2018 Q4 Review – A Violent Decline

