Crypto Market Forecast: The week ahead, 3rd December

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

This week in Crypto

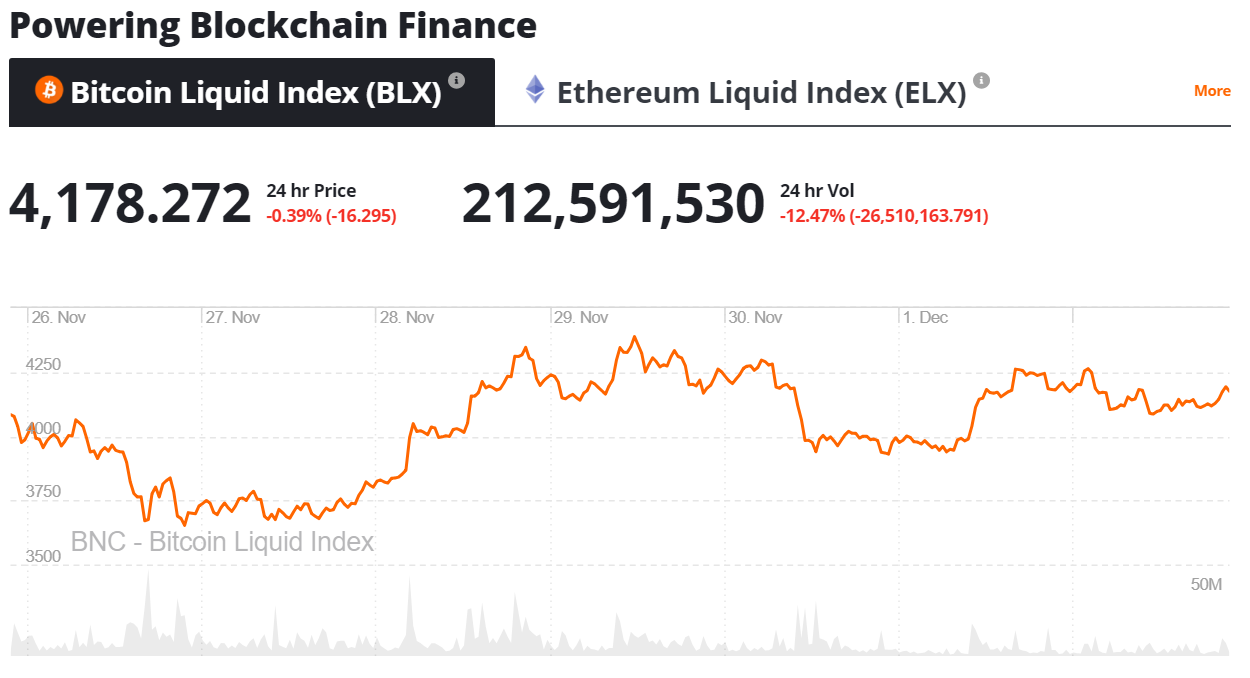

Following a challenging month of trading in November, crypto markets bounced back over the last week with strong green trading driving the crypto market cap up 9.22%. Midcap alts such as TRX enjoying strong gains (up 20%), while individual benchmark assets BTC, rose ~2%.

This week’s price performance was encouraging, with buyer interest and consolidation at lower price levels ($3600-$3900 for BTC) indicating that the ‘Bitcoin/crypto is dead’ narrative, pushed during November’s bear market, was short-sighted and.exaggerated.

That said, there were signs last week that crypto’s bear market will likely continue for some time. SEC chairman Jay Clayton speaking at the recently concluded Consensus:Invest conference, was overall bullish about the potential of blockchain technology but was quick to point out that aspects of the ecosystem, such as the ICO fundraising model, was littered with bad actors whose cavalier actions would no longer be tolerated by enforcement agencies.

In addition, there was mixed sentiment during the week around the prospects for large scale institutional entry into the crypto investment space. During the same discussion, chairman Clayton aired concerns that the current hurdles to a Bitcoin ETF approval from the SEC — market manipulation and inadequate custody solutions — remain undeniable and without clear solutions.

On the flipside of the now more unlikely Bitcoin ETF, Nasdaq announced plans to release a ‘crypto futures 2.0’ platform in Q1 2019 partnering with Van Eck SolidX. During the announcement, representatives of the platform were clear in voicing a house view that NASDAQ maintains a positive long term outlook on the value of Bitcoin as an asset and the general blockchain ecosystem, despite market-wide price struggles in 2018.

