Crypto Market Forecast: Week of November 14th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, the drama surrounding FTX encompasses digital asset markets, Bitcoin miners face challenges as profits shrink, and the FTX black swan sees fundamental model predictions miss the mark.

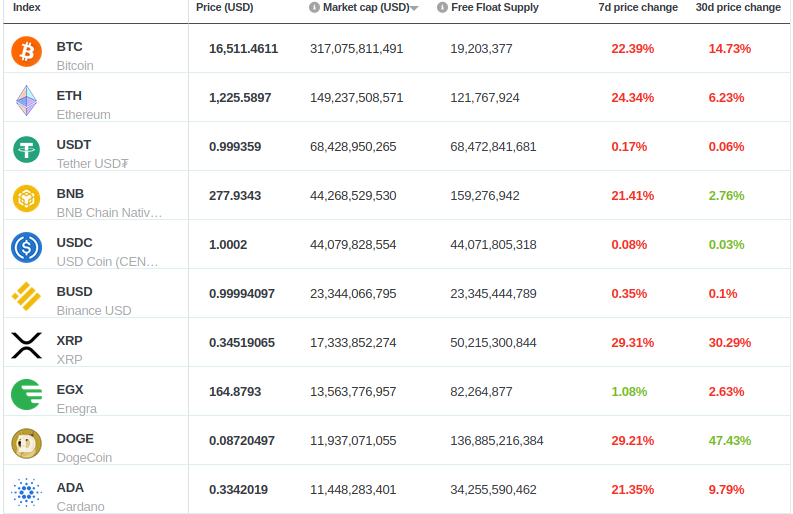

The price of Bitcoin (BTC) nose dived by 22.4% this week and currently trades at ~US$16.5K. Ether (ETH) dropped by 24.3% to ~US$1.2K. Binance-coin (BNB) also dropped by 21.4%, now trading at ~US$278.

The CEO (now former) of major crypto exchange FTX Sam Bankman-Fried (known as “SBF”) became a savior of sorts in June and July when FTX came to the rescue for both Voyager Digital and BlockFi amidst the series of events now considered a meltdown across crypto lending platforms. SBF was also reported to have some of the “deepest pockets” for political donations leading up to the midterm elections.

Amidst what already seemed to be a perfect storm of events following May’s Terra-LUNA death spiral that pushed the digital asset prices further downward with each bit of news, the industry has learned that FTX and its sister company Alameda were on shaky financial ground. More specifically, Alameda found itself in financial trouble in the aftermath of the collapse of crypto lending firms earlier this year, and as it turns out, FTX borrowed user funds to bail out its sister company.

In a dramatic series of events, SBF tweeted that “Assets are fine”, but FTX announced a pause of user withdrawals the same day. Binance considered buying FTX but quickly changed its mind after reviewing FTX’s financials. Regulators in the Bahamas (where FTX’s non-US operations are headquartered) froze FTX’s assets. Despite not being headquartered in the United States, FTX has filed for bankruptcy there, and SBF has stepped down as CEO.

FTX may be expected to (if not already) clear its balance sheet, including Bitcoin, pushing asset prices to new lows.

When it rains it pours. Let us not forget that Bitcoin miners have been under major stress as of late with network difficulty and hash rate being all-time highs, and miner revenue (measured in USD) down dramatically — especially with global energy prices at historic levels.

Additionally, HashrateIndex.com’s index of mining-related stocks of public companies (including, but not limited to miners themselves) shows a strong downward trend since November 2021 when Bitcoin’s price reached an all-time high. With Bitcoin’s price drop since the FTX collapse, miners without sufficient fiat cash balances to cover operating expenses over the long “crypto winter” will struggle even more to stay afloat by selling off bitcoin holdings.

Where we see additional miner stress, we can expect miner sell pressure of successfully-mined bitcoins. Holding the demand constant, an additional quantity of bitcoins entering exchanges for sale means one thing: more downward price pressure.

BlockFi Update

In the first major contagion event since the FTX bankruptcy on Friday November 11th, BlockFi also announced in a blog post and email to customers that it had been affected by FTX’s situation, pausing user withdrawals.

In its first communication to customers since it paused withdrawals, BlockFi says it is “deeply saddened to see the devastation that is cascading across an industry that we love and believe in, touching the lives of so many people.”

Although it admits exposure to FTX and Alameda, the crypto platform says rumors that a majority of BlockFi assets are custodied at FTX are false. It also, curiously, implies that the infamous line of credit provided by FTX earlier this year, still has undrawn amounts – which it will be pursuing. “We do have significant exposure to FTX and associated corporate entities that encompasses obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX US.”

What’s next for BlockFi?

Like other failed lending platforms Celsius, Vauld, Hodlnaut and Voyager before it, BlockFi says it is now exploring a number of scenarios around how to proceed. It says it has “the necessary liquidity to explore all options” which means it can continue to pay its staff and its external advisors, but the company has not revealed the magnitude of its financial shortfall in terms of being able to return client funds.

The company says it has hired expert financial advisors including BRG to assist it in navigating its next step. Haynes and Boone continues to serve as BlockFi’s primary outside counsel.

How Long Before BlockFi Clients Receive Their Funds?

To date, none of the crypto banking platforms that have failed this year have returned any funds to depositors and many have filed for Chapter 11 bankruptcy or similar legal protection in other territories outside of the United States.

Chapter 11 is not a liquidation – instead it gives the failed business court protection from its creditors while it comes up with a plan to return the most value possible to affected stakeholders. A typical Chapter 11 bankruptcy in the US takes between three to five years to resolve.

BlockFi’s says its top priority “remains doing the best we can for our clients,” and it is exploring every strategic option available to it. With liquidity in the crypto space in short supply and no bail out/buy out likely, a Chapter 11 filing will likely be the best option for the company given the prolonged protection it offers from legal action. This option is even more likely given FTX has filed for Chapter 11 bankruptcy and a major part of BlockFi’s strategy for reclaiming assets is dependant on how much it will see returned from FTX in its bankruptcy proceeding – which will likely take several years.

Crypto news for the weeks ahead

1 December

The Theta Network will launch its “Metachain” on December 1st.

13 December

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of November. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

14 December

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are presently leaning towards a fifth interest rate hike but to pivot away from the previous four consecutive 75 bps hikes to “only” 50 bps. To the extent that crypto assets may still be seen by traders as risk-on, this would mean additional downward price pressure.

Top 10 Crypto Summary

Brave New Coin’s top 10 assets by market cap suffered a strong drop in price this week following the news of shaky financials then bankruptcy for both major cryptocurrency exchange FTX and its sister company Alameda. XRP and DogeCoin (DOGE) were hit hardest with over 29% drop each. DOGE’s drop might be best considered a recovery downward following its huge spike upwards over the previous weeks following news of Elon Musk’s successful Twitter takeover. (Musk has promoted DOGE, and as we covered in recent weeks, is expected to turn Twitter into a payment platform).

Bitcoin Price Chart

Over the previous two weeks, we discussed here what Glassnode identified to be key metrics that appeared to be evidence of a Bitcoin bear market bottom, formed around the US$18K price point. What the market learned since then turns out to have pushed asset prices down significantly further: FTX and Alameda’s shaky financial situation, which played its part in dropping BTC’s price to as low as $15.7K over the past week.

The various indicators are indeed useful, but markets are a complex, dynamic discovery process. While our tools and knowledge play a vital role in helping us identify what the late Nobel Prize-winning economist FA Hayek referred to as “mere pattern predictions”, in the current highly volatile environment, the future of price remains unpredictable.

Don’t miss out – Find out more today