Litecoin Price Analysis – Speculation kicks in

After making a break for the county line known as the US$100 psychological level, the litecoin (LTC) rocket ship has officially blasted off into outer orbit, leaving the trappings of gravity behind. Now holding a US$17.77 billion market cap, with US$8.36 billion trading volume in the last 24 hours, LTC is up 10,000% from the low posted in March 2017.

After making a break for the county line known as the US$100 psychological level, the litecoin (LTC) rocket ship has officially blasted off into outer orbit, leaving the trappings of gravity behind. Now holding a US$17.77 billion market cap, with US$8.36 billion trading volume in the last 24 hours, LTC is up 10,000% from the low posted in March 2017.

The US on-ramping service, Coinbase, has experienced unprecedented and explosive growth over the past few weeks, boasting more users than stock brokerage Charles Schwab. While the exact figures are no longer available, there is now a vague mention on their about page, as of November 26th the page reported 13,300,000 users and 45,200,000 unique wallets. The company has been regularly adding over 50,000 new users a day.

These accounts represent what is referred to as ‘new money’, whether it be institutional or retail investors. This large cash infusion over a prolonged period has helped LTC accrue sustained buying since late November. Being the cheapest of the three options available on Coinbase means that whole integer bias with the mere suggestion of a high percentage return, compared to Bitcoin and Ethereum, has fueled speculation.

Charlie Lee appeared on CNBC yesterday to help explain the protocol as well as give his thoughts on the wider industry. For many people, seeing a face behind a digital asset assuages many concerns raised with Bitcoin regarding an anonymous, unknown creator. The appearance also occurs in the setting of crypto mania in general, and helped bring to light the purpose and use case for Litecoin.

Legendary investor Michael Novogratz also discussed LTC on CNBC today and described it as speculative mania, “none of these protocols will be ready for prime time until at least two or three years”.

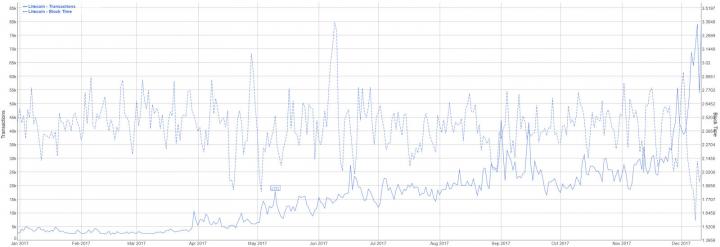

The cryptocurrency discussion on Twitter has exploded over the past year. Tweets per day for LTC had been stagnant until a few days ago when that metric more than quadrupled. Twitter is an excellent gauge of sentiment, open interest, and emotion surrounding price action.

Unconfirmed transactions now stand at just over 700, at the time of writing, whereas Bitcoin (BTC) and Ethereum’s (ETH) unconfirmed transactions are well above 100,000 and 13,000 respectively. 31,000 of the bitcoin transactions have fees set to <US$0.01, far below the current appropriate level. These unconfirmed transactions account for 0.87% for LTC, 1.5% for ETH, and 27% for BTC. The current median fee for LTC is US$0.0786.

Trading volume has been led by the Bitcoin and the US Dollar (USD) pairs. The LTC/BTC pairs on Bittrex, Poloniex, and OKEX share an essentially equal portion of the volume. GDAX holds 61% of the LTC/USD volume.

The rise of GDAX volume and liquidity has come quickly thanks to retail and institutional investors clamoring on board through parent company Coinbase. As an early entrant into the US market, Coinbase has grown to be the go-to company for retail investors in the US. Gemini, Bitstamp, and Kraken are also available to US customers, but are not as widely known and do not specifically cater to retail investors.

Technical Analysis

Technical Analysis

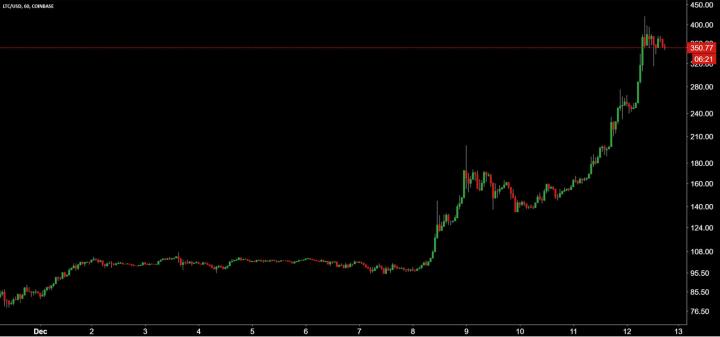

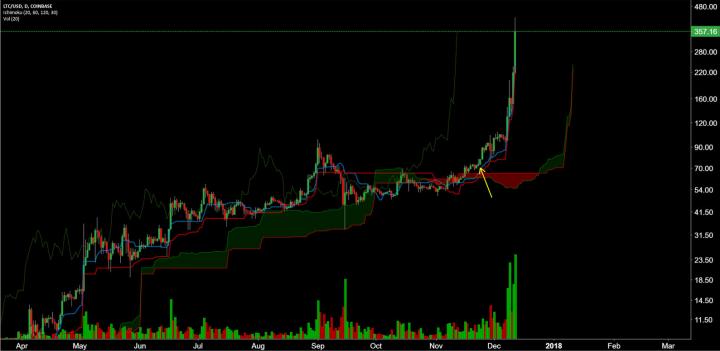

After cleanly breaking the US$100 all time high and psychological barrier, LTC has entered pure unadulterated price discovery with very little technical basis for the current price levels. Fibonacci extensions and Pitchforks can help understand why the price is overextended at these levels.

Fib extensions are useful for determining potential reversal zones, especially when there is no prior resistance levels. From the previous all time high to low in September, the price has pierced the 5.618 fib extension. This shows the force of the most recent move over the past week.

Conclusions

Conclusions

Although seemingly coming from out of nowhere, true believers of LTC have been holding since single digit prices. However, it may be a stretch to call this true organic growth as speculation appears to be driving the market. The listing on Coinbase provides investors easy access, and has been a gateway to cryptocurrency for millions of users over the past month.

Technicals show price discovery in obvious overextension. Although technicals supported a long entry in mid-November, technicals do not justify current prices. Should the pace of buying continue, US$1000 LTC is not an impossibility.

Don’t miss out – Find out more today

Technical Analysis

Technical Analysis