Coins to watch in 2022: FTX and the FTT token – Crypto’s largest startup

FTX is officially one of the largest startups in the world, crypto or otherwise. Its recent whopping US$32 billion valuation has caught the attention of observers in the tech and crypto space. The FTT token has enjoyed strong gains in the last two years alongside the booming FTX exchange. Can this growth be sustained?

FTX (FTT) is a Hong-Kong based one-stop-shop cryptocurrency exchange that offers derivatives, fiat-to-crypto, crypto-to-crypto, and OTC solutions for investors and traders. The exchange is powered by a native token, FTT. Using FTT on FTX gives traders discounts on trading fees and a variety of other perks. Staking FTT gives users further powerups on the exchange including access to airdrops and further fee discounts. FTX works as both a utility token and as a proxy bet on the growth of the FTX ecosystem.

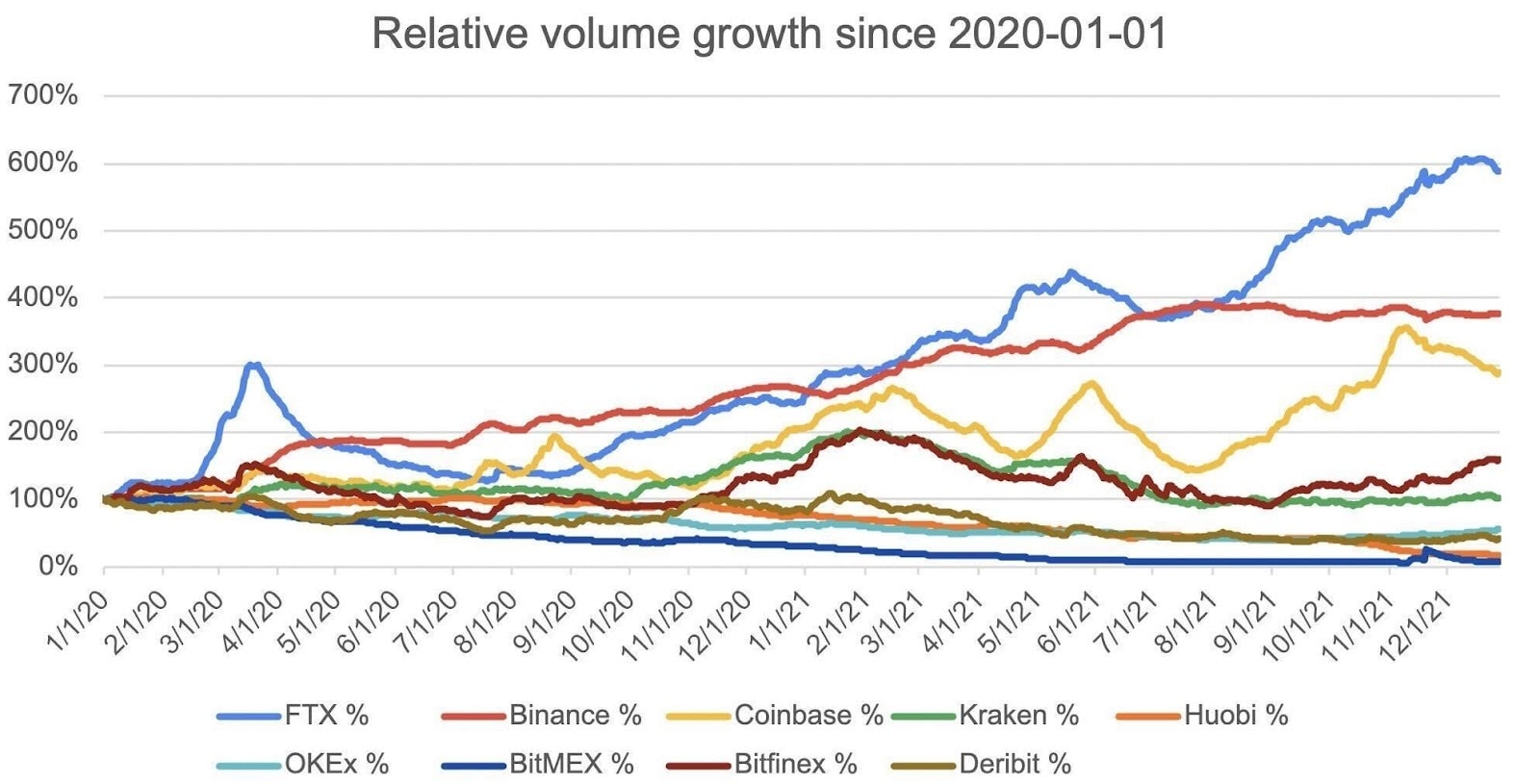

Despite only being founded in 2019, FTX has risen to a position of prominence within the crypto exchange space. It is currently the second largest fiat-to-crypto exchange in the world, behind Coinbase, controlling ~18% of the fiat-to-crypto trading volume. It also hosts the second largest share of Bitcoin futures open interest in the world.

