Under-collateralized lending questions DeFi’s “Soul”

What is the best way to leverage on-chain behavior and reputation in a Web3 world?

The need for a unique, non-transferable on-chain credential that enhances utility and safety across Web3 has grown in interest since Ethereum patriarch, Vitalik Buterin, co-penciled the 36-page paper, Decentralized Society: Finding Web3’s Soul.

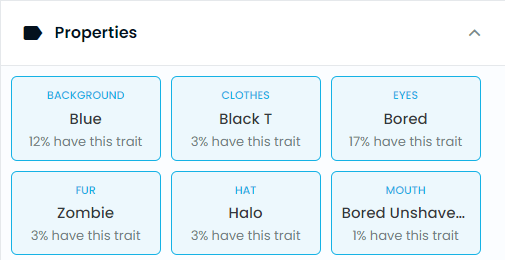

The paper discusses how “non-transferable ‘soulbound’ tokens (SBTs) representing the commitments, credentials and affiliations of ‘Souls’ can encode the trust networks of the real economy to establish provenance and reputation.”

Soulbound

The translation being that Web3 and DeFi should be focusing on “encoding social relationships of trust” rather than the hyper-financialization it appears to be succumbing to – “Built on the premise of trustlessness, DeFi … at best, risks throttling network growth by rent extraction and at worst risks ushering in dystopian surveillance monopolies dominated by “whales” who harvest and hoover up data in a race-to-the-bottom—much like web2.”

The co-authors further elaborate that – “The true power of this mechanism emerges when SBTs held by one Soul can be issued — or attested — by other Souls, who are counterparties to these relationships. These counterparty Souls could be individuals, companies, or institutions.”

The above segues into the facilitation of under-collateralized credit (referenced 18 times in the paper) – "Perhaps the largest financial value built directly on reputation is credit and uncollateralized lending. Currently, the web3 ecosystem cannot replicate simple forms of uncollateralized lending."

Source: https://polygontech.medium.com/the-crypto-loan-economy-d788ac794b3c

Many DeFi participants have long stated that native and permissionless, under-collateralized lending is the “holy grail” of DeFi. Ninor Mansor of Arrington Capital says “Undercollateralized capital markets represent one of the biggest opportunities to transform capital efficiency in crypto with projects like RociFi introducing the idea of on-chain credit scoring.

Despite the sudden enthusiasm for under-collateralized lending, the “Souls” only approach is not without shortcomings.

https://twitter.com/CryptoBrookins/status/1530207240002625537

A holistic approach

A holistic credit approach requires three complementary risk assessments:

- Credit risk – the borrower is able to repay the loan, i.e. creditworthiness

- Fraud risk – the borrower is willing to repay the loan, i.e. trustworthiness

- Reputation risk – the borrower has something to lose in the event of failing to repay the loan, i.e. social recourse

_Source: RociFi Credit Risk Assessment Funnel _

RociFi’s NFCS is designed to be a holistic DeFi credential verifying a user’s credit, reputation, and trust in one ERC-721 token. Despite the reputation-only limitations, the awareness brought to this topic will only help grow under-collateralized lending in DeFi.

As NFCS ownership blossoms, greater integration into the broader Web3 and DeFi ecosystems will drive utility beyond under-collateralized lending with CyberConnect and Link3 partnerships offering the first example.

More details in RocFi’s litepaper and whitepaper.

Follow them on Twitter: https://twitter.com/rocifi

Don’t miss out – Find out more today