Bitcoin Price Analysis: Week of June 3

This past week has seen a pair of interesting headlines. The feud between [Roger Ver and OKCoin](news/roger-ver-revealed-as-bitcoin-com-owner-in-bitter-dispute-with-okcoin/) intensified, and even brought former top employees into the mix, while Ben Lawsky addressed the final version of the BitLicense in what is most likely his last public appearance as a regulator.

Market Thoughts

This past week has seen a pair of interesting headlines. The feud between Roger Ver and OKCoin intensified and even brought former top employees into the mix. In a reddit post, former CTO Changpeng Zhao (aka CZ) accused the company of not only being the likely culprit of altering the contract and using his signature but also of having bots on the exchange faking volume – which most of us in the industry have long suspected but could never prove. As mentioned last week, all these accusation only lead to one direction, a further loss of confidence.

It is hard to understate how important confidence is to a financial system, if that is what Bitcoins intends to be. The world has been running on unbacked paper currencies since 1971 and while many gloom and doom analysts have been screaming the world is on the verge of collapse for over 10 years, the financial markets continue to make all time highs. The Bitcoin ecosystem is no different, yes the technology behind the Blockchain is something revolutionary, and is perhaps more advanced than the current banking system, but as most Alt-coin advocates will be first to point out, this tech is far from perfect and of course their offering is better. So why are all the Alt-coins practically useless and Bitcoin still controls over 95% of the Market Cap in Crypto space? 2.0 platforms and pre-mined coins excluded, it’s all because it is the one Blockchain that has earned the ecosystem’s trust, even if the community of users is still small.

Another significant event took place today as Ben Lawsky addressed the final version of the BitLicense in what is most likely his last public appearance as a regulator before joining a company involved in the Bitcoin space. What New York, and to a greater extent the federal Government of the United States, has yet to realize is that Bitcoin is a global phenomenon. Future regulation will barely make a dent in the survival or the spread of this technology. It is perhaps more global in scope than anything we have ever seen before. Until now innovation in the United States has definitely been hindered by regulation, or more accurately the fear of future regulation, as there is a major problem with companies getting a banking relationship. Perhaps it is just a matter of time, and this regulation will slowly become less critical as the United States global dominance weakens with every given month. A perfect example is seen with most of the western world ignoring the United States advice in staying out of the Asian Infrastructure Investment Bank.

What these two headlines are showing us is that we need far more competent and trusted innovation in one of the three most critical aspects of the Bitcoin Ecosystem, Mining and Wallets being the other two. And also that the Government’s who are most in need of retaining their power will continue to put out stifling regulation, without ever realizing that it will lead them to lose the power they acquired over the years by embracing the free-market.

Market Outlook

Once again we turn to the technical picture. In what might still resemble a free market, all this news should be priced in.