Source: The Block data, CryptoCompare

Source: The Block data, CoinGlass

Source: Twitter user @Matthuang

The relative volume of the growth of FTX since the beginning of 2020 is exceptional. While some competitors struggled to handle and capture the influx of new crypto buyers in 2021, FTX’s volume surged and it appeared to competently onboard many new users.

In the last week, the exchange has grabbed headlines following a US$400 million series C fundraise that gave FTX an enormous US$32 billion valuation. FTX is not just large for a crypto company, its new valuation makes it the 8th largest start-up, of any kind, in the world according to data from the Visual Capitalist.

It is bigger than powerhouse tech brands like Epic Games, Nubank and Grammarly. Participants in the funding round included Paradigm, Temasek, Multicoin Capital, and SoftBank. All participants had participated in previous FTX investment rounds. This Series C funding comes a few months after the firm raised $420 million, which at the time gave it a US$25 billion valuation.

Matt Huang, co-founder of VC firm Paradigm, said on Twitter after the Series C, “Their volume and market share growth over the past two years tells a clear story … just the beginning of what’s to come!” Huang also described FTX as, “a generational company in the making.”

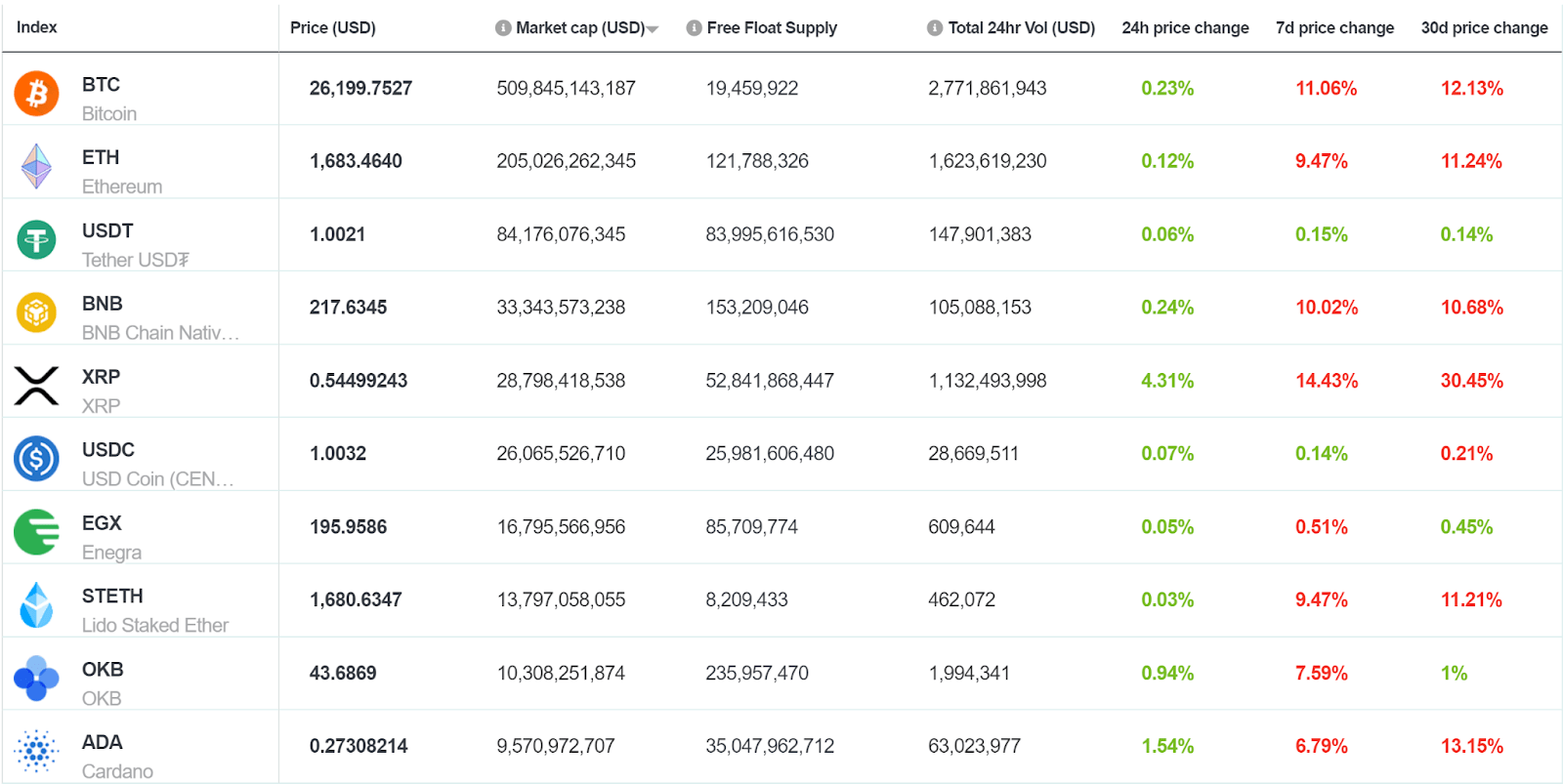

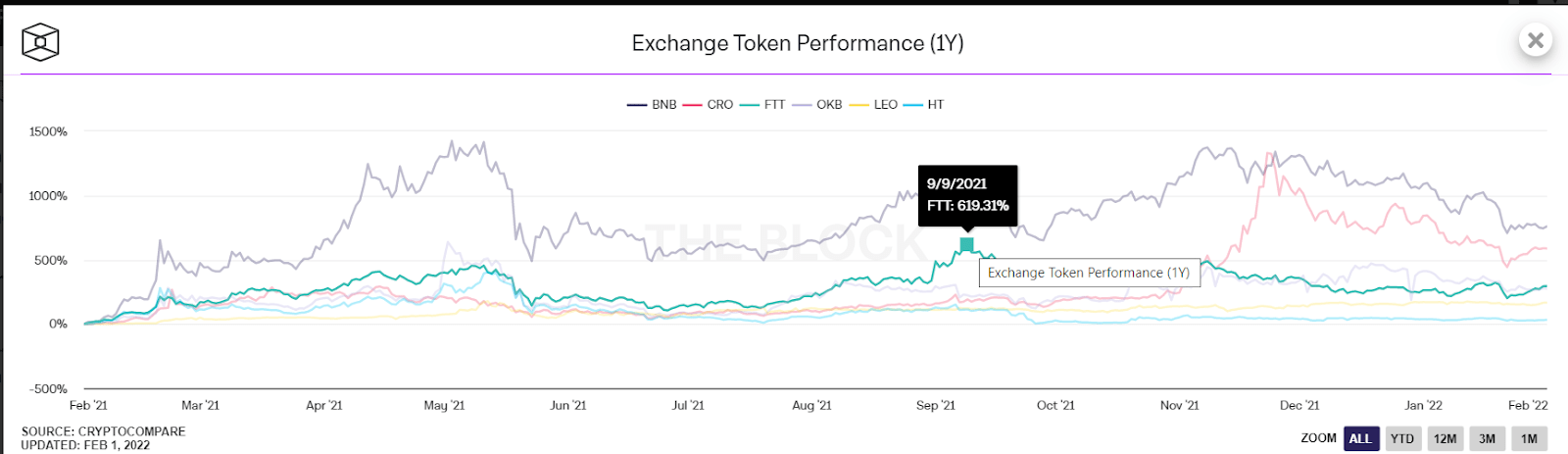

The FTT token is currently the 29th largest on the Brave New Coin market cap table. At the beginning of 2021, it was the 41st largest asset in crypto. At the time the market cap of FTT was US$653.3 million, the value of the token is now US$4.9 billion.

In the last year, the price of the FTT token has risen from US$11.86 to currently sit at US$45.14. This constitutes a ~281% rise in value.

Exchange Token Performance in the Last Year

Source: The Block Data, CryptoCompare

While perhaps not as exciting as the gains of other exchange tokens like Binance’s BNB and Crypto.com’s CRO, the gains of FTT appear to be more consistent and cycle resistant than others as it has shown an ability to hold relative value and resilience during bearish periods.

An indication of this resilience is its price performance over the last month. In the last 30 days while Bitcoin (BTC) and fellow exchange token Binance-coin (BNB) have dipped by ~21%, and ~28%, in the face of bearish global macro tailwinds, FTT has risen by ~3%.

