Crypto Market Forecast: Week of March 1st 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin dips below USD45k, renewed optimism for the US economy affects other markets, and Cardano bucks the bearish market trend.

Crypto bulls will hope to move on from a difficult week of trading, during which most large-cap assets suffered heavy double-digit losses. The Bitcoin price fell by ~23% last week while the Ethereum price fell by ~29% over the same period.

One asset that bucked the bearish trend was Cardano (ADA). Cardano is now the third-largest asset in crypto by market cap after rising 16% in the last week. At the start of this week, Cardano’s Mary update is set to launch. The Mary hard fork will allow users to create their own custom tokens on Cardano. The Cardano foundation says it will add “a new layer of functionality and utility” to the blockchain. The update has created a buzz in the Cardano community as it means assets like nonfungible tokens (NFTs) and stablecoins can be built on Cardano.

One factor that may have influenced Bitcoin’s price drop is an ongoing trend of long-term Bitcoin Holders decreasing their net wallet holdings. Lex Moskovski, CEO of Moskovski Capital, says since last October many long-term BTC holders have been reducing their reserves and taking profit during the ongoing bitcoin bull run. Last week’s price drop coincided with an increase in selling from long-term BTC holders.

A rise in bond yields and predictions that the US may cut its fiscal stimulus drove bearish conditions across many markets. Crypto, stocks, and gold all fell last week as the 10-year U.S. Treasury yield jumped to 1.61% on Thursday – its highest level since February 2020.

Rising yields have been interpreted as a suggestion that the Fed may tighten its fiscal policy. This would likely occur because of expectations of a more organic economy recovery as Covid-19 vaccines roll-out and the US economy normalizes. 10-year yields dropped back to 1.41% on Friday but optimism about the future of the US economy in 2021 continues to grow. Bitcoin succeeded during 2020’s pandemic environment, which affected the global economy, as a detached safe haven against devaluing fiat currencies and faltering global supply chains.

Last week the SEC officially published a form S-1 for the Coinbase exchange, paving the path for the company to launch its direct listing on the Nasdaq. The S-1 filing revealed that Coinbase posted a net income of USD322 million in 2020, against revenue of USD 1.1 billion. Revenues were largely generated through trading fees (96%).

Crypto news for the week ahead

1st March – OKCoin Delists Bitcoin Cash (BCH) and Bitcoin Satoshi’s Vision (BSV)

On Monday Hong Kong-based exchange OkCoin will delist the two largest Bitcoin fork chains, BCH and BSV, that have market caps of ~USD8.5 billion and ~USD3.3 billion respectively. OKCoin says it is doing so because of the “misinformation wars” waged by members of the fork’s communities like Craig Wright, and to protect investors who “may feel tricked or confused by the branding ambiguity between these assets and Bitcoin.”

2nd March – Aavegotchi launch

Aavegotchi, a digital collectible game developed by Pixelcraft studios, is set to launch this Tuesday. The launch event will take place at Aavegotchi.com and feature an NFT drop releasing 10,000 Aavegotchi Portals for the public. Aavegotchi is built by Aave (AAVE) one of the largest protocols in the DeFi space and gamifies DeFi by combining elements of borrowing and lending with an interface that revolves around collectible creatures.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

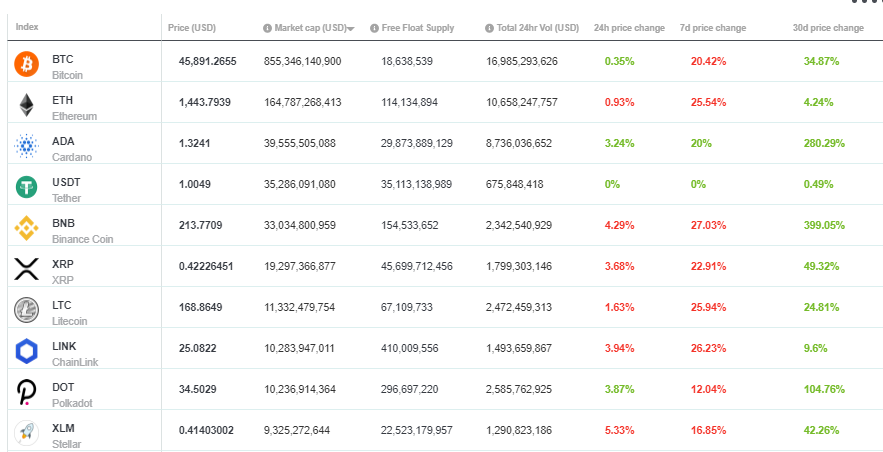

Top 10 Crypto Summary

Large-cap assets detoured last week from an otherwise bullish beginning to 2021. Two assets in the top 10, Cardano (ADA) and Polkadot (DOT) received a strong vote of confidence from Dubai-based FD7 Ventures, a global crypto investment fund with $1 Billion USD worth of assets under management. The fund announced plans to sell off 750M USD worth of its Bitcoin holdings over the next 30 days to increase the company’s positions in ADA and DOT. The move was made because of greater belief in the two assets’ utility and their positions as foundations of “the new internet and Web 3.0.”

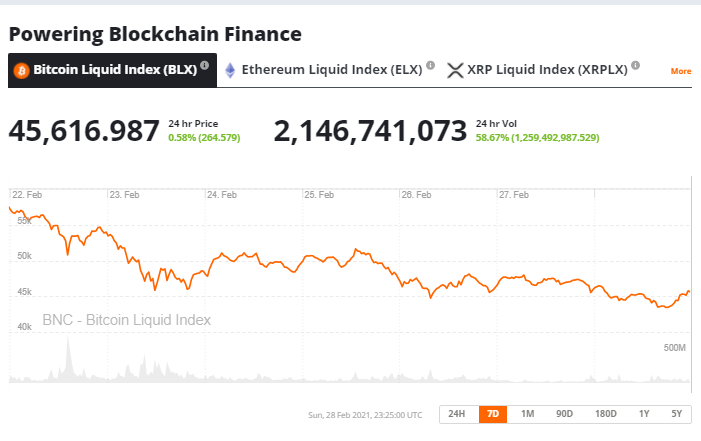

Bitcoin Price Chart

Despite the bearish price activity in the last week, fundamentals continue to look strong. Total hashrate on the network hit new all-time highs last week. This is a sign of strong network health and protects against double-spend attacks. The bigger the hashrate of a blockchain, the more computer power is needed to attack it.

Don’t miss out – Find out more today