Investment Watch: Picking Winners In Web3 Gaming

Web3 game developers were on the receiving end of mountains of investment in 2022. Today those investments are starting to pay off as the next wave of Web3 games hit the market. This article looks at the current state of play.

What is Web3 Gaming?

Web3 gaming, refers to the next generation of gaming experiences that incorporate decentralized technologies, such as blockchain, non-fungible tokens (NFTs), and decentralized finance (DeFi), in some aspect of their gameplay loop. They are often characterized by a play-to-earn (P2E) mechanic where game players earn crypto tokens as rewards for completing tasks such as finishing levels and winning battles against other players. Rewards can be in the native currencies of protocols such as MANA, or NFT assets.

Web3 is a catch-all term used to describe the vision for a new, more equitable version of the internet. At its core, Web3 hopes to take power away from large private companies who act as intermediaries and return it back to everyday users. Through its permissionless nature, decentralized ethos, and native crypto payments, Web3 hopes to return ownership of assets such as personal data and the ability to be compensated for online activity, back to users. Web3 gaming applications do not require personal information when signing up to play, and users earn rewards directly in the form of tokens or NFTs for contributing to online gameplay and activities.

The top Blockchain games in the world, as listed by dappradar.com, have impressive 30-day transaction volumes. Axie Infinity (deployed on Ronin and Ethereum) did US$41.3 million in transaction volumes in the last 30 days, Gods Unchained (deployed on ImmutableX and Ethereum) has done ~US$20.6 million worth of volumes, while DeFi Kingdoms (deployed on Avalanche, Harmony, Klaytn, and the DFK chain) had US$4.15 million worth of volume over the same period. Overall, Dappradar lists a total of 2326 games on its registry but there are many smaller unlisted P2E games yet to be discovered.

While transaction volumes remain steady, activity within the Web3 gaming sector has well fallen below the peak levels hit during the boom periods of 2022.

Breaking down the gaming sector by individual blockchain networks, there are clear drop-offs in activity on the Solana, Hive, and Celo blockchains between April 2022 and January 2023. While 2023 had a quiet start, activity has picked up, notably in April 2023 when user activity soared, primarily driven by the Klaytn blockchain.

This was likely down to the launch of Iskra, a recently released single destination Web3 gaming application with a variety of games built into it. The Klaytn foundation in its monthly report for April wrote that 2.48m accounts interacted with Iskra in the month, accounting for 90% of April’s Monthly Active Users (MAA).

Another chart from Footprint Analytics, reveals that while the number of transactions and users has remained lower but steady, transaction volumes have fallen off a cliff. This may be because of the price struggles of many Web3 gaming tokens.