Origins of FTX

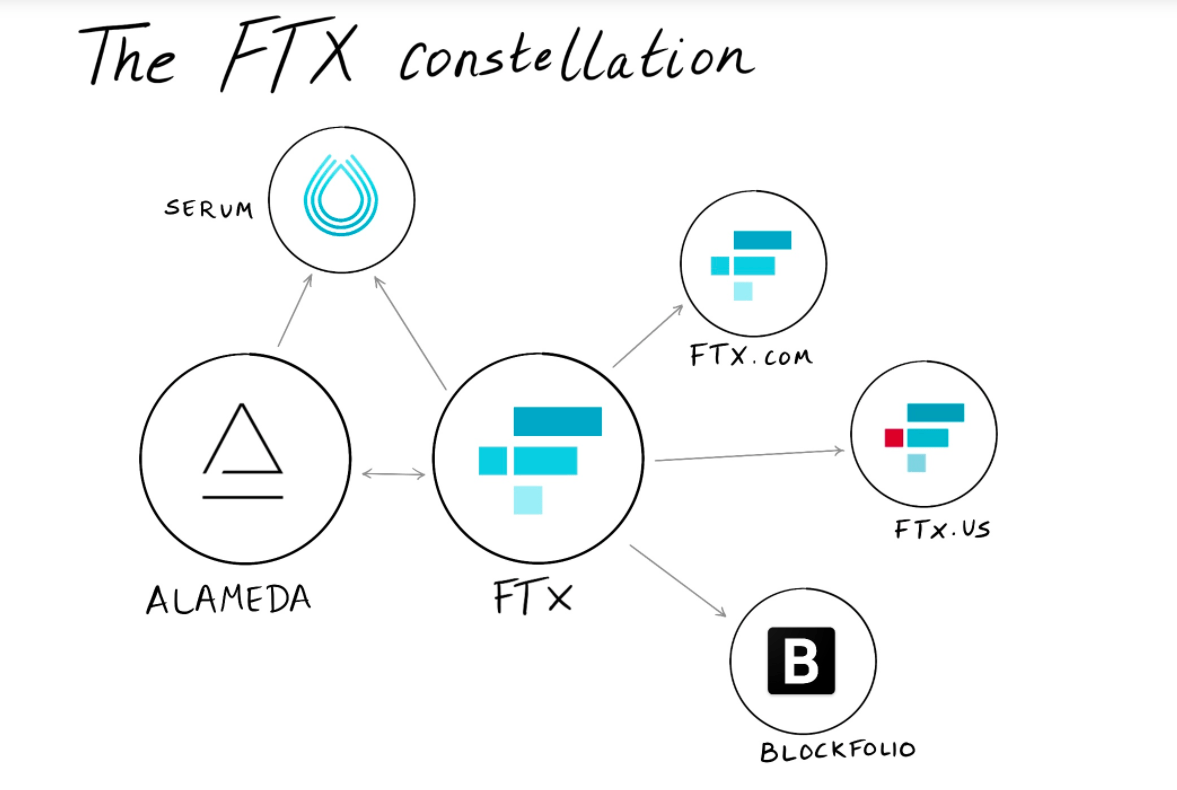

FTX launched in April 2019 and was incubated by Alameda Research, a quant-focused cryptocurrency trading firm. FTX was incorporated in Antigua and Barbuda but is headquartered in Hong Kong. FTX and Alameda share the same leader, the mercurial Sam Bankman-Fried aka SBF.

Forbes lists Sam Bankman-Fried as the richest man in crypto with a net worth of US$17.1 billion. Bankman-Fried is just 29 years old. He studied physics at MIT and is the son of two Stanford law professors. After starting off in crypto in 2017, initially gaining success finding arbitrage opportunities in Asian markets, Bankman-Fried built FTX as an exchange “by traders for traders.” He has helped steward it to become one of the largest crypto exchanges in the world.

On top of the success of FTX, it has often been stated by insiders that Alameda Research may be the single largest investor in the crypto space. At one point it was believed that Alameda constituted for 5% of the total crypto trading volume, handling around US$1 billion of trading volume a day.

During the early days Alameda helped FTX bootstrap its growth by being its primary market maker, however, this function has become less required over time as FTX became larger. Alameda still has a core role in powering FTX’s no-fee OTC desk.

Beyond Alameda, the FTX ecosystem is littered with other interconnected entities that support each other. While “FTX” is the main holding company based in Hong Kong, it has two branches FTX.com and FTX.us.

FTX.com is what most people visualize when they think of FTX. It is a full-featured exchange with numerous bells and whistles. It hosts different innovative products and a variety of fiat on-ramp options, and derivatives. FTX.us is a watered-down version of FTX.com and features fewer exotic products so that it can be within the bounds of stricter crypto regulations in the United States. This is similar to the relationship between Binance and Binance U.S.

In August 2020, FTX acquired the market-leading mobile news and portfolio tracking app, Blockfolio, for $150 million. Blockfolio offered FTX significant access into the retail crypto traders space and the app has since been integrated into FTX branding. Blockfolio’s technology now acts as the backbone of the FTX mobile app.

The final piece of the FTX ecosystem is Serum, a decentralized exchange built on Solana. Serum was built by Alameda and Bankman-Fried. Alameda offers liquidity on Serum and FTX routes some of its trading flow to Serum.

Source: The Generalist

The FTX model for derivatives liquidation helps it grow

FTX was initially launched with a focus on creating a better environment for crypto derivatives traders. The exchange uses a unique 3-tiered liquidation model designed to minimize the social losses associated with leveraged positions being liquidated on crypto exchanges.

With leveraged trading, traders are using borrowed money – this means their accounts can go negative during sharp price moves against them. In crypto derivatives trading, unlike in traditional finance, because of reduced KYC and AML requirements, and the non-use of brokers, an exchange cannot go outside of the system to claim assets to cover a trader’s losses.

Because of this other traders on exchanges have to help cover positions when leverage traders face negative account balances and a social cost is incurred.

In a worst case scenario an exchange will institute a clawback to prevent the losses from a large leveraged account crashing it. A clawback is when a crypto derivative account has to step in and claim users’ funds across the exchange because an leveraged account has gone too far negative.

FTX attempts to prevent the social loss of trading by taking an early, staggered approach to dealing with leveraged accounts that are about to go negative.

Like other crypto derivatives exchanges, FTX starts the process by automatically detecting when a user has dropped below a maintenance margin. This is when it is dropping quickly but still not yet negative. The initial maintenance margin for FTX is much higher than other crypto derivative exchanges and at this first stage, traders are prevented from making new trades.

