Regulatory Pressure Heats Up – Crypto In the Firing Line

The U.S. is continuing to ramp up the regulatory pressure on crypto assets. With multiple lawsuits, conflicting definitions of digital assets from different agencies, and a new anti-crypto campaign led by Elizabeth Warren, what is the future of crypto in the U.S.?

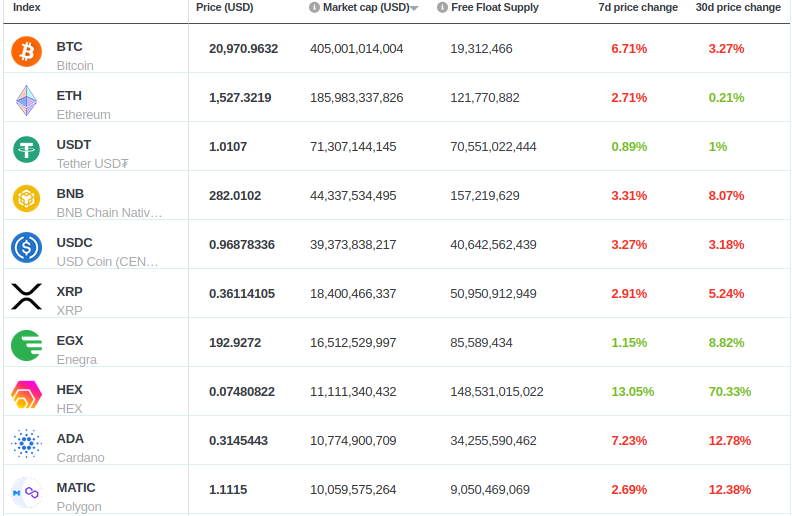

Digital assets like Bitcoin and Ethereum, and the networks they support, have been making waves in recent years. They are attracting investors and businesses alike because of their potential for disruptive innovation.

As an emerging asset class with a number of novel characteristics never seen before in the investable asset space, how and who should regulate assets is still being debated. Regulators are still trying to figure out exactly what Digital Assets are. Are they Securities, Commodities, or are some Digital Assets securities and others commodities?

Regulators are trying to toe the line between letting innovation and financial opportunity emerge, while also protecting investors against fraud. Governments, builders, and consumers are all awaiting regulatory clarity on where digital assets fall in the eyes of regulators.

The USA, the world’s largest economy and the global financial hegemony has been making news in 2023 by taking legal action against a number of cryptocurrency companies, and executives of these companies, driven by a new framework for regulating crypto.

In contrast to China which went after crypto by banning it outright, America’s financial regulators have been suing and regulating perceived crypto bad actors one at a time.

In 2017, the Securities and Exchange Commission (SEC) declared that some ICOs should be treated as securities and were therefore subject to regulation. The agency hunted down a number of projects in 2017 and 2018 based on this reasoning.

Source: SEC.gov There was a notable ramp-up in crypto regulation following the post-ICO boom of 2017. This was topped by enforcement in 2022.

The Framework

In 2022, there was a shift in how digital assets were regulated. In September 2022, the Biden administration released the first-ever comprehensive framework for cryptocurrency regulation in the United States. The framework followed an Executive Order sent by the President’s Office asking for the “Responsible Development of Digital Assets” written in March of the same year.

The framework handed far more power to existing financial regulators like the SEC and the Commodity Futures Trading Commission (CFTC). The framework states that it encourages the SEC to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.”

Furthermore, it asked the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC), as appropriate, to “redouble their efforts to monitor consumer complaints and to enforce against unfair, deceptive, or abusive practices.”

As well as an increase in the number of enforcement actions placed, US regulators appear to be going after much bigger fish. Although there were a number of actions placed in 2017 by the SEC, most of these were against no-name ICOs like Centratech and Airfox.

