Crypto as an Asset Class and Goldman’s Straw Man

In May 2020, Goldman Sachs’ Wealth Management division (GSWM) hosted an investment advisory call titled “US Economic Outlook & Implications of Current Policies for Inflation, Gold and Bitcoin.”

GSWM issued a markedly negative view on cryptoassets. They addressed topics such as bubbles, money laundry, and hacking susceptibility. Most of their claims are either inaccurate or outdated and some express points of view instead of facts. But in one crucial argument of their thesis against cryptoassets they took the rhetoric too far: “Cryptocurrencies Including Bitcoin Are Not an Asset Class.”

In an attempt to justify such a peculiar position, GSWN laid down a series of ad hoc requirements that assets should fulfill in order to qualify as an asset class. While claiming that cryptoassets do not constitute a class, they listed those requirements in the form of a series of bullet points, each starting with “(Cryptocurrencies) Do not.”

It’s not explicit by just reading the slides if each individual requirement is necessary or simply sufficient, but it is reasonable to assume that they meant sufficient, otherwise there would be no asset classes at all. Either way, none of the elements of their list is really connected to the general idea of what asset classes are, as will be shown later on. But first, it is worth delving into each point presented.

Cryptoassets “do not generate cash flow like bonds.”

Indeed cryptoassets do not pay fiat cash flows. However, neither do commodities or foreign currencies and those are widely recognized as assets classes. Real Estate generates cash flow from rent, which is something that can also be done with cryptoassets. It’s also relevant mentioning that some relevant cryptoassets do provide in kind returns to their holders, in the form of airdrops and staking rewards.

Cryptoassets "do not generate any earnings through exposure to global economic growth"

Cryptoassets are the incentive mechanism of blockchain networks that seek to address important real life problems. It’s fair to state that when networks succeed they will be delivering valuable services and elevating the economy’s overall productivity. However, differently from companies, blockchains don’t convert the value they create into earnings. Instead, their respective cryptoassets are expected to appreciate as demand for these services increases. When cryptoassets reach maturity, their prices will likely respond to shocks in the global economy. In the meanwhile, they behave more like options, with prices reflecting the probability that this future will come true.

Cryptoassets "do not provide consistent diversification benefits give their unstable correlations"

Correlations are non-observable measures and the best one can do is to estimate them. A problem then arises: if you want to estimate short term correlations, your assessment tends to be very imprecise because of the small samples. The variability observed in these estimations doesn’t mean that the true correlation is changing over time.