At the second stage, if the account drops further, FTX will begin market selling from the users account to maintain the position.

“We don’t sell so quickly that the liquidation orders themselves will crash the market; that would be dooming the entire process. We also don’t give up if the price looks ‘bad’ — it might only get worse from there and you have to do the best you can liquidating an account rather than hoping things magically reverse.” FTX explains in a blog post.

FTX writes that this is usually enough, however, if the price falls further then a backstop liquidity provider system kicks in. In this situation, liquidity providers who have opted into the system will internalize the position. They’ll step in close to when a position goes bankrupt, to manage the collateral and obligation. The backstop liquidity providers will source liquidity from other exchanges and inject it into FTX as an extra layer of protection.

FTX explains that if all else fails there is a final step, “FTX will do what other exchanges do — it will auto-delever an account’s position against accounts that have the opposite position on, and attempt to cover any losses out of the insurance fund; and if the insurance fund runs dry then there will be clawbacks.”

Clawbacks are rare but have occurred in the crypto derivatives space in the past. FTX’s more measured approach has stood them in good stead within the crypto trading community.

Nobody wants to pay for other traders’ mistakes and FTX more so than any other crypto derivatives platform ensures that this does not happen. The platform’s growth in the last two years is an indication that traders approve of the strategy.

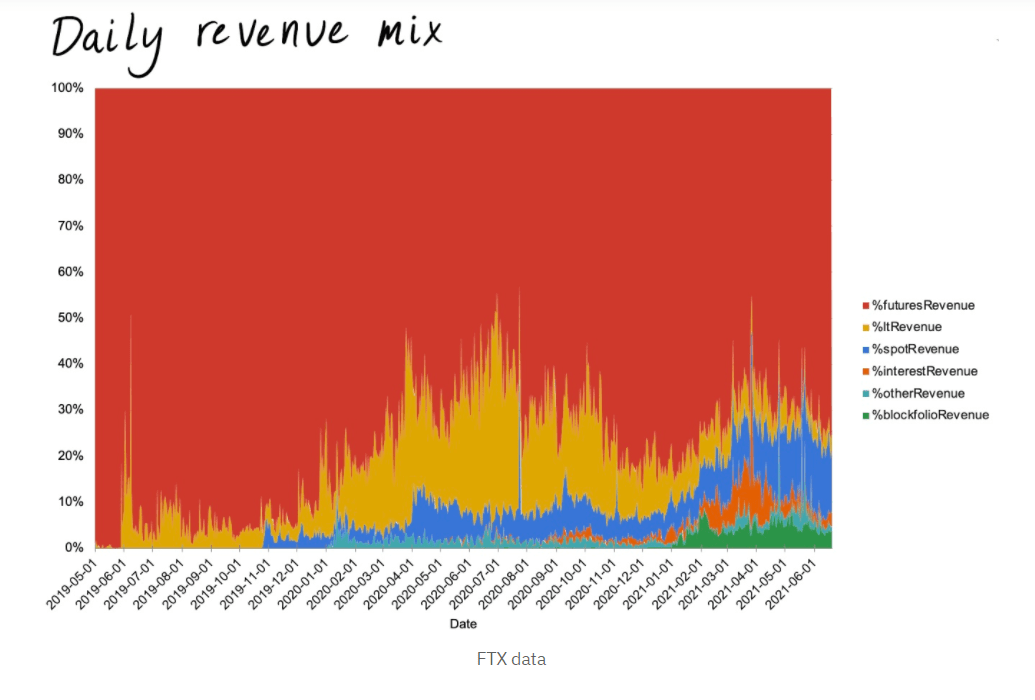

The majority of FTX’s revenue is generated from its Futures product. Source: The Generalist

Other things FTX does well

Beyond an innovative approach to managing margin trading liquidations, there are other things that FTX does well.

FTX popularized the Leverage Tokens model. Leveraged Tokens mimic the experience of trading on spot markets but allow 3X, -1X, or -3X multipliers on various tokens. I.e. With the Bitcoin3X if the spot price of BTC rises by 1%, Bitcoin3X will rise by 3 times that. With Bitcoin-3x if the spot price of BTC rises by 1% the Bitcoin-3X will fall by 3 times that.

Traders can add multipliers to go long or short on a crypto asset without having to deal with using margin. Users can less messily attempt to gain leveraged returns. These simple derivative products were instantly popular on the platform.

FTX was also the first exchange to popularize and create efficient markets for BVOL. The BVOL token tracks the implied volatility of the Bitcoin price. These tokens can be longed and shorted to bet on the predictability or unpredictability of the BTC price.

FTX also offers tokenized versions of stocks like Gamestop and Apple to crypto native traders. This product is offered through a partnership with CM-Equity as a brokerage. CM-Equity is fully regulated in Germany, and is a licensed financial institution permitted to offer these products. Beyond this FTX also offers prediction and options trading, to ensure it covers as many bases as possible.

