Crypto Market forecast: 2nd December

The crypto markets were steady this week following large sell-offs earlier in November. The price of market benchmark, Bitcoin, rose by 4%. The week's major news story was the hack of popular South Korean exchange UPbit where ~US$50 million of ETH was stolen.

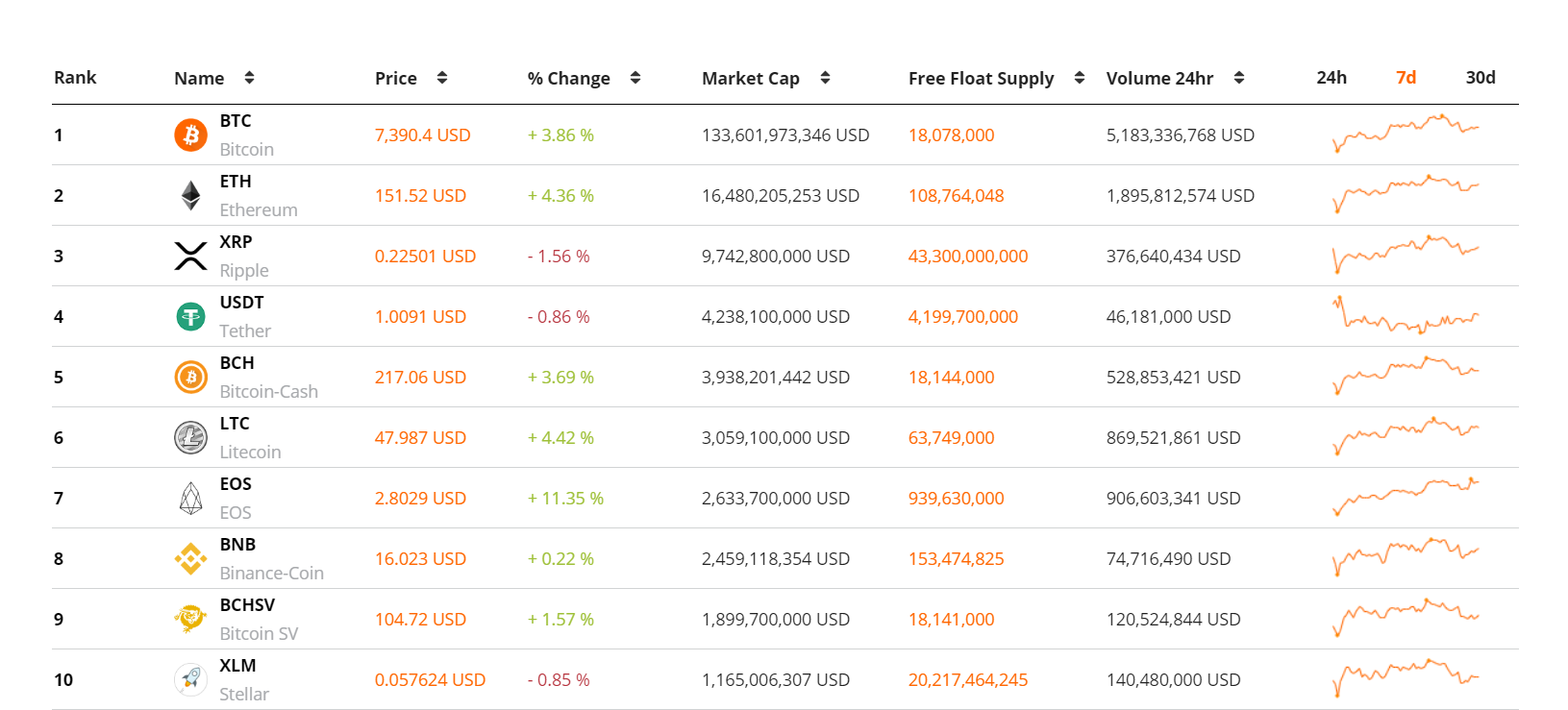

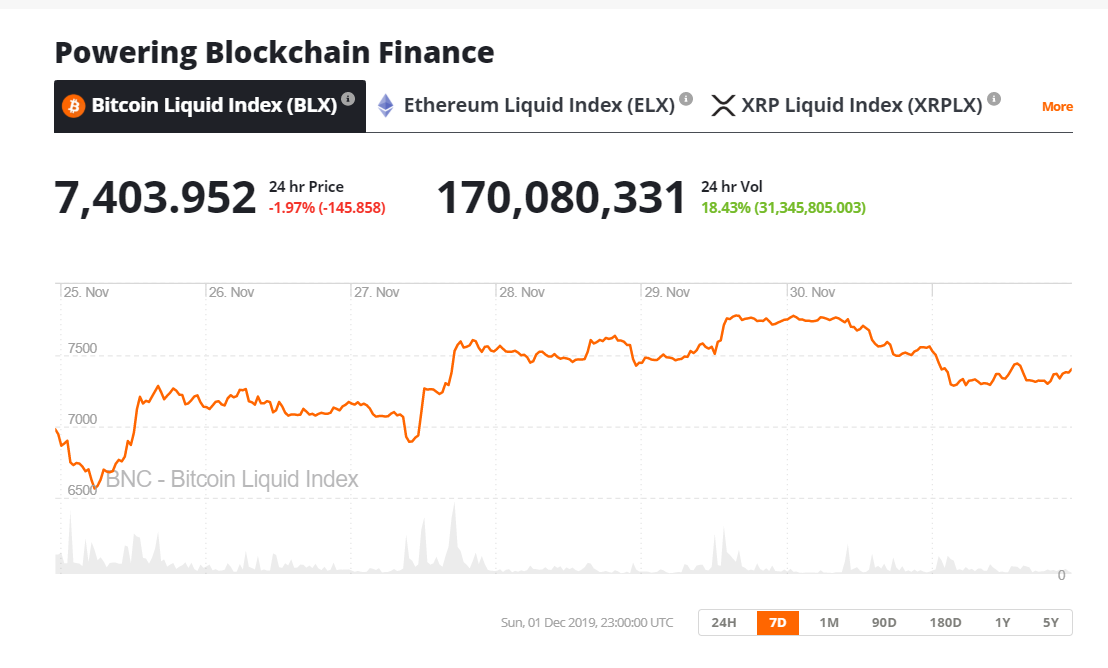

It was a slow week of consolidation in the crypto markets. Most assets ended the week slightly in the green following the sharp market-wide price drops earlier in November. Market benchmark asset Bitcoin (BTC) rose ~4% across the week. The number two and three assets on Brave New Coin’s market cap table, ETH and XRP, ended the week up ~4% and down ~2%, respectively, while the overall crypto market cap rose ~4%.

Major South Korean crypto exchange Upbit suffered a significant hack last week. The exchange lost a sizable 342,000 ETH worth an estimated US$ 50 million. The CEO of the exchange’s operating company, Lee Seok-woo, confirmed that the ETH had been taken from an Upbit hot wallet on November 27th. Deposits and withdrawals from Upbit have been suspended for at least two weeks while an investigation is conducted. There has been speculation that the theft may have been an inside job.

Upbit has confirmed that the thief has moved the coins into cold storage. There are now multiple tagged ‘Upbit hacker’ wallets being tracked by Etherscan (Including; 1,2,3,4) and much of the stolen ETH appears to be moving into cold storage.

Given the size of the ETH theft, it may be difficult for the hacker to find the liquidity (counterparties) needed to sell such a large amount, especially now that the wallets involved are being watched closely.

This is 2019’s second major crypto theft following the PlusToken scam, which has reportedly taken over US$4 billion in crypto from victims. Many have suggested that ongoing liquidations by the PlusToken scammers have depressed the crypto markets through 2019, and there are concerns that if the hacker is able to successfully liquidate the stolen ETH, it will have an adverse effect on the ETH markets.