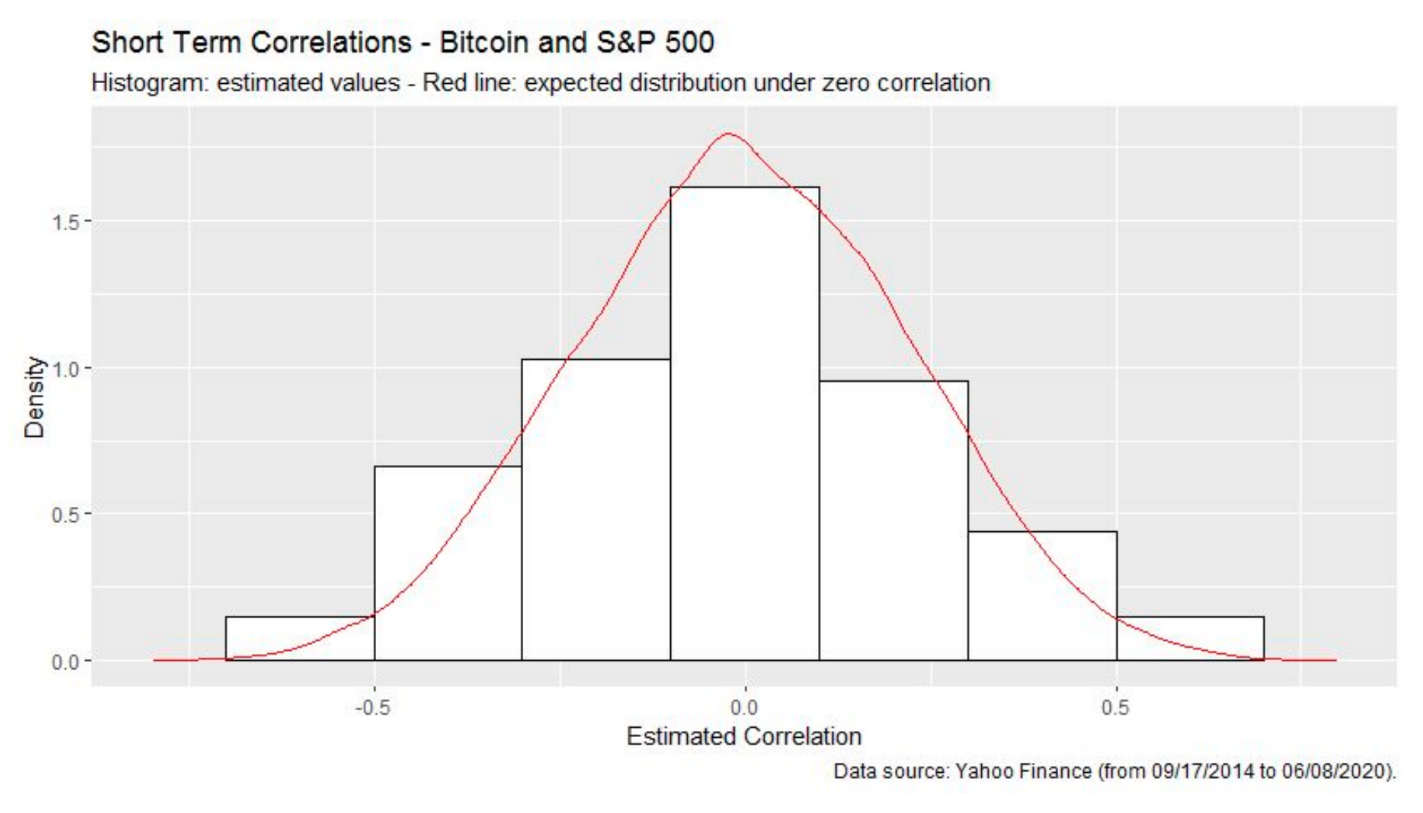

For instance, in estimating the correlation between the daily returns of Bitcoin and the S&P 500 in 21-day windows, we will find results ranging from less than -0.5 to more than 0.5. However, this is not inconsistent with the hypothesis that the correlation between them is fixed and equal to zero.

In the chart below, the red line shows the theoretical distribution of 21-day correlation estimates under true correlation set to zero. The histogram shows actual 21-day estimates of the correlation between Bitcoin and the S&P 500. Note that the histogram of observed estimates is reasonably well in line with the theoretical distribution. In other words, a wide range of values found for correlation estimates in short windows does not mean that the true correlation is not steady.

Nevertheless, it is reasonable to assume that correlations depend on several factors that are not fixed over time, such as investors’ liquidity needs or the overall appetite for risk in an economy. The point here is to show that correlations can be much more stable than short run estimates suggest. This goes for Bitcoin, other cryptoassets, and traditional classes.

Furthermore, the variability of correlations estimates is inversely related to the magnitude of the true correlation. Low correlations between crypto and traditional assets can create a false impression of instability in the true correlation. Finally, it’s also worth mentioning that from a theoretical or a practical perspective, relevant benefits from diversification are possible even under unstable correlations. Actually, it is possible to design specific examples in which the instability of correlations does not affect diversification at all.

Cryptoassets "do not dampen volatility given historical volatility of 76% – On March 12, 2020, the price of Bitcoin fell 37% in one day"

The first part of this statement is technically misleading. The possibility that the inclusion of a new asset reduces the volatility of a portfolio depends on their relative volatilities and also on their correlation. The high volatility of cryptoassets usually is more than offset by their small correlations with traditional assets classes. Even an extremely conservative portfolio composed uniquely by Vanguard Short-Term Treasury ETF could have its volatility shrunk with the addition of Bitcoin in fractions up to 25 bps.

Goldman’s assertion that the price of Bitcoin fell 37% on one day is correct but far less alarming than it seems at first sight. Bitcoin really fell half of its annualized volatility on March 13th 2020 but the exact same thing happened to the S&P 500 (-9.5%). Still, the worst day of the season for the S&P 500 was yet to come with the 12% drop on March 16, while Bitcoin performed slightly positive. When we look at the 2020 crisis so far, considering the assets’ volatilities, Bitcoin has suffered far less than other classes.

Cryptoassets “do not show evidence of hedging inflation"

Cryptoassets were created in 2009. Since then, developed economies have experienced very low inflation in spite of huge monetary stimulus. So far, it’s been impossible to design empirical tests for theories about how Bitcoin (or other cryptoassets) behave during inflationary periods. Although some of these theories rely on arguably unsound assumptions, empirical tests are the ultimate tool to rule them out or not.

GSWM’s argument is a classical straw man fallacy, in the sense it doesn’t address the real discussion of whether or not crypto is an asset class. Since a formal and universally accepted definition of what constitutes an asset class does not exist, we set out to find a commonsensical designation.

According to Wikipedia “an asset class is a group of financial instruments which have similar financial characteristics and behave similarly in the marketplace.” Cryptoassets fit that definition perfectly. All cryptoassets share some basic features in terms of technology, they are mostly traded in the same exchanges, and they exhibit peculiarly high volatility and risk-adjusted returns, which are unparalleled by traditional classes.

The online encyclopedia also describes that “often, assets within the same asset class are subject to the same laws and regulations.” In recent years, across the globe we have been witnessing the creation of specific laws and regulations for crypto. In summary, cryptoassets fit neatly into the notion of what constitutes an asset class.

Additionally, from a quantitative perspective, cryptoassets have a high correlation within themselves and low correlation with traditional assets. For example, the average correlation between all pairs of the 16 cryptoassets from the Hashdex Digital Assets Index (HDAI) is close to 0.5, nearly double that between S&P 500 constituents.

On the other hand, HDAI has single digits (percentual) correlation with the vast majority of indexes that represent non-crypto classes and low two digits with a few others. Any simple clustering algorithm based on this metric would have no problem to group the cryptos together, apart from traditional assets.

The claim that cryptoassets do not constitute an asset class is just not reasonable. As such, it makes one wonder why an institution would support it. One possibility is that some financial advisors subscribe to this invalid notion in order to delay the responsibility of giving (long or short) calls on such volatile (and unknown for some) assets. If this is the case, it will be in vain. As Pablo Neruda once said: “you can cut all the flowers but you cannot keep Spring from coming.”

Don’t miss out – Find out more today