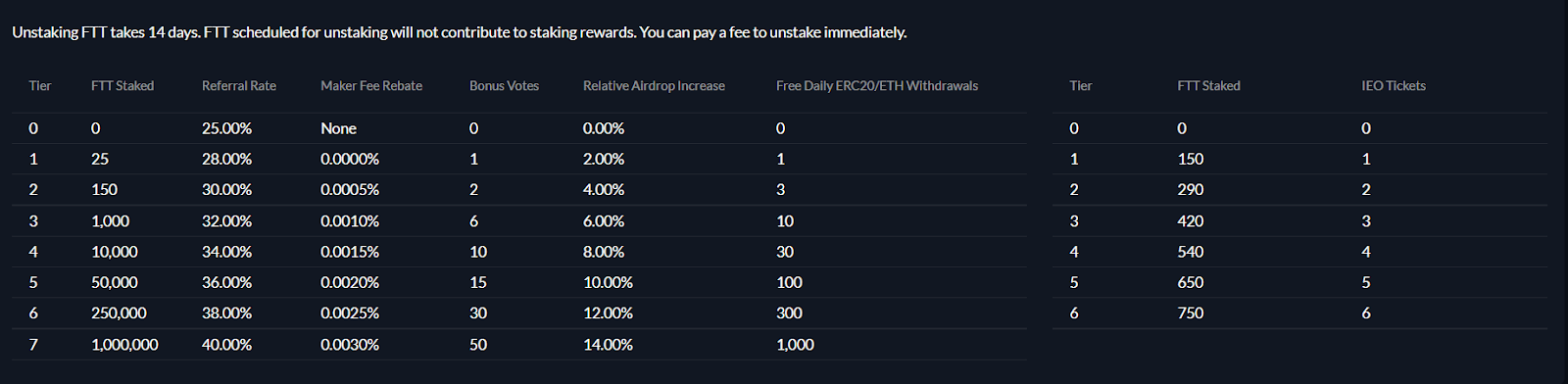

Amongst FTX’s other unique features is the option for ERC-20 withdrawals for users who stake native FTT. In the last year gas prices have shot up because of the growing popularity of Ethereum. Gas prices are also variable and this means that they can jump to unsustainable levels.

ERC20 tokens are popular on many crypto exchanges for speculative purposes. Moving them between private wallets and exchanges can get as high as US$50 for a single withdrawal on days when the network is busy.

FTT holders, based on the numbers they have staked, get access to a set number of free ERC20 withdrawals a day. Users who stake 25 FTT get access to 1 free ERC20 withdrawal a day. At the highest tier, users who stake 1,000,000 FTT get access to 1000 free ERC20 withdrawals.

FTX is also appreciated by the crypto community for its handling of US dollar stablecoins. FTX treats all stablecoins the same apart from US-Dollar Tether (USDT). This means users don’t have to worry about finding the right stablecoin market for the right trading pair or exchanging between stablecoins in order to find a matching pair.

USD, USDC, TUSD, USDP, BUSD, and HUSD all count as “USD Stablecoin” balances on FTX.

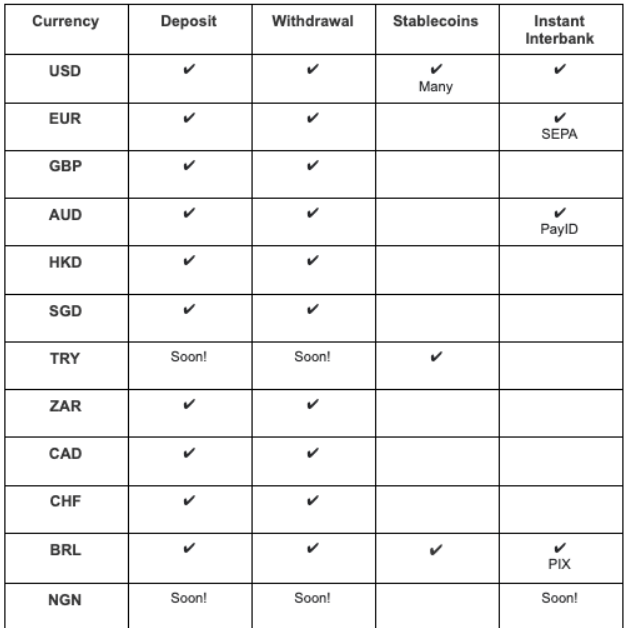

FTX also supports a variety of different fiat currencies.

Source: Medium user @stakingbits

Users can deposit and withdraw fiat currencies via wire transfer. In order to freely transfer fiat funds on FTX users have to go through level 2 KYC/AML verification. This is comprehensive and involves providing: full legal name, date of birth, address, proof-of-address/phone jurisdiction, description of source assets, a passport and other similar government-issued identification, and facial verification.

FTX only charges for withdrawals in USD and BRL, USD withdrawals under US$10,000 incur a US$75 fee.

FTX also has a feature that allows for straightforward and quick conversion from other fiat currencies to USD or USD stablecoins. Fiat currencies are converted into USD stablecoins using the live exchange rate that the FTX OTC desk uses.

