Crypto Market Forecast: Week of February 15th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin hits multiple new all-time-highs as Tesla, banks, and other multinationals announce new digital asset integrations and services.

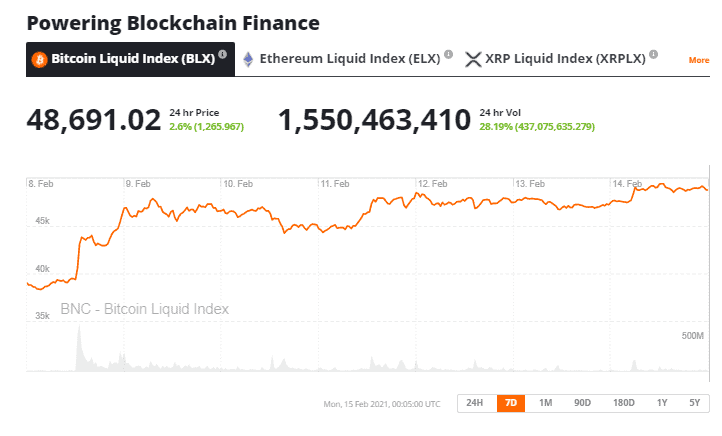

The cryptocurrency market had another stellar week to continue the bullish start to 2021 as the Bitcoin price hit multiple new all-time highs. The BTC price touched USD49633.77 on Sunday, eclipsing previous highs of ~USD48,500 reached on Friday and ending the week up ~28%. The Ethereum price rose ~16% in the same time period, while XRP (XRP) was up 43%.

The week began with a boom. On Monday, Tesla, the world’s largest car company by value, announced it had invested USD1.5 Billion in bitcoin as part of a new company investment policy. In the same report the firm said it expects to accept bitcoin as a form of payment for its products soon. This news pushed the BTC price from below USD40,000 to above USD46,000 by the end of the day (GMT) on Monday.

Trading was quiet for much of the rest of the week before the Bitcoin rocket was refueled on Thursday when BNY Mellon, the USA’s oldest bank announced that it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. The bank will roll out a digital custody unit later this year and says additional services may include leveraging digital assets for lending purposes and collateral, and issuing digital assets like tokenized securities.

On Wednesday, payments giant Mastercard announced it plans to offer merchants the ability to natively support cryptocurrency payments on its network. In a blog post announcing the move, Mastercard said. “We are here to enable customers, merchants, and businesses to move digital value — traditional or crypto — however they want. It should be your choice, it’s your money."

Following the BNY Mellon news on Friday, Bloomberg reported on Sunday that according to people with knowledge of the matter, Counterpoint Global, a $150 billion investing arm of banking giant Morgan Stanley is considering making a bet on bitcoin. Counterpoint Global is an Active Fundamental Equity team, that seeks to make long-term investments in unique companies whose market value can increase significantly for underlying fundamental reasons. Before it can make the investment, however, the investment management team would need approval from Morgan Stanley and US regulators.

The new signals of broader acceptance that bitcoin and digital assets received this week appear to have activated a new wave of bitcoin buyers. Digital assets are now being integrated into the business models of some of the world’s largest corporations and banks, a reality that would have seemed completely far-fetched just a few short years ago.

Crypto news for the week ahead

16th February- Monte Carlo Dex (MCDEX) V3 launch

MCDEX is a decentralized derivatives trading platform that combines an off-chain order book with an on-chain Uniswap-like Automated Market Maker (AMM). This Tuesday, it launches a Version 3 update which will add key features to the exchange that include an operator feature that will allow any user to create a perpetual market and introduces a new AMM pricing formula to better utilize funds by aggregating a larger percentage around index price. The price of the MCDEX native token, MCB, has risen by ~39% in the last month.

18th February- MantraDao AMA

MANTRA DAO is a community governed DeFi platform that enables protocols with staking, lending, and governance. Three members of its team will host an open community AMA (‘ask me anything’) on Thursday. The project has had a bullish start to 2021 with its native token, OM, rising 279% YTD. The sentiment from an AMA has the potential to affect the short-term buy/sell action of a project’s token.

Top 10 Crypto Summary

It was a strong week of trading for large cap assets on the Brave New Coin market cap top 10 with double-digit gains observed across the board. BNB was the best performer on the list up ~99% in the last week and touching new all-time highs. The token is the native asset of the Binance Smart Chain which Dappradar says seen a major pick up in activity across transaction volume since the start of the year. The data provider also writes that it is the third-largest blockchain in terms of unique active wallets with the daily unique active wallet of 50,000 at the moment of writing.

Bitcoin Price Chart

It has been an exciting week for bitcoin bulls with crypto’s original asset hitting multiple new price milestones. One of the biggest beneficiaries of the BTC price jumps were bitcoin miners. Data provider Glassnode reports that on February 12th the highest hourly miner revenue in Bitcoin’s history so far was recorded with miners making USD 4 million in a single hour.

Don’t miss out – Find out more today