Crypto Market Forecast: The week ahead, 23rd March

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

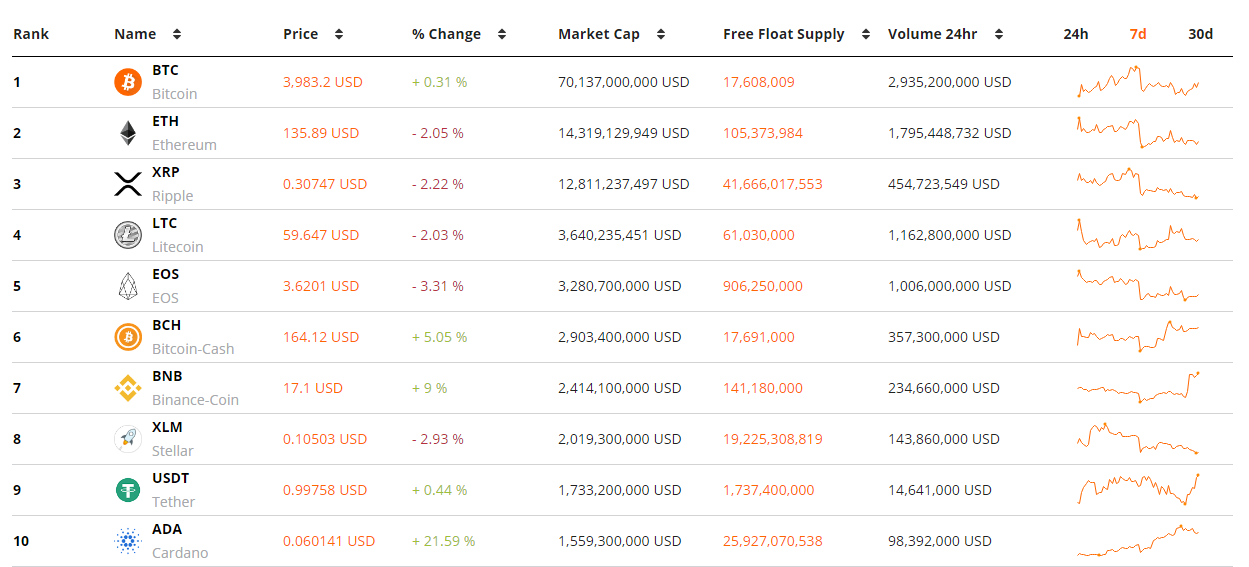

As Bitcoin bulls and bears continue to wage an extended war around the $4000 psychological price level, the majority of the crypto market experienced middling performance with a few select altcoin markets surging strongly. Crypto benchmark BTC rose by ~0.5% in the last week, while the overall crypto market cap fell by ~0.5%. Meanwhile, top-30 coins Binance-coin (BNB), Cardano (ADA) and Tezos (XTZ) rose rose ~8%, ~19% and ~37% respectively, emerging as standouts amongst large cap assets.

Binance-coin (BNB) was able to build a wave of positive sentiment following the announcement that the Binance launchpad ICO platform, which lets BNB holders exclusively access newly launched tokens like Bittorrenttoken (BTT), will be restructured to have a more inclusive issuance structure.

XTZ has enjoyed a period of strong price performance following the release of the network’s first live community decided self-amendment protocol. The crypto community has responded well to the tangible, working, democracy-by-code initiative pushed by Tezos, and this positive reaction bodes well for the on-chain governance sector within crypto, with networks like Decred having major ongoing onchain voting proposals through 2019.

The wider crypto ecosystem was jolted by the release of a slidedeck developed by crypto ETF and index builder Bitwise which evidenced that as much as 95% of reported Bitcoin trading volume is likely faked by unregulated exchanges, with 71 of 81 studied exchanges displaying signs of wash trading.

While this may seem to some to be an indictment of Bitcoin trading markets, the legitimate markets observed in the report are efficient, well-arbitraged and fair to use for traders. Meaning Bitcoin markets are not as ‘manipulated’ when the echo chamber of fake volume is removed from assessments.