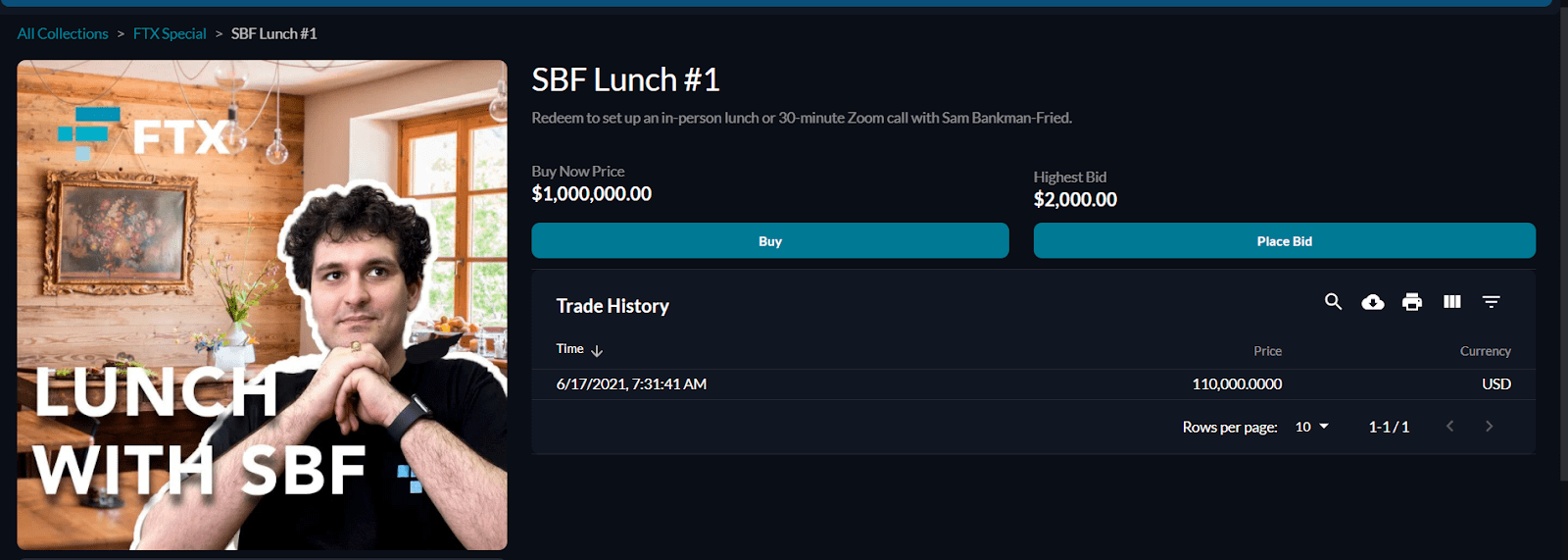

Another example of FTX’s product experimentation is its NFT marketplace. FTX allows artists to create and upload their creations and sell them to the exchange’s users.

The marketplace is notable for some FTX-specific NFT experiences. On the marketplace a user can buy an NFT that is redeemable for an in-person lunch or 30-minute Zoom call with Sam Bankman-Fried. Users can also redeem an NFT that is redeemable for a game of League of Legends against an FTX team.

The depositing and minting of NFTs is not available on FTX international. Both US and non-US users can mint, deposit and trade NFTs on FTX.US.

FTX has recently launched a product focused on merchants, FTX Pay. FTX Pay is a widget that a merchant can use to accept both crypto and fiat payments for their site, app, or store.

There are two ways merchants can receive payments through FTX Pay, either an FTX account, and an external wallet. Just like the NFT marketplace, international merchants seeking to access FTX Pay have to reach it through FTX.us at ftx.us/pay. This is despite FTX Pay not being unavailable to merchants in the United States.

What is the FTT token?

FTT is the utility token of FTX and offers holders a variety of benefits on the exchange. These include:

- The weekly burning and buyback of FTT tokens, a proxy dividend for holders

- Lower FTX trading fees

- FTT is used as collateral for futures trading

- Socialized gains from the insurance fund

33% of all fees generated by the exchange, 10% of all net additions to the insurance fund, and 5% of all other fees will be used for the repurchase and subsequent burning of FTT until half the total supply is destroyed.

Assuming that demand to use the FTT token grows over time or remains constant, the burn feature which constricts the supply of the token should have a positive effect on the price of FTT. Given the rapid growth of FTT over the last two years this appears to be a simple investment thesis.

Fee discounts for FTT holders begin from 3% if the user holds US$100 worth of FTX and rise up to as much as 60% for users holding at least US$5 million worth of FTT. As a maker, if you stake FTT, then you don’t pay any fees and also receive small rebates.

FTT holders also get increased referral rebate rates. Referrers that stake FTT are paid a higher fraction of their referees’ fees.

