Cryptopia update – Liquidator Says It’s Close To Returning Funds

The long, drawn-out process of returning customer funds continues for Cryptopia liquidators Grant Thornton - with the latest liquidators report being released on 12th June.

More than four years on from the beginning of the Cryptopia exchange liquidation process, liquidators Grant Thornton have yet to return any account funds to Cryptopia’s customers. The liquidation process which began in May 2019, following the all-encompassing exchange hack of January 2019, remains ongoing. Grant Thornton first began referring account holders to the Cryptopia claims portal in December of 2020.

Cryptopia Update Released

David Ian Ruscoe and Malcolm Russell Moore, of Grant Thornton New Zealand Limited, were appointed jointly as liquidators of Cryptopia Limited in May 2019. The latest Cryptopia news is that a new liquidators report has been released in the last week, following the previous report which came out in November 2022.

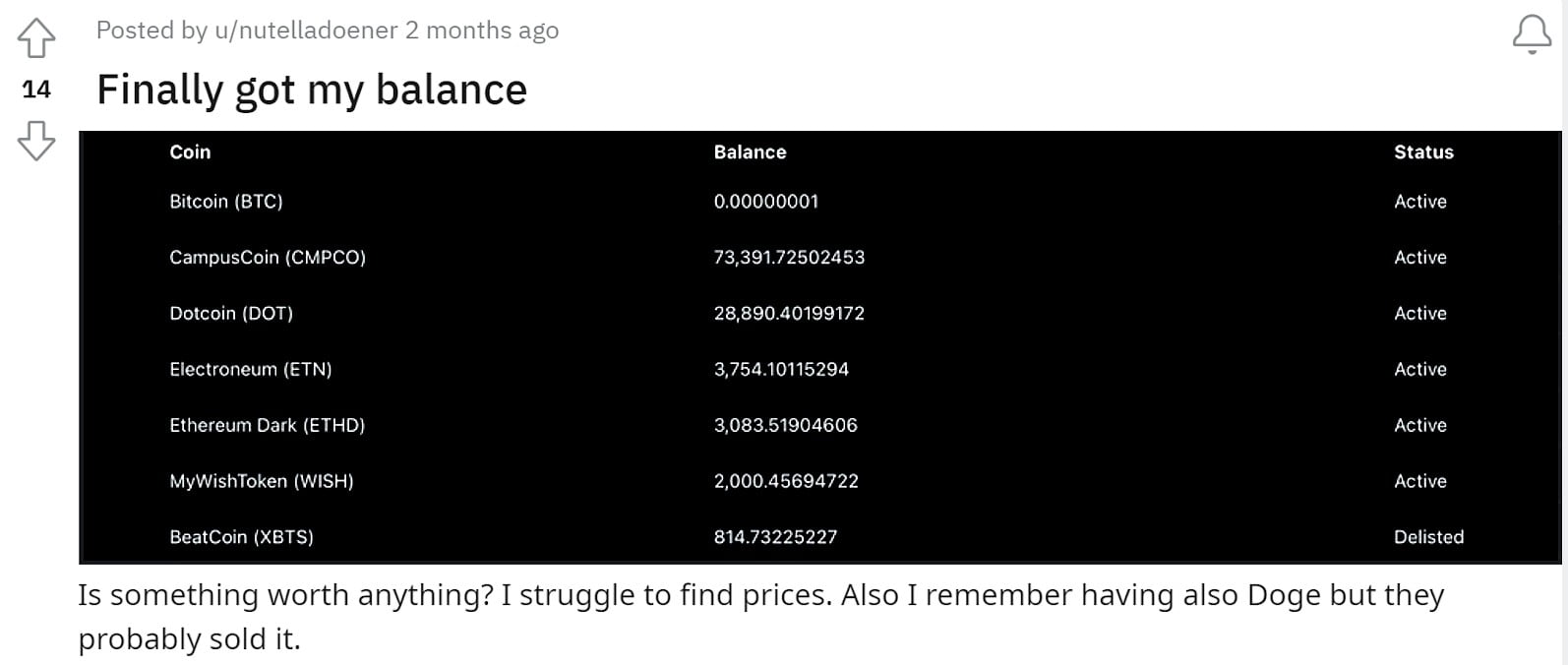

The liquidators write that as of June 2023, they are still in stage 3 of the process, and still confirming and agreeing to user balances and pre-distributing assets that are owed. While the liquidators say they will file for distribution this month and funds will start being returned soon, delays have occurred in the past. In the November 2022 liquidators report, it was written that Grant Thornton expected the distribution, and the 4th stage of liquidation, would begin in Q1 2023. It did not.

