Crypto Market Forecast: Week of November 21st 2022

A curated weekly summary of forward-focused crypto news that matters. This week, the FTX collapse drives the price of Bitcoin to new lows, FTX contagion causes connected crypto firms to tremble, and assets flow out of exchanges as traders lean towards self-custody.

The price of Bitcoin (BTC) remains mostly flat since last week, hovering at just under US$16.6K. Ether (ETH) saw a 5.8% decline in its price, currently at ~US$1.17K. Binance-coin (BNB) also fell by 4.4%, now trading at ~US$269.

Many thought that Bitcoin’s price had bottomed at the US$18K level, it turned out that there was at least one remaining major domino to fall — albeit with a delay.

Alameda and FTX’s recent collapse appears to be a tail end of a series of events following May 2022’s Terra-LUNA debacle. The collapse of various high risk crypto lending platforms that promised unsustainably high yield, in retrospect, seems almost inevitable due to the climate of unprecedented levels of fiat monetary expansion around the world, beginning in 2020. That is, under high inflation and low interest rates, individuals are nudged towards riskier investments promising high yields as they seek a stable store of value. Terra’s Anchor Protocol, which offered users nearly 20% APY, is a prime example.

But there are at least two silver linings on the horizon in the aftermath of FTX’s collapse (a Mt. Gox-level event for cryptocurrencies). They both suggest a healthier industry once the dust settles.

The first is a stronger-than-ever push towards self-custody as a way to overcome counterparty risk. Both Glassnode and Coindesk have noted strong net outflows from exchanges of crypto assets like BTC and ETH (a so-called “bank run”). The second is the learning component. No credible person expects that central banks will bail out cryptocurrency exchanges like they did for banks in the Global Financial Crisis. Over the short-term, it is unfortunate for individuals that lost because of FTX and Terra. Over the long-term, it means that when bad actors dangle 20% APY as a carrot, most traders are less likely to go for it — at least not without more careful due diligence.

The FTX contagion effect can be felt even further amidst the uncertainty. This time by crypto retail service provider Genesis Block, crypto lender Genesis Global Capital (no connection to Genesis Block!), and the Gemini exchange.

Reuters reported on Friday that Genesis Block had ceased trading. Genesis Block’s chief executive Wincent Hung told the news agency that “as we don’t know which counterparties would fail next [after FTX and Alameda] …we would rather close out all our positions to regain some of our liquidity”. However, unlike some platforms we have seen during the present bear market, Genesis Block, to its credit, invited customers to withdraw their funds.

Meanwhile, the other (unrelated) “Genesis” company, Genesis Global Capital, announced that it has suspended withdrawals on its crypto lending platform. The company’s parent company, Digital Currency Group, tweeted that the decision to suspend customer withdrawals “was made in response to the extreme market dislocation and loss of industry confidence caused by the FTX implosion”.

And finally, after the exchange Gemini paused customer withdrawals on Wednesday from its yield-earning program, it also saw a “rush of withdrawals”.

Crypto news for the weeks ahead

1 December

The Theta Network will launch its “Metachain” on December 1st.

13 December

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of November. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

14 December

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are presently leaning towards a fifth interest rate hike but to pivot away from the previous four consecutive 75 bps hikes to “only” 50 bps. To the extent that crypto assets may still be seen by traders as risk-on, this would mean additional downward price pressure.

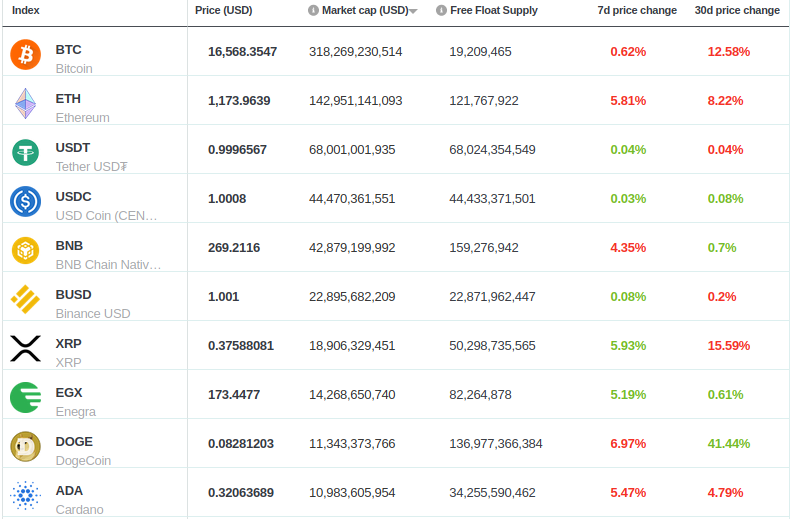

Top 10 Crypto Summary

Brave New Coin’s top 10 assets by market cap largely traded sideways this week as markets still struggle to understand what happens next with the collapse of FTX and Alameda. With closing prices for the week, no single asset price reflects more than a 7% change up or down, calm for cryptocurrencies. DogeCoin (DOGE) suffered the biggest price drop (just under 7%) and remain volatile as Elon Musk (who has taken a liking to DOGE) marches onward towards reshaping Twitter into a payments platform. Meanwhile, ETH suffers downward price pressure as a so-called “FTX Accounts Drainer” swaps large quantities of ETH for BTC.

Bitcoin Price Chart

What sort of activity are we seeing amidst the aftermath of FTX-Alameda’s collapse? Glassnode’s most recent on-chain analysis report looked at exactly that. As FTX is a centralized exchange, traders and HODLers around the globe proactively took custody into their own hands. Both BTC and ETH saw massive net outflows from exchanges. Stablecoins, by contrast, saw a net inflow into exchanges — mostly from smart contracts. Glassnode concludes this to be people trading what they believe to be higher risk stablecoins (which have their own counterparty risk) for lower risk BTC & ETH.

Don’t miss out – Find out more today