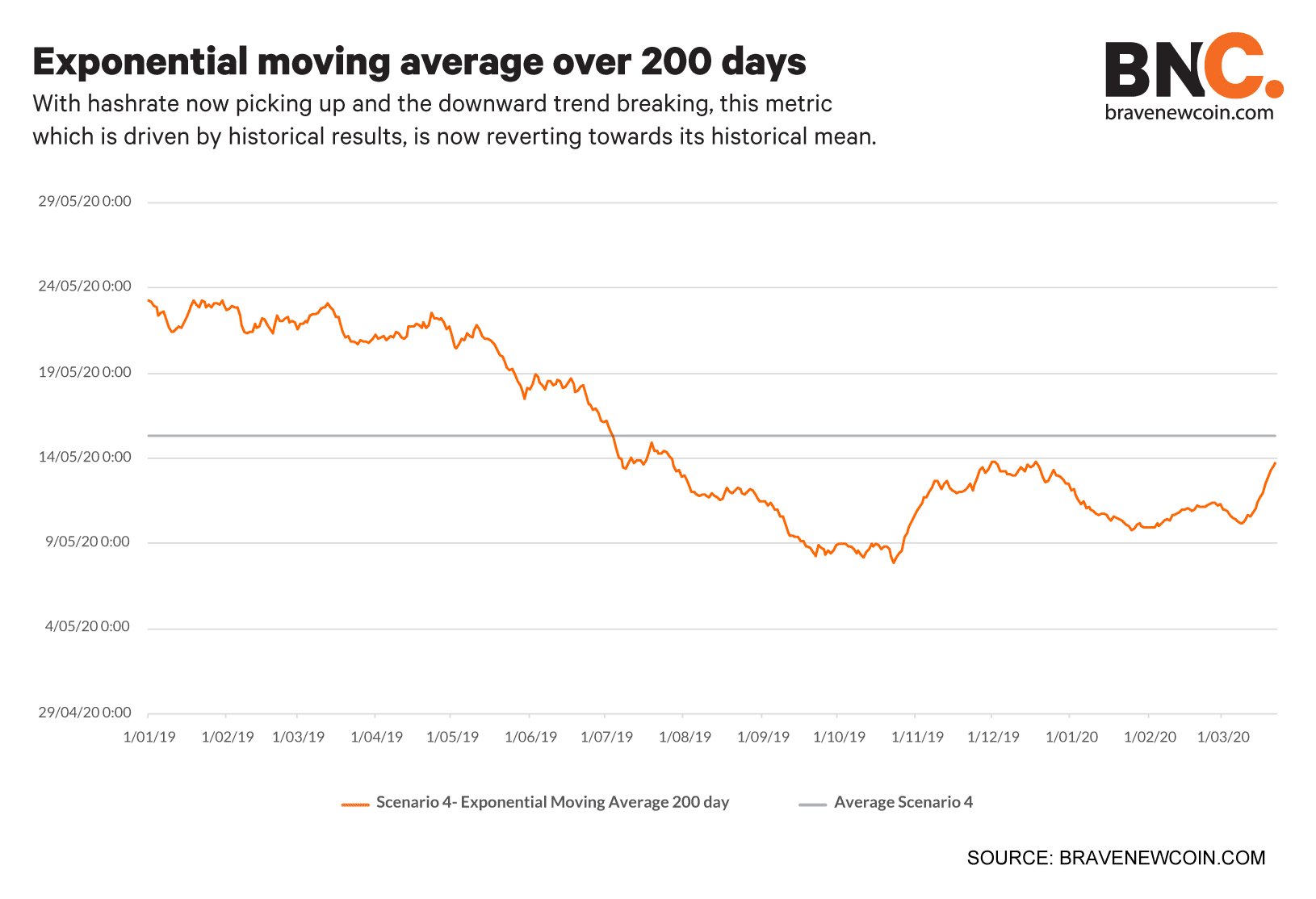

Scenario 4: Exponential Moving Average block time 200 day

This is a type of moving average where a greater!significance is given to the most recent average block times. This provides good signals on crossovers and divergences from the historical average block time. This is a lagging technical indicator. When the average block time crosses the moving average block time, the large changes are expected in the average block time, where the trend changes direction. As EMA provides higher weight to the recent daily average block time than on older data, it is more reactive to the latest block time changes.