There are four stages to the Cryptopia claims process, that has been communicated at various times during the process by Grant Thornton, and now an extra step has been added to the 4th stage:

Stage 1: Claims Registration. This allows the registration of account holders’ details and for holders to make claims for their account balances.

Stage 2: Identity verification. Verifies account holder identities to the necessary verification standard.

Stage 3: Claim acceptance. Provides account holders with the opportunity to agree that Cryptopia records represent the amount due.

Stage 4: Asset transfer. Instigates asset transfers to account holders. The first part will be wallet address collection. This will allow eligible account holders to submit wallet addresses for each balance qualified to participate in asset distribution. The next stop will be the crypto-asset return. This will return the account holder’s assets proportional to distribution calculation using transaction/s broadcast on the relevant digital asset’s blockchain

In November of 2022, stage 3 of the claims process began. This was for users who had completed stages 1 and 2 of the process. Grant Thornton writes that by the end of May 2023 80% of those invited to participate in stage 3, responded and accepted the balance suggested. They say that less than 2% disputed the suggested balance, while the rest did not respond.

As of a December 2022 update, 84.5% of users had participated in the Cryptopia claims process in some way. This, however, includes any users who may have only opened the email or clicked on the link to the portal and are yet to fully engage in registering their claims.

While there are still a large number of Cryptopia users yet to be accounted for, the Grant Thornton customer support says it has engaged with 93,700 claimants.

Grant Thornton writes that for users to begin receiving distributions “input and approval of the Court,” is required. The processes that require approval include;

- The approval of a distribution process and how cost should be allocated across the cryptocurrency trusts associated with Cryptopia,

- Confirming what will occur with any unclaimed cryptocurrency,

- Setting a cut-off date for when claims need to be reviewed and assessed.

In the latest liquidators released on June 15th, 2023, Grant Thornton says — “These documents are currently being finalised and we expect to file this distribution application this month.”

Another notable aspect of the liquidator’s report is the costs involved with the process. Grant Thornton has spent over NZ$20.5 million on the liquidation process as per this latest report. They have spent ~NZ$459,727 in the last 8 months. A detailed breakdown of costs and a description of the work processes can be found in the report. The liquidators have a variety of creditors providing funding for the process.

At the time of its collapse, Cryptopia had 800,000 users with a positive balance and well over US$100 million worth of funds trusted to it. Additionally, most of Cryptopia’s users were international, complicating this process.

The international nature of Cryptopia has meant that actions have been filed in the United States, Singapore, and Malaysia to track assets. This was mainly done to track whether assets attained during the hack were shifted to exchanges and then sold or laundered. They have also continually worked with NZ police over the last four and a half years.

Grant Thornton has reported that some restrained assets attributed to the hack and theft have been traced to the USA, and that US law enforcement has been petitioned to offer support.

In Singapore, an exchange that is believed to have received hacked funds has been contacted. The liquidators write that the exchange has complied with their disclosure request. The focus will be on the user accounts that are believed to have received funds from the hack.

There are other complications laid out in the operational process in the latest liquidators report. This includes rebuilding the Cryptopia wallet environment. Grant Thornton explain that this is “due to the fact that the source of the original hack is still unidentified. This means the risk that malicious code still resides in the historic wallet environment still exists.” The liquidators explain they are engaging with international cybersecurity experts to secure wallets on behalf of users and transfer assets to a secure environment.

They also write that because of poor record-keeping and reporting deficiencies on the part of Cryptopia, reconciling assets held within the exchange’s wallet and what is owed to customers is a challenge that they are addressing with success. Liquidators had to forensically reconstruct parts of the exchange wallet based on on-chain movements to corroborate customer withdrawals.