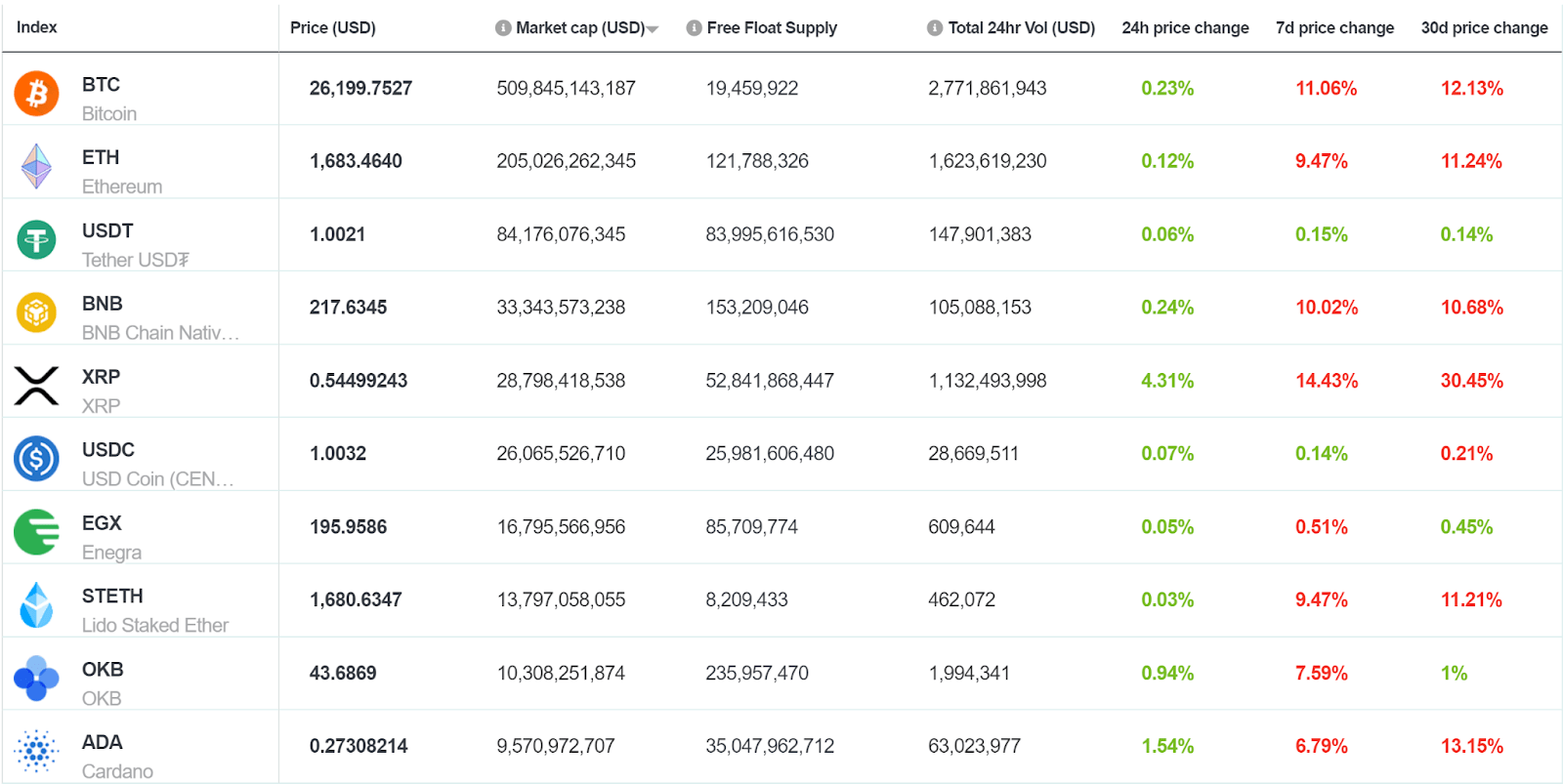

While major large-cap digital assets like Bitcoin (BTC) and Ethereum (ETH) have performed strongly in 2023, some tokens tied to Web3 gaming applications and gaming blockchains have underperformed in comparison:

Year-to-Date Performance

Bitcoin (BTC) + 79.6%

Ethereum (ETH) + 55.7%

ImmutableX (IMX) + 105.5%

Apecoin (APE) – 49.5%

Illuvium (ILV) + 7.9%

Ronin (RONIN) + 68.9%

DeFi Kingdoms (JEWEL) -17.2%

Axie Infinity (AXS) – -4.1%

It should be noted that performance across the gaming sector has been mixed. Tokens such as ImmutableX and Ronin have performed strongly in 2023. This, however, is more likely because they are tokens attached to the layer-2 blockchain. The layer-2 blockchain sector, unlike the Web3 gaming sector, has performed very well in 2023. It is a quirk within the digital asset space that tokens can fall under two separate categories, and one of these sectors can be performing well while the other is not.

In the DappRadar X Web3 gaming Alliances (BGA) Blockchain Games Report for Q2 2023, it is reported that the quarter had an average of 699,956 daily Unique Active Wallets, a decrease of 12% from the previous quarter. The report also found that within the Metaverse sub-sector of Web3 gaming, there was a sharper drop in activity.

Another interesting note from the report is single gaming applications dominate user activity on smaller blockchains. Alien World dominated 61% of the activity on the WAX blockchain in Q2 2023 and Splinterlands dominated 91% of the activity on the Hive Blockchain.

Source: Dappradar

There are a number of emerging blockchains designed specifically to target the gaming industry, particularly Aptos and Sui, that are gathering steam. Both Aptos and Sui are founded by ex-members of Meta’s Libra blockchain team.

Sui is a brand new Layer-1 blockchain with an eye-catching valuation. The mainnet of the network launched on 3rd May and the token is already amongst the 100 largest tokens in the world. The token had a public sale price of US$0.10 and a private sale of US$0.03, the Sui token currently trades for US$1.16 and has a market cap of US$ 611.6 million.

