Crypto Market Forecast: 17th February

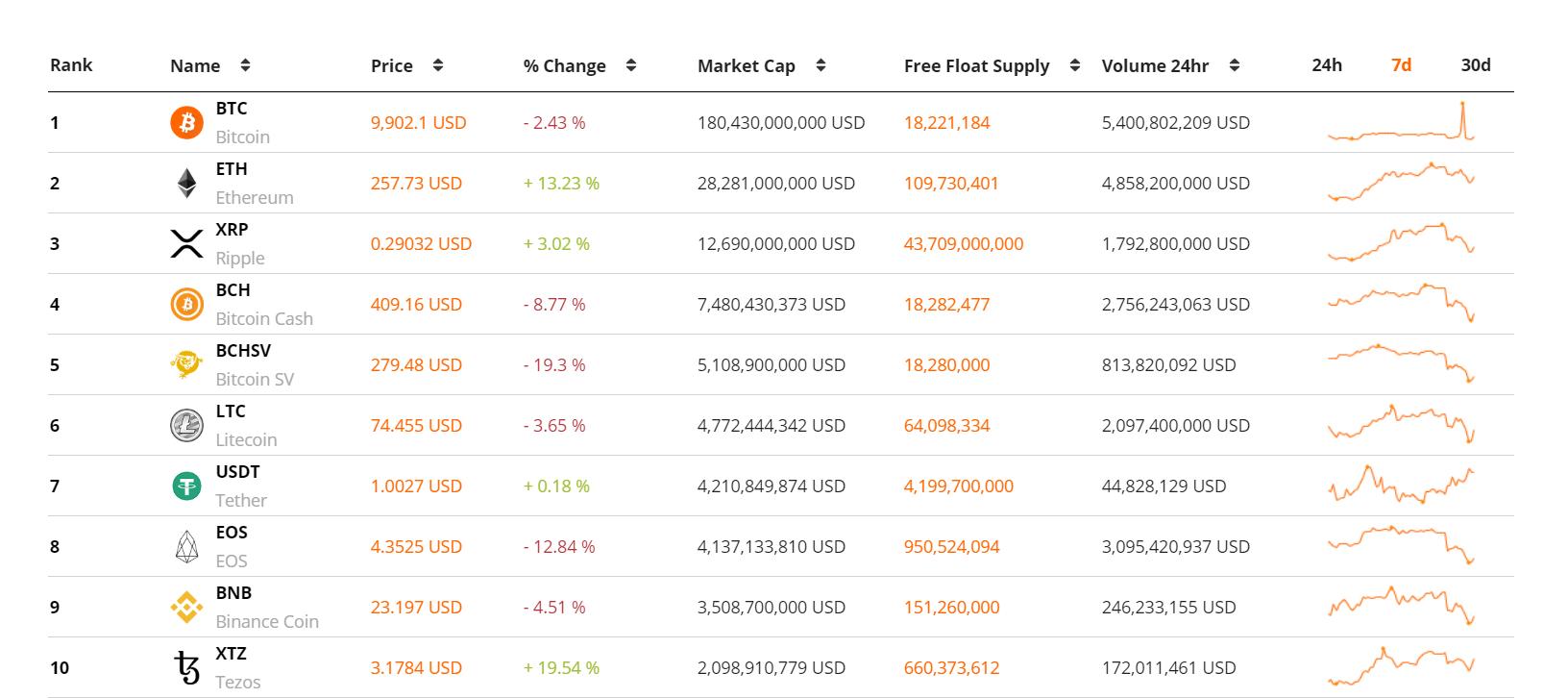

It was a week of varying fortunes for tokens in the digital asset markets. While Bitcoin and a number of altcoin markets dumped over the weekend, assets like ETH and XTZ resisted sell pressure and continued to build on a strong macro bull trend that has been active since the start of the year.