They write “This process has involved a significant amount of data discovery exercise involving millions of transactions and addresses.” They say this on-chain corroboration has helped to update account holders’ balances to ensure that what is due (and what is owed) is correct. It is safe to assume that factors including gas costs, particularly given the number of ERC-20 token that Cryptopia listed, may complicate this process further. Any users hoping for a Cryptopia refund should urgent engage in the process via the Cryptopia claims portal if they haven’t yet done so.

What is the Cryptopia exchange?

Cryptopia was a digital asset exchange operated by Rob Dawson and Adam Clark between 2014 and 2019. The exchange was based in Christchurch, New Zealand. Dawson and Clark were better known to customers by their online usernames “Hex” and "sa_ddam213". Dawson has said that he and Clark were compelled to build Cryptopia after negative experiences with other exchanges, and “a desire to build the website that we ourselves wanted to use.”

After two years of operating, Dawson and Clark both quit their jobs in order to run Cryptopia full time. The platform peaked in popularity following the 2017 market-wide bull run, when the value of Bitcoin (BTC) and other cryptographic assets skyrocketed. By 2018, Cryptopia had more than 80 staff members and a user base of ~1.4 million.

On January 15th, 2019 the Cryptopia Twitter account announced that the trading platform had suffered a major security breach resulting in “significant losses.” Trading services were suspended and a police investigation was launched that night. This led to a lockdown and a physical investigation of the company’s headquarters the next day.

The hack saw over 70,000 wallets compromised and over US$23 million in Ethereum (ETH) and ERC-20 tokens stolen. A second hack occurred on January 28th, where an additional US$284,000 from 17,000 wallets was captured. In May 2019 it was announced that the Christchurch based exchange had gone into liquidation. An investigative report by a local media outlet Stuff suggested that there were personal conflicts and tensions between the Cryptopia founding members and executive teams. To date, no one has been charged over the theft.

David Ian Ruscoe and Malcolm Russell Moore, of Grant Thornton New Zealand Limited, were jointly appointed as liquidators of Cryptopia Limited. Grant Thornton New Zealand released its Liquidators’ Third Report on the State of Affairs of Cryptopia on June 12th.

The Report says that customers did not have individual wallets, and it would be impossible to determine individual ownership using just the cryptographic keys registered within the Cryptopia wallets. Cryptopia operated as a centralized exchange and customer trades occurred on the exchange’s internal ledger, without any confirmation on blockchains like Bitcoin or Ethereum.

Grant Thornton also stated that a detailed reconciliation process between the customer databases and the crypto-assets held in the Cryptopia wallets has never been completed by the operators of the exchange. The liquidators closed its third report into the Cryptopia failure by stating “at this stage it is not practicable to estimate a completion date for the liquidation.”

On 8th April 2020, the High Court of Christchurch issued a judgment stating that the liquidators estimated Cryptopia had cryptocurrency currently worth about NZD 170 million at the time of the hacks. Somewhere between nine and 14 percent of its cryptocurrency was stolen, according to the court document.

This ruling also gave Moore and Ruscoe permission to begin the process of reconciling assets lost by Cryptopia. Before the ruling, there was a lack of clarity surrounding whether the digital assets residing in Cryptopia’s wallets were held in trust for account holders.

Judge Gendall says the courts had to clarify concerns around the legal nature and status of the digital assets and potential equitable interests in them. Whether digital assets could be considered property and if Cryptopia’s account holders had rights to this property.

The decision was firstly driven by the fact that cryptocurrency is “property” for the purposes of the Companies Act 1993. And secondly, the account holders’ cryptocurrency is held in trust by Cryptopia on behalf of users. A separate trust exists for each type of cryptocurrency the exchange held.

In his decision, Judge Gendall explained that it is his view that cryptocurrency was property as it met, “some degree of permanence or stability,” which is a requirement of Section 2 of the Companies Act. This means that the cryptocurrencies are owned by the account holders, and will not form part of the pool of assets available to unsecured creditors.

Don’t miss out – Find out more today