Branding: The visibility of FTX builds

FTX has developed an aggressive marketing and branding strategy. In the summer of 2021, it was announced that FTX had bought the naming rights for NBA franchise, the Miami Heat. The exchange bought the rights for a whopping US$135 million and the former American Airlines arena is now the FTX arena.

A few days after this the company spent a further US$210 million to gain the naming rights for e-sports giant Team Solo-Mid. After the deal, Team Solo-Mid became “TSM FTX”.

Just a few weeks after these two deals, FTX became the first crypto company to become a Major League Baseball (MLB) sponsor. Now MLB umpires have an FTX patch on their sleeves.

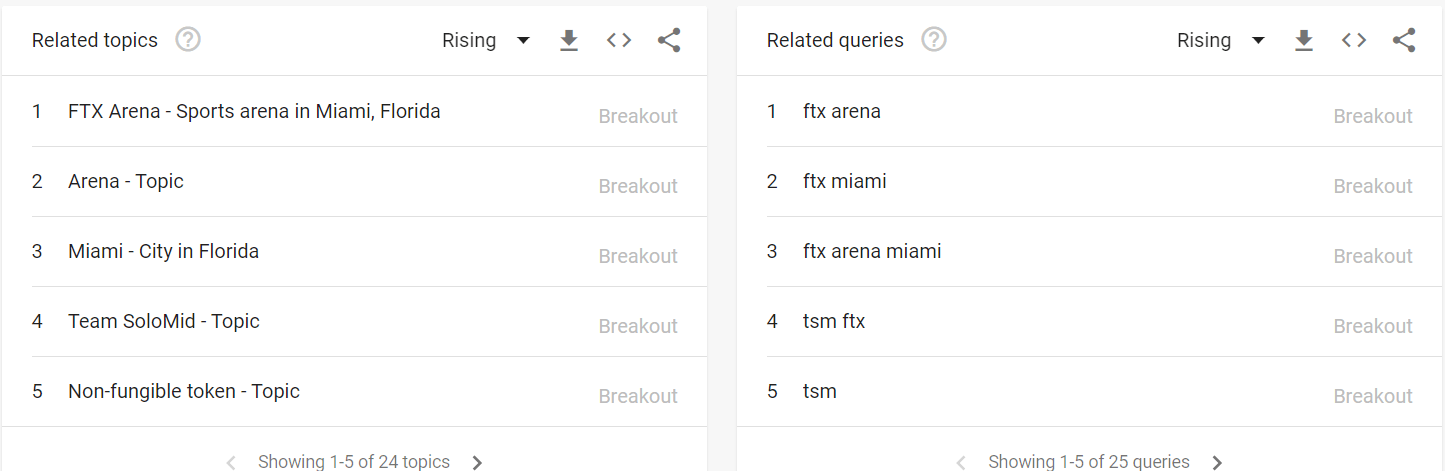

Source: Google Trends

Data from Google Trends indicates that since the summer of 2021 worldwide search interest for the term ‘FTX’ has steadily ticked upwards.

Source: Google Trends

The related query and topic data indicate that the FTX arena and Team Solo-mid were clear factors in the uptick of search interest.

Similar to Crypto.com, FTX is spending a large amount of money to embed its brand in the culture of the demographics that crossover into crypto.

Crypto, basketball, baseball, and e-sports are all popular with young adult males. Often buying into crypto is a cultural decision that is based on other factors outside of a black or white decision about whether an investment will generate a return. FTX understands that new users often get into crypto because it is perceived to be cool, exciting, and glamorous.

FTX is also considered one of the good guys in the crypto space. The FTX Foundation is a non-profit organization that collects 1% of all fees generated by FTX and then donates them to cost-effective charities. In June 2021, the FTX Foundation launched FTX climate, a project with hopes to make FTX carbon neutral. FTX climate also funds promising climate change research.

In October 2021, the FTX foundation also announced a fellowship program to support high quality community projects and build an effective altruism community in Barbados.

Conclusion

FTX is officially one of the largest startups in the world, crypto or otherwise. Its recent whopping US$32 billion valuation has caught the attention of observers in the tech and crypto space. FTX has become one of the visible brands in the crypto space because of its eye catching investment rounds and marketing plays such as its sponsorship of one of the largest sporting and events venues in Florida.

The FTT token has enjoyed strong gains in the last two years alongside the booming FTX exchange. Its dual value as a utility token to be used on the exchange and as a way for retail users to speculate on the growth of the FTX exchange, has helped it hold value even when wider market conditions are bearish. In the last month, as other digital assets have dipped drastically in value, FTT has held steady.

Looking underneath the hood, it is easy to see why FTX has so many committed investors and users. It is one of the most innovative builders of new trading products in crypto and more importantly, it has focused on building a smooth, fair trading platform for margin and spot crypto traders. Mapping out FTX it is clear that throughout the ecosystem there is a focus on good engineering, quality, culture and ethics.

FTX continues to absorb more volume and market share from competitors within the crypto spot and derivatives ecosystem and it seems likely that this upward momentum will continue.

Don’t miss out – Find out more today