Sui was founded by an ex-Meta executive and already has 200 projects in its directory and over 100 supposedly vying to launch on the Rust-based blockchain. The team behind the blockchain, Mysten Labs, raised US$300 million during a series B at a valuation of US$2 billion.

Sui is designed to have technical specifications that support an “object-based” approach to on-chain assets that is designed to appeal to game creators. Sui’s head of Gaming Partnerships & Investments Anthony Palma, wrote on Twitter, after revealing a new trailer for Sui gameplay footage wrote — “These great games are fun and engaging, and our focus is to enable deeper levels of player excitement and agency for a more immersive gaming experience.”

The gameplay shared was impressive, indicating games on SUI have high-end graphics and gameplay. One of the games being developed on Sui is based on a popular comic book and TV series, The Walking Dead.

The Aptos blockchain, launched in late October, currently has a TVL of ~US$50 million. The blockchain’s native token APT, has a market capitalization of US$1.5 billion, already making it a top 50 crypto asset by market cap.

Aptos is a layer-1 blockchain, with resource objects and is built with the Move programming language. Aptos was created after Diem, the Meta Blockchain project, was sold to Silvergate Capital for US$135 million. Following the sale, employees of Diem split to build their own open-source blockchain, Aptos.

Like Sui after it, Aptos was able to attract hundreds of millions of dollars of Venture Capital investment. Early investors in the project include a16z, Franklin Templeton, Circle Ventures, and Temasek.

Aptos has specific infrastructure designed to appeal to game builders including the Unity SDK, indexer, and APIs that abstract away the blockchain so game developers can focus on games. The Move programming language is designed to be flexible and able to safely manage assets. Aptos also offers rapid throughput through its consensus model and a parallel execution engine. The blockchain is also set up to be easily upgradeable and advance quickly when necessary.

In both Sui and Aptos cases, there is an element of sacrificed decentralization and project picking by the operators of these blockchains. This may go against some traditional blockchain sensibilities, however, building games is a complex process with multiple points of failure. Support and structure for game developers appears to be a potential strategy to create a funnel of well-designed, functional games.

Web3 gaming within the wider gaming ecosystem

2022 was a major year for the wider gaming sector, headlined by major deals and game releases. Microsoft acquired Activision, Sony acquired Bungie and T2 acquired Zynga. Blockbuster games like Elden Ring, God of War: Ragnarok, and Call of Duty: Modern Warfare 2 achieved record sales. The last game on the list sold a billion dollars worth of copies within 10 days after it was released.

In PWC’s Perspectives from the Global Entertainment & Media Outlook for 2023–2027, the accounting giant points out that in 2023, the Super Mario Bros. movie became the first film based on game IP to gross more than US$1 billion at the worldwide box office. It has become one of the top 20 highest films of all time. They also note that streaming giants Netflix and HBO are both lining up TV shows and films based on game IP. 2022 was the best year ever for gaming films, driven by the success of Sonic the Hedgehog 2 and Uncharted.

Source: PWC

One of the most notable trends in the last 5 years has been the rise of advertising within Video Games.

The gaming sector was one of the fortunate few to succeed during the pandemic. With much of the world stuck indoors because of lockdown measures, people turned to gaming for entertainment. PWC charts the growth of the gaming sector in 2020 and 2021. It also forecasts the sector to continue growing strongly heading into 2027. It is estimated that by 2027 there will be 3.2 billion users gaming globally.

Source: PWC

Web3 Investments Continue Despite the Allure of AI

Futureverse, a Web3, AI and metaverse company based in Auckland, New Zealand, has raised $54 million in a new round of funding designed to bring AI to the metaverse. 10T Holdings led the round and included participation from Ripple. Futureverse‘s technology platform includes a suite of proprietary AI content generation tools designed to enhance the music, objects, characters, and animations that will be part of the metaverse.

Futureverse is a group of 11 companies including gaming studios, Web3 payment platforms, AI studios, and blockchain protocols. Futureverse is designed to provide the needed tools for brands, users, and builders to create content and experiences for the metaverse.

There is a perception that VCs have turned from Web3 towards AI, however, the successful raise by Futureverse shows that there are many well funded, technologically sophisticated teams that are focused on building out the Web3 gaming space.