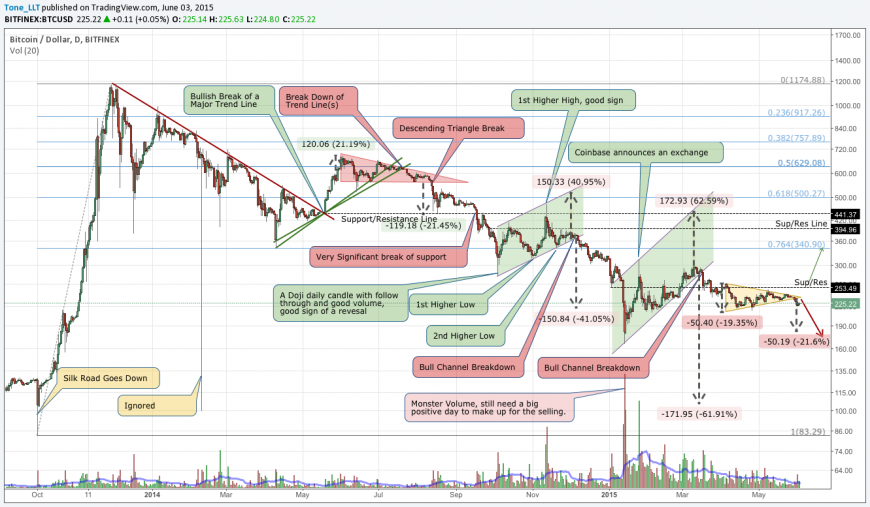

The Symmetric Triangle that was added to this chart a week ago has broken to the expected downside direction, however, it was a very shallow move and didn’t reach the recent low of around $213. It is definitely primed for a much larger breakdown and the odds certainly favor a move to $200 and lower before we see the recent highs of $250. As with most downward breakout patterns, it is common for price to retreat back to previous levels, providing smart traders a chance to get out of their wrong positions and inexperience traders some hope that they might have been right before the original move accelerates. In this case we can easily see the price come back to the $235 area before the real fireworks begin.

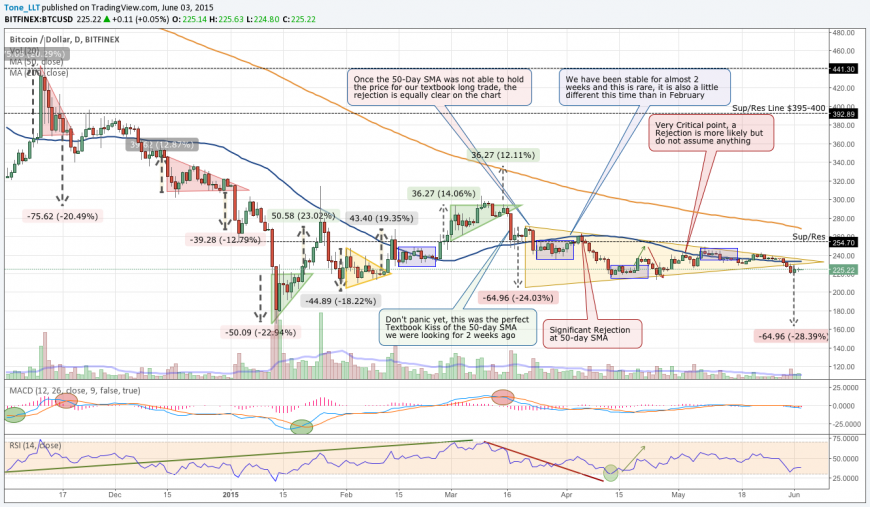

In a more detailed view you can see this triangle breakdown much clearer, and how the counter rally described above might play out. More importantly however, the price has fallen bellow the 50-day Simple Moving Average once again, which is a worrying sign. The 200-day Simple Moving Average continues its decline, though this recent price stability has allowed the two Moving Averages to be closer than they have been in several months. The momentum indicators of RSI and MACD are now sitting in negative territory, yet still have plenty of room before reaching oversold conditions.

Final Thoughts

Today’s final thoughts reside with the unjust sentencing of Ross Ulbricht, who will now spend the rest of his life in prison for what is arguably a victimless crime – or not a crime at all when asking those in favor of free-markets. This was clearly a statement on the side of the government and goes to show that any attempts to make waves in the free-market space must be done very carefully, anonymously, and as far away from western governments as possible. In the end this accomplishes nothing for the United States Government and their drug prohibition as Roger Ver nicely pointed out in his tweet:

"While the DEA & FBI are busy destroying lives, drugs for sale online have more than doubled since the #silkroad bust."

— – Roger Ver

Looking at that chart Ver included in his tweet you might recognize a few names that turned out to be scams, and ran off with large amounts of bitcoin. This was a chance for the big western governments to get something right and work with a site like Silk Road to turn it into a real company with a review system and consumer protection and some standards so that we can be on a path to ending this horrendous policy that only leads to street violence. Instead they are following the Napster’s blueprint by throwing the book at the innovator, and we all know how that turned out for the downloading industry.

This article was completed on Wednesday June 3 10:00 pm ET, when BraveNewCoins Index showed Bitcoin price at $227 USD.

Tone Vays will be a speaker at the upcoming Inside Bitcoins Chicago Conference July 10-11.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today