Has the recent stock market performance contributed to the slide of Bitcoin?

All financial markets have experienced significant volatility in 2020. But do stock market slides necessarily mean Bitcoin and other crypto assets will follow suit?

Equity investors will have noticed an increase in the volatility of the stock market of late, with indexes such as the tech-led Nasdaq 100 experiencing a roller-coaster ride throughout 2020. Stocks have traded against an uncertain and volatile climate, where shares are being undermined by a lack of correlation between price and the company’s underlying earnings.

All major U.S. stock indexes closed lower again on Wednesday, as investors worry about mixed messaging around further coronavirus aid, rising COVID-19 cases, the potential for a contested U.S. election and news reports that global banking giants helped criminals launder money.

The S&P 500 dropped by 2.4%, the Dow Jones Industrial Average was down 1.9%, and the Nasdaq Composite was down 3%.

Despite an attempt to bounce from oversold levels, stock markets are on track to have their first bearish monthly close since March. That means that risk assets such as Bitcoin and crypto assets are likely to be sold off if the stock markets slide further.

The underlying vulnerability of stocks and the continued socio-economic impact of Covid-19 remains a huge threat to investors. During this unpredictable time, utilizing a stock analysis site can help guide you towards making the right decisions.

Some market commentators also believe that the further decline of the Nasdaq could precipitate a further fall in Bitcoin’s price. But is this really the case, and what should investors look for in terms of correlation?

Stock market volatility increasing

This month has been particularly volatile for Nasdaq investors, with September 11th seeing the index trail its record high by 9.2%.

However, the cumulative value and performance of the Nasdaq 100 was still up by more than 70% since its March low, when the stock market crashed as the WHO confirmed that the coronavirus was officially a global pandemic.

Of course, stocks have been directly affected by the socio-economic impact of Covid-19, with sentiment, volume, and share values tumbling against the backdrop of wide-scale job losses.

Most recently, indexes such as the Nasdaq 100 have been hindered by disappointing jobless claims and stagnant job creation numbers, with more than 29 million Americans still receiving some form of benefit following a loss or reduction of employment.

Edward Moya from Oanda has suggested that investors had subsequently turned their attention to the recent Fed meeting and placed their hopes on the ability of Congress to agree to a viable coronavirus stimulus package. However, these hopes have been dashed by the failure of Republicans and Democrats to strike any form of accord.

Republicans and Democrat negotiations over a broader stimulus package have stalled, made worse by the high stakes political situation that has arisen following the death of Supreme Court Justice Ruth Bader Ginsburg. However, Democrats have said they would push for new stimulus checks and with the election looming Republicans may yet be receptive.

The decline of the stock market is also being driven by the recent news that the Japanese multinational conglomerate SoftBank has been placing huge and risk-laden option bets on tech shares.

It’s thought that such speculation has artificially inflated the performance of the Nasdaq and its stocks during a pronounced rally in August, compounding a wider issue that has driven tech stocks higher despite relative stagnation in earnings throughout 2020.

How does the stock market impact Bitcoin?

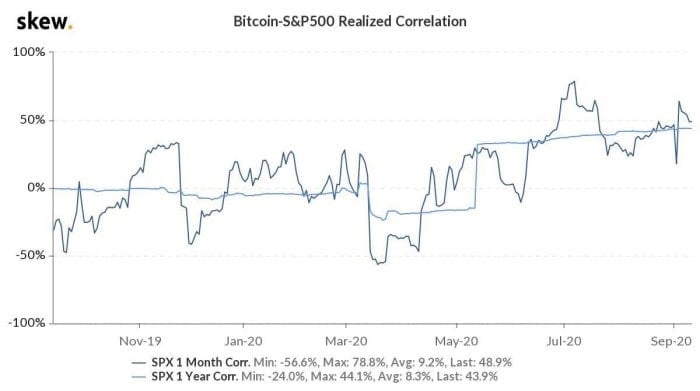

In 2020 the performance of the Nasdaq, and the S&P 500 has been tracked by the value of Bitcoin, suggesting a high level of correlation at present.

Over the course of the last three months, Bitcoin and stocks have largely moved in sync, with many predicting this trend to continue well into Q4. The lead up to the U.S. election could be particularly challenging for investors, with the global stock market poised for a major, short-term correction.

This could well encourage investors to adopt a short-selling position within the next week or so, while many may also assume a more risk-averse approach as both markets remain bound by widespread uncertainty.

For Bitcoin investors with strong conviction and a long term time horizon, Q4 may provide further buying opportunities.

Don’t miss out – Find out more today