It was a big week for the BAKKT futures platform with trading volumes continuing to increase rapidly following a tepid launch in September. Trading volume for BTC monthly contracts on BAKKT hit a new all-time high of US$40 million on Wednesday, suggesting some institutional investors may be eyeing opportunities in the Bitcoin markets following the recent price drop. Interestingly, almost all of the volume appears to be coming from the monthly as opposed to the daily contracts. This suggests investors are not yet concerned with receiving physical BTC daily and are instead choosing to do their trading in monthly contracts.

This week in crypto events

2nd December- Open of new CME Bitcoin futures contracts (BTCG20)

A new round of quarterly Bitcoin futures contracts opens on the CME this week. The new open gives traders an opportunity to enter a new contract and make a new assessment on whether they are short or long entering the end of the year period. Information around early orders is likely to determine how back-seat investors will choose to enter positions.

3rd December- Fintech Connect London

A leading event within the European ecosystem, FinTech Connect links crypto and fintech with traditional capital markets and investors. Speakers at the event include Cameron Craig, Deputy General Counsel and Group Head of Data and Privacy Control at HSBC. From the crypto space, speakers include Chris Aruliah, Head of Banking Relations at the Bitstamp exchange.

Most crypto assets achieved moderate gains across the trading week. EOS was the biggest winner in the top 10 despite reports this week that a single entity currently controls 6 nodes on the permissioned blockchain, implying significant network centralization. It may have been technical factors driving traders to purchase the token last week.

Following a difficult start to the week, the BTC markets moved up to end the week at the $7500 price level. Some technical traders are concerned that this current price run-up does not have much momentum and a return to a bearish trend could happen this week.

Don’t miss out – Find out more today