Average predicted halving date (first observation 01/01/2019)= 15/05/2020 08:56

Predicted halving date on 01/03/2020= 13/05/2020 17:01

Network fundamentals

Average Daily Hashrate 23/03/2020- 29/03/2020= 101,582,512,381Th/s

Average Daily Hashrate the week before= 95,340,488,026 Th/s

Percentage change= 6.55%

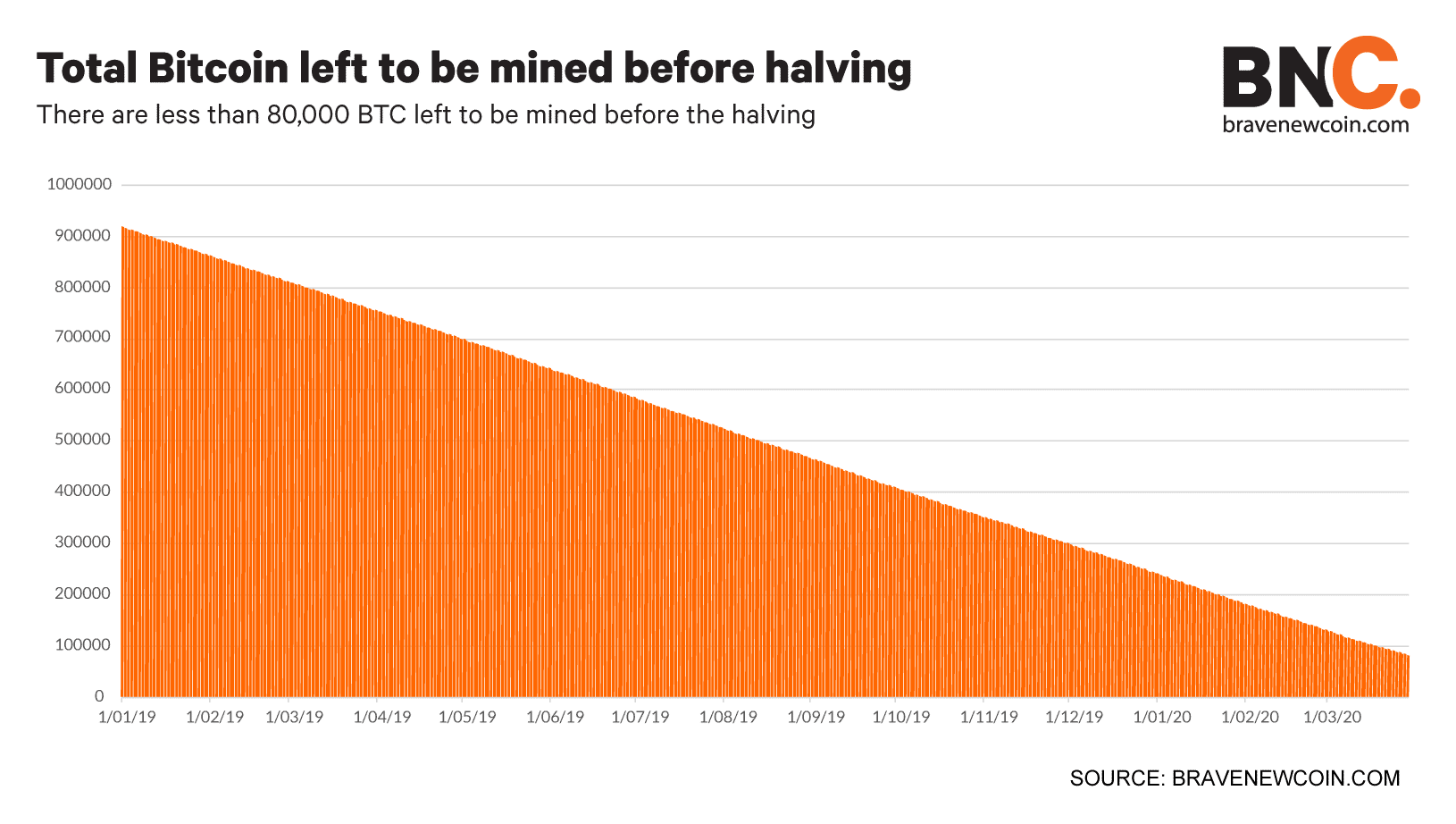

Bitcoin left to be mined before the halving as of 23/03/2020= 92575 btc

Don’t miss out – Find out more today