In fact, blockchain is a growing factor in investments within the gaming space. Drake Star reports that amongst private placement deals, blockchain deals accounted for more than any other sub-sector.

Other blockbuster deals in 2023 include Savvy Games Group announcing the acquisition of Scopely for $4.9 billion. Scopely is a mobile gaming developer that has built games with IPs like The Walking Dead and the WWE. Also the year, the Sega Sammy Company announced that it intends to purchase Rovio Entertainment for US$775 million.

Source: Drake Star Global Gaming Report 2022

While Web3 gaming has had a great deal of venture investment poured into it, it remains a much smaller sub-sector than the PC/Console or mobile markets. There are many Venture Capital firms entering the Web3 gaming space, most are focused on seed-or-early-stage gaming projects.

In the DappRadar x Web3 gaming Alliances (BGA) Blockchain Games Report for Q2 2023, it is noted that investments in Web3 gaming projects in Q2 2023 totaled $973 million, which represented a 31% increase from Q1 2023. The standout investment in the last quarter was Bitkraft’s $221 million raise for a 2nd token fund. Bitkraft is a venture firm focused on Web3 gaming and the fund has been said to be prioritizing investing in projects that have higher-than-average experience behind them, this may have been gained in Web2.0.

This is another area where Web3 gaming separates itself from the rest of the sector. Generally, smaller game developers and indie game developers don’t receive large Venture Capital investments. Gaming is considered a high-risk investment category, as a very small percentage of games go on to be big hits. Games often need big investments and investors realize that few offer returns. Projects like Ouya and Star Citizen are cautionary tales of gaming startups that had millions of dollars poured into them but in the end, had very little to show for the investments.

Investing in token-based Web3 gaming projects is separated for a few different reasons —

- Liquidity – In order to realize profits from an equity investment in a startup, investors often need to wait for an event like an IPO. They are often tied to their investments for an extended period of time.

- Passive income options – Web3 gaming often gives investors the option to stake their tokens pre-game launch or contribute to liquidity trading pools on Decentralized exchanges. This allows investors to earn a passive income and earn more when they exit.

- The hype and outsized returns attached to crypto projects – As evidenced by Sui, Crypto projects can rise aggressively in value. Speed and value arrive quickly. This is clearly appealing to investors. There is a hype and value cycle attached to anything blockchain-related, the bull run of 2021 dwarfed the bull run of 2017, which dwarfed the bull run of 2013. The rising tides of crypto can raise all boats and investors often appreciate the sectoral play as much as they back individual projects.

Everyrealm in its review of the Web3 gaming space in 2023, says only 30.1% of Web3 gaming projects actually have a game that is live.

A factor in this lag may be the incubation of high-quality games. A noted factor in why Web3 gaming has not reached the adoption level of mainstream gaming is the lack of quality or complexity in the gameplay. Everyrealm notes that so few Web3 gaming startups are launching games likely because they are aiming to release higher quality games that may be able to penetrate the mainstream gaming audience.

The most popular and successful blockchain game ever released, Axie Infinity, is also noted for using a very simple gameplay model.

Axie Infinity is a Pokemon-style turn-based Role-Playing game (RPG) with elements of card battler games like Heartstone. The core gameplay loop of Axie Infinity is:

- Battle with your Axies

- Upgrade them so that they can compete at a higher level and beat stronger players

- The final element of the loop trifecta is utilizing an upgraded Axie and some battle skills to earn SLP cryptocurrency tokens that have money elements

The more you battle, the more you can earn and upgrade. The more you upgrade, the more battles you can win and the more tokens you earn. The more you earn, the more you are encouraged to battle and earn.

Turn-based games have a very simple non-dynamic play-style where players take turns to perform pre-restricted actions that are executed automatically. Complicated button combinations don’t need to be remembered and skills like aiming are not required to be successful within these games.

This simple play style means it is ideal for an auto-play-focused game (Just tap a button many times on repeat). There are many popular free-to-play RPG games that utilize this simple gameplay element and instead focus on directing players towards secondary in-game goals like social goals, upgrading characters, or earning items.

Axie Infinity has achieved popularity thanks to its immense social media communities and monetary incentives driven by token rewards and NFTs. This appears to be the modus operandi for the majority of the Web3 gaming space. Simple straightforward games that gain engagement through secondary activities.