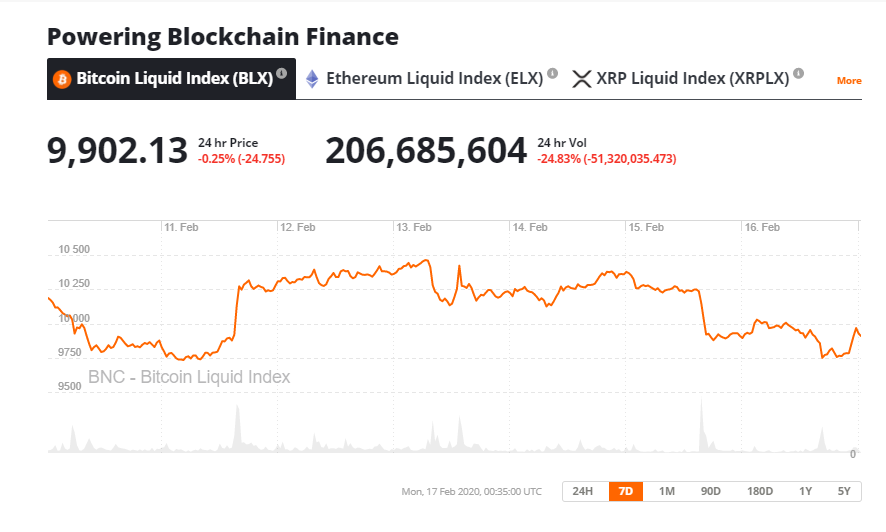

It was a mixed week in the crypto markets. The week was defined by a sharp price fall on Saturday morning that saw Bitcoin plunge from $10,300 to ~$9700 where it remains. The fall meant that BTC ended the week down ~3% after a very bullish start to the year.

Bucking the BTC trend, large cap assets such as ETH, XTZ, and LINK were able to find enough bullish momentum to avoid the market-wide sell pressure over the weekend, with each token rising ~13%, ~22%, ~28% respectively over the last 7 days. It appears that these assets may have hit resistance in the short term, however, and despite a strong start to the week, the overall crypto market cap fell by ~2% over the last week.

Despite the price pullback, this week continues ETH’s excellent start to 2020, with the asset now up ~95% year-to-date. Reuters reported last week that JP Morgan is considering merging its flagship blockchain project Quorum with New York-based Ethereum development startup Consensys.

Quorum is already built on the public Ethereum blockchain and underpins a 300+ entity interbank information network (IIN) that is likely to use the proposed JPMorgan coin as a medium for transactions. It’s thought that the development of the INN will continue to be a core focus for Consensys.

For Consensys and the Ethereum network, a high profile brand endorsement from JP Morgan would be a valuable addition to the ecosystem. Consensys announced last week that it would lay off 14% of its staff, as part of a restructuring that will separate the startup into separate software development and venture capital divisions.

Last week centralized (CeFi) crypto lending platform BlockFi announced a successful $30 million series B funding round led by Valar Ventures. The raise also included participation from a number of other notable crypto VC players including Morgan Creek Digital and Castle Island Ventures and brings BlockFi’s total funding to ~US$100 million. BlockFi offers rates of 8.6% on Bitcoin, Ether and USD stablecoins, zero-fee trading fees for users transacting within the platform and it even lets users liquidate up to 50% of their crypto collateral on loans into USD. The startup is also known for offering crypto banking services for the private markets and crypto startups with large crypto borrowing and saving requirements.

This week in crypto

20th February – Decentraland Public Launch

The Decentraland VR blockchain enters its public launch this Thursday. The launch will see the launch of the Decentraland DAO and aims to decentralize control of numerous aspects of the software platform including the economics of the native MANA token, and the curation of content within plots of VR LAND. The price of MANA fell ~11% despite the upcoming release.

20th-21st February- Blockchain Economy Istanbul

This week the 2nd edition of the popular conference happens in the country with the highest proportion of cryptocurrency owners in the world (Statista Global consumer Survey 2019). This year’s event features an impressive list of speakers including popular Bitcoin price analyst and managing partner at Fundstrat, Tom Lee, and mega investor Tim Draper.

It was a varied week for assets in Brave New Coin’s Market cap top 10 with several clear winners and losers within the group. Some of the gains were surprisingly bullish despite the mixed wider market conditions. XRP for example, hit a 6 month high towards the end of last week while Tezos continues to rally strongly despite having risen over 150% since the start of the year.

Despite a strong close to the end of last week with signals suggesting that BTC would carry on its medium-term bullish momentum towards price levels in the high 10,000s, the price of BTC has pulled back strongly this week. Both bullish and bearish short term narratives remain intact, with bulls strongly defending the $9,800 price level to ensure the last 4 hours of the week were green, however, recent daily price charts suggest the market is dragging down with a trend of lower highs and lower lows to close key time frames over the last week.

Don’t miss out – Find out more today