Crypto Market Forecast: Week of March 8th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin challenges the USD 50,000 price level on the back of a strong weekend, the US prepares for another round of money printing, and the Ethereum community is hyped about a new improvement proposal.

The crypto market ended the week strongly on the back of macro-tailwinds that are setting up risk assets to perform bullishly in the short term. The Bitcoin price ends the week up ~11% and has risen ~6% since Saturday following the approval by the US Senate of a US$1.9 trillion stimulus package.

The stimulus may speed up economic recovery but will come at the cost of inflation. Traders expect this will come at the expense of a weaker US dollar and are backing asset classes like cryptocurrencies and Asian equities to perform strongly in this macro environment. The Ethereum price was up 18% during the week, while the Binance Coin price was moved up 13%.

The relief package will now head back to the House of Representatives, who will have to approve changes to the bill made by the Senate before it can be brought before President Biden. This is expected to happen next week. There are a number of reasons why a stimulus package like this one may be leading to greater confidence in the cryptocurrency market.

Bitcoin was in part created to be an easily accessible digital safe haven and a hard asset to be used when increased fiscal stimulus and bail-out packages, funded by government debt, threaten to devalue fiat currencies globally.

Inflation remains low in the US despite the continual money printing. This is likely due to a spike in unemployment due to COVID19, however, this appears to be a temporary condition and there are expectations that US dollar inflation is set to ramp up. This may increase the appeal of hard, fixed supply, and fixed emission schedule assets like Bitcoin.

Additionally, a portion of the stimulus package will be used to provide American citizens with a USD1400 stimulus cheque. During the last stimulus in 2020, many people used these extra funds for investment and it is thought the same may be true this time too.

Crypto news for the week ahead

12th and 15th March – Symbol Snapshot & Launch

This week the NEM (XEM) group will host the final snap and launch the mainnet for Symbol, the next-generation enterprise-grade blockchain solution that is set to replace the original NEM blockchain. Initially, however, the two blockchains will run simultaneously and after the snapshot 1 XEM = 1XEM + 1XYM. Jeff McDonald, co-founder of NEM, spoke to BNC’s Andy Pickering about Symbol and all things NEM last year.

15th March – Mimblewimble code launch for Litecoin

Litecoin (LTC) developer David Burkett says code for Mimblewimble implementation will be released at the end of this week. MimbleWimble (MW) uses zero-knowledge proofs and a specific type of transaction mixing to obscure transaction details while still allowing for transaction verification. Adding MW through EBs allows for the opt-in use of transaction privacy on the LTC chain and brings increased coin fungibility.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

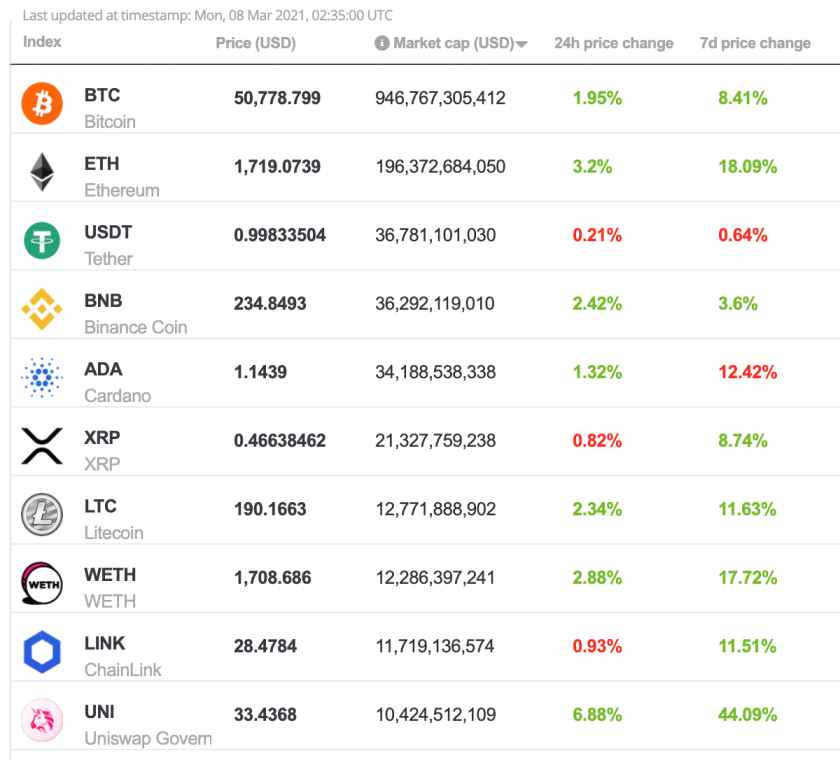

Top 10 Crypto Summary

It was a positive week for coins on the BNC Market Cap top 10, particularly for assets based on the Ethereum blockchain with ETH, UNI, and LINK rising 18%, 12%, and 44% respectively. This week Ethereum Improvement Proposal -1559 was confirmed to be implemented in the July London hard fork. The ETH community and users have embraced the EIP because it will dynamically and programmatically adjust fees so users only pay the lowest bid for each block. It also introduces a deflationary tokenomics mechanism where the base network fee will be burned for each transaction.

Bitcoin Price Chart

Bitcoin ends a bullish week challenging the key USD50,000 price level. If this price level is rejected then on-chain data suggests USD47,000 as the next support level to watch. Rafael Schultze-Kraft suggests strong onchain support at these levels based on UTXO coin movement data.

Don’t miss out – Find out more today