The other factor in why these types of games are popular with developers is their ease of creation. Developers can create relatively simple games, and monetize them with tokens and NFTs. It is a high return on investment with low operational and startup costs.

The potential and relevance of the blockchain to gaming are clear. Traditional gaming has never truly offered a way for players to really own in-game assets, or be truly rewarded for their in-game efforts. Gaming can be a hard slog and players are often left with simply a sense of accomplishment or a higher rank. blockchain-based games with self-contained economics can reward players for their contributions with money (tokens).

Games like Aradena, which is backed by major VCs like Animoca Brands, writes on its Twitter — “There’s no such thing as web3 gaming. Just gaming, enhanced by Web3 technology. We’re here to build a great GAME that is FUN to play.”

Aradena is a medieval, turn-based strategy card game. It is part of a new wave of blockchain games that have learned from the mistakes of predecessors and focused on solving pain points such as mediocre gameplay and a lack of asset value.

Aradena, for example, is focused on a play-first model as opposed to an earn-first model, which most first gen blockchain games focused on. It has a collectible card game mechanic that is well-suited for an NFT trading and Aradena cards are popular on OpenSea. Purchased cards can then be deployed within the Aradena Battlegrounds game.

An Aradena Battlegrounds Closed Beta went live on June 2nd, the game has been played by major streamers and run a variety of contests over this period.

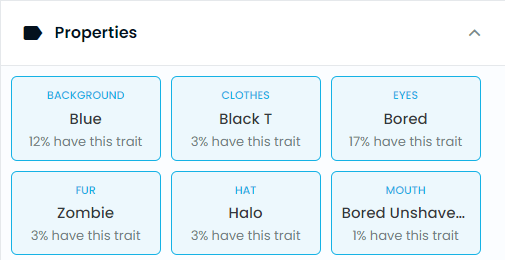

Token-based games have another layer because tokens earnt within a game may be used within decentralized applications. Gaming-focused blockchains like Aptos can create interconnected gaming universes, where tokens from one game can be transferred to another. Projects like Bored Apes with its native token, APE, are creating interconnected games tied together by a token with actual monetary value that can be earned across games.

The entire Web3 gaming sector also received a boost when Google announced that it would be changing its Play Store policy to allow blockchain games and apps on its platform. The policy update “will require that apps be transparent with users about tokenized digital assets,” Google said in a blog post.

The blog post notes “Google Play hosts a variety of blockchain-related apps, and we know that our partners are excited to expand on these offerings to create more engaging and immersive digital experiences with tokenized digital assets such as NFTs.” They say this is driving the new policy but the tech giant also states it wants to find a balance between innovation and user protection.

Blockchain developers will have to disclose that their game is a blockchain game, any in-game NFTs need to be declared as such. It appears if developers do play ball, they can have games with built-in NFTs, something which Apple does not allow. Developers are not allowed to “promote or glamorize” NFT trading and crypto.

According to the blog post, the developer Mythical Games (the maker of games NFL Rivals and Blankos) and message board Reddit are cited as two firms Google is working with to refine its Web3 gaming policy.

Conclusion

The potential of Web3 gaming to be both an exciting sector for investment and a gaming industry disruptor is evident. Web3 gaming projects offer self-contained economics that rewards players for their in-game contributions with monetary rewards. A compelling narrative and model, particularly for online and social games, where contribution to a games experience is not rewarded by traditional systems. The wider gaming sector continues to grow and gain traction and as a highly investable sub-sector within a booming industry, Web3 gaming is receiving a high level of interest and capital.

The sector has seen a decline in activity compared to the boom periods observed during the COVID-19 global lockdown period. There are, however, emerging blockchains like Sui and Aptos, founded by ex-members of Meta’s Libra blockchain team, that are designed specifically to target the gaming industry. The recent rise by New Zealand’s Futureverse team indicates that the buzz and excitement around the industry remain, and there are many similar teams that are continuing to build in anticipation of the next wave of Web3 users.

The majority of blockchain games have simple gameplay models but there appears to be a new wave of more advanced games coming. As the rapidly growing gaming industry continues, the potential for blockchain technology to enhance the gaming experience is massive in the years ahead.

Don’t miss out – Find out more today