Upcoming events in crypto

December 2nd- Waves launches mobile wallet

The release of a consumer ready mobile wallet can be a significant event for a digital asset. It allows for stable on-the-go access, plus custody and payment options that crypto communities demand. Popular token issuance and DEX platform WAVES, buffered by expectations of its upcoming mobile wallet release, has enjoyed a strong week, rising 53% in 7 days. Positive reviews after launch may build new fundamental support to continue the short term price run.

December 3rd- FinTech Connect, London

A leading event within the European ecosystem, FinTech Connect links crypto and fintech with traditional capital markets and investors. Speakers at the event include Jonathan Wood, Senior Vice President, consumer applications, Mastercard & Jeremy Light, Vice President of EU Strategic Accounts, Ripple.

December 6th- Bitshares (BTS)- Bi-annual hardfork

Historically significant and once a top 20 digital asset, BitShares is scheduled to release an important hard fork and network update this Thursday. The network is crypto’s original Delegated Proof of Work consensus innovator and each new update promises improved performance and services across the BTS blockchain community. The BTS token currently trades at $0.05 and has risen ~2% in the last week.

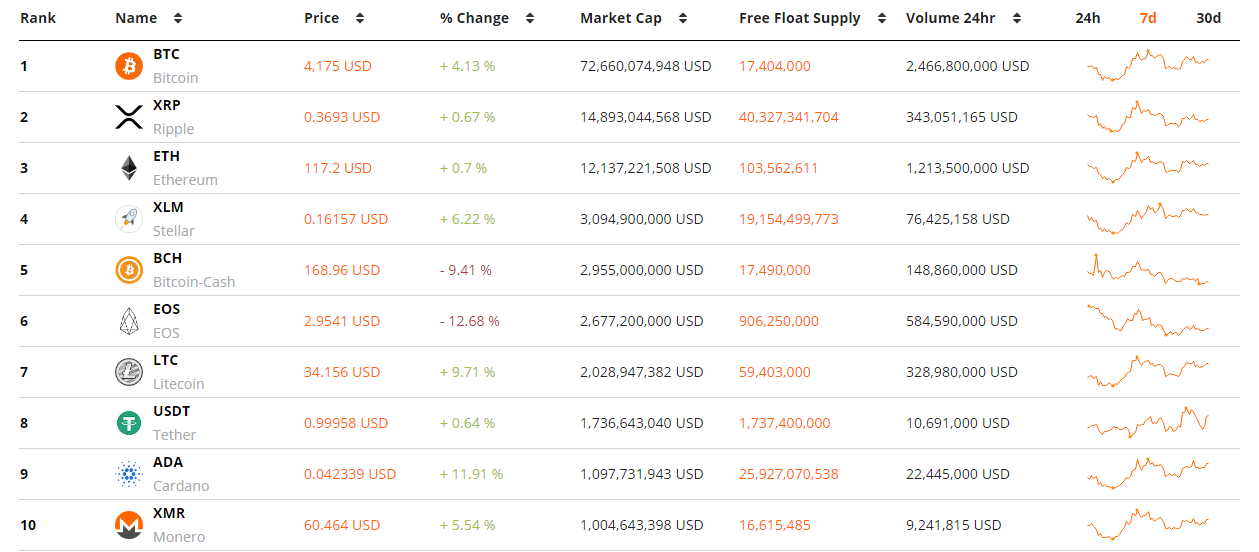

Top 10 Crypto Summary

It was a mixed week for large caps, with some strong green, red, and middling movements. Standout performers include Cardano (ADA). As highlighted by Cryptocurrency Newsfeed, events such as completing its integration with Emurgo, a Cardano focused ICO structuring platform, added new tools to create commercial ventures on the network, and buoyed positive performance.

Meanwhile, the price of EOS moved in the opposite direction on the back of news that founder Dan Larimer, has may move on from the project to a new currency style crypto solution tentatively titled ‘MonerEOS’.

The price of BTC rose ~2% this week and is currently hovering around $4000. Despite falling below $4,000 early last week, price was able to bounce back and appeared to find new buying volume on crypto exchanges.

At a fundamental level, Bitcoin had one of its most significant negative difficulty adjustments in recent years reducing ~12.9%. It appears that at some levels, miners are feeling the pain of falling profit margins with reduced operations and miner exits now affecting network performance more broadly.

Don’t miss out – Find out more today