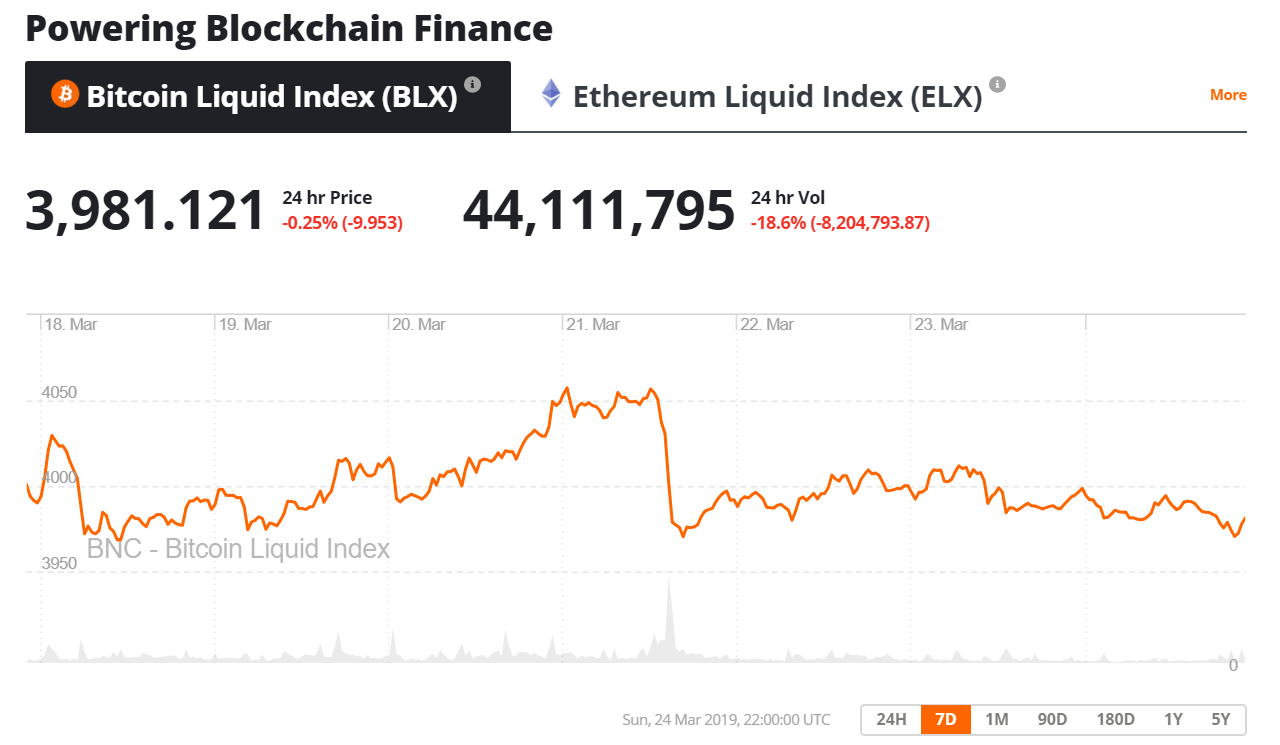

The analysis is also an endorsement for price indices like Brave New Coin’s BLX. The BLX was built, and is reviewed consistently, to ensure that the constituent exchanges used to derive a fair price of Bitcoin are reporting legitimate volume created by real market demand.

This week in crypto events

29th March- CME Bitcoin futures market expiry

This Wednesday the latest round of BTCH19 CME futures (contract started on 1st October 2018) ends. The nature of futures contracts means they need to be settled on a set, predefined date, based on a contract. If Bitcoin price markets begin moving following an extended period of low volatility, any squeezing of CME longs or shorts around the expiry date may exaggerate price jumps.

31st March (expected)- Bittorrent token product release

The release of the first version of a live version of the Bittorrent token product within the utorrent client is set for the end of March. If released, it will create immediate utility for the BTT token as seeders on the Bittorrent network will begin being rewarded BTT for their file sharing services. The price of BTT has lagged in recent times and has fallen ~35% since hitting an all-time high on the 6th of February. Price momentum may be created around the launch date as a number of short term sellers may have already left the market.

31st March- Wanchain 4.0 release

Interoperability, cross-chain solution Wanchain, releases its 4th version of its blockchain solution at the end of the coming week. The blockchain interoperability space is growing and Wanchain has differentiated itself from other market solutions by building private smart contract that utilize Monero-style ring signatures. The price of Wanchain has risen 33% over the last 30 days.

It was a mixed trading week for large cap crypto assets with most experiencing small losses and a select few like ADA and BNB enjoying significant gains. ADA’s gains have been driven by a positive reception to recent roadmap updates and the live release of Cardano 1.5 on the network’s mainnet.

Bitcoin continued on its run of short term stability, moving by less than 1% in the past week. BTC BLX prices did not fall below ~USD 3970 in the last week. Price has risen ~0.52% in the last 24hrs, ~0.83% in the last 7 days and ~0.56% in the last 30 days (as per time stamped observations).

Bitcoin’s hash rate has jumped in the last few weeks and is now approaching 48000 P/Hs and highs for 2019. The last difficulty adjustment was positive and the next is expected to be positive which will dampen the rising hash rate thus easing energy costs for miners.

Don’t miss out – Find out more today