So far in 2023, the SEC has filed actions against former executives of global exchange giant and token issuer FTX, the major exchange operations Gemini and Kraken, major borrowing and lending firms Genesis Global and Nexo, and Digital Asset issuer Terraform labs (LUNA & UST).

The SEC has also filed a Wells Notice but has not yet charged publicly traded exchange Coinbase. A Wells Notice is a letter that the U.S. Securities and Exchange Commission (SEC) sends to people or firms at the conclusion of an SEC investigation that states the SEC is planning to bring an enforcement action against them.

The CFTC has recently charged major global exchange Binance and its founder, Changpeng Zhao for the wilful evasion of Federal Law and operating an illegal Digital Asset Derivatives Exchange.

The CFTC alleges that Binance ran a crypto derivatives (which the CFTC considers to be commodities) trading operation in the United States while disregarding “applicable federal laws”. The CFTC alleges that Binance relied on personnel and vendors in the United States, including institutional customers, chose to ignore registration and regulatory requirements, and hid behind an “ineffective compliance program”.

Another notable element of the lawsuit is its clear definition of a number of digital assets as commodities and not securities. The lawsuit alleges that Binance “operated a facility for the trading of futures, options, swaps, and leveraged retail commodity transactions involving digital assets that are commodities including Bitcoin (BTC), Ether (ETH), and Litecoin (LTC) for persons in the United States.”

The CFPB launched its first civil investigation into a crypto company in December 2022. It is launching legal action against Nexo Financial over its Earn product.

Alongside the directive to continue regulation, the framework in some way does acknowledge the value and potential of digital assets. To its credit, the framework does recognize crypto’s potential to drive innovation and positive change in the financial system, with the potential to promote financial inclusion, support economic growth, and increase access to capital for individuals and small businesses.

The President’s Economic Report Looks At Crypto

The Economic Report of the President is an annual report written by the Chairman of the Council of Economic Advisers. It overviews the nation’s economic progress and extensive data appendices.

The latest report has an entire chapter dedicated to the rapidly evolving landscape of ‘crypto assets’. It discusses digital currencies, stablecoins, non-fungible tokens (NFTs), and decentralized finance (DeFi). Interestingly, Gregory Schneider (Lawtoshi) the Deputy General Counsel at Hedera, told Brave New Coin that despite its overall negative tone, the report concedes crypto is “here to stay”.

Nonetheless, the report highlights several perceived challenges and risks associated with crypto assets. These include concerns around consumer and investor protection, market stability, financial integrity, and national security. The report says that crypto assets are subject to limited regulation and oversight. It assesses that their rapid growth and adoption pose potential risks to financial stability and the broader economy. The report also calls for greater international cooperation and coordination to address the global nature of crypto assets and their potential impact on the global financial system.

Schneider says that the report assumes the only purpose of crypto is a replacement for fiat money, he says this ignores the plethora of use cases that have gone live with crypto assets in the last month including collectibles, loyalty rewards, decentralized identity, and art. He says the report does not fully appreciate the importance of how provable digital scarcity and ownership for intangible assets are and that this can be a total game changer.

He further says that the report is wrong about the use of crypto in money laundering cases. It ignores how the Department of Justice (DoJ) has made its largest value seizure of assets because of the traceability that crypto enables.

Warren’s War

Democrat Senator Elizabeth Warren has ramped up her anti-crypto stance, posting on Twitter that she is building an anti-crypto army. Warren, who is on the Senate Banking Committee that oversees the U.S. Securities and Exchange Commission (SEC), has been a vocal proponent of several high profile anti-crypto bills that have been introduced over the last year.

Crypto advocates are fighting back but Warren’s willingness to work with GOP lawmakers reflects a broader force that is uniting progressives and conservatives, watchdog groups, and bankers, who all seek to derail crypto.

The upcoming U.S. election cycle is likely to feature crypto front and center. Many pro-crypto U.S. voters will be forced to become single-issue voters in response. Can ‘Crypto America’ survive the spotlight of the main stage?

Don’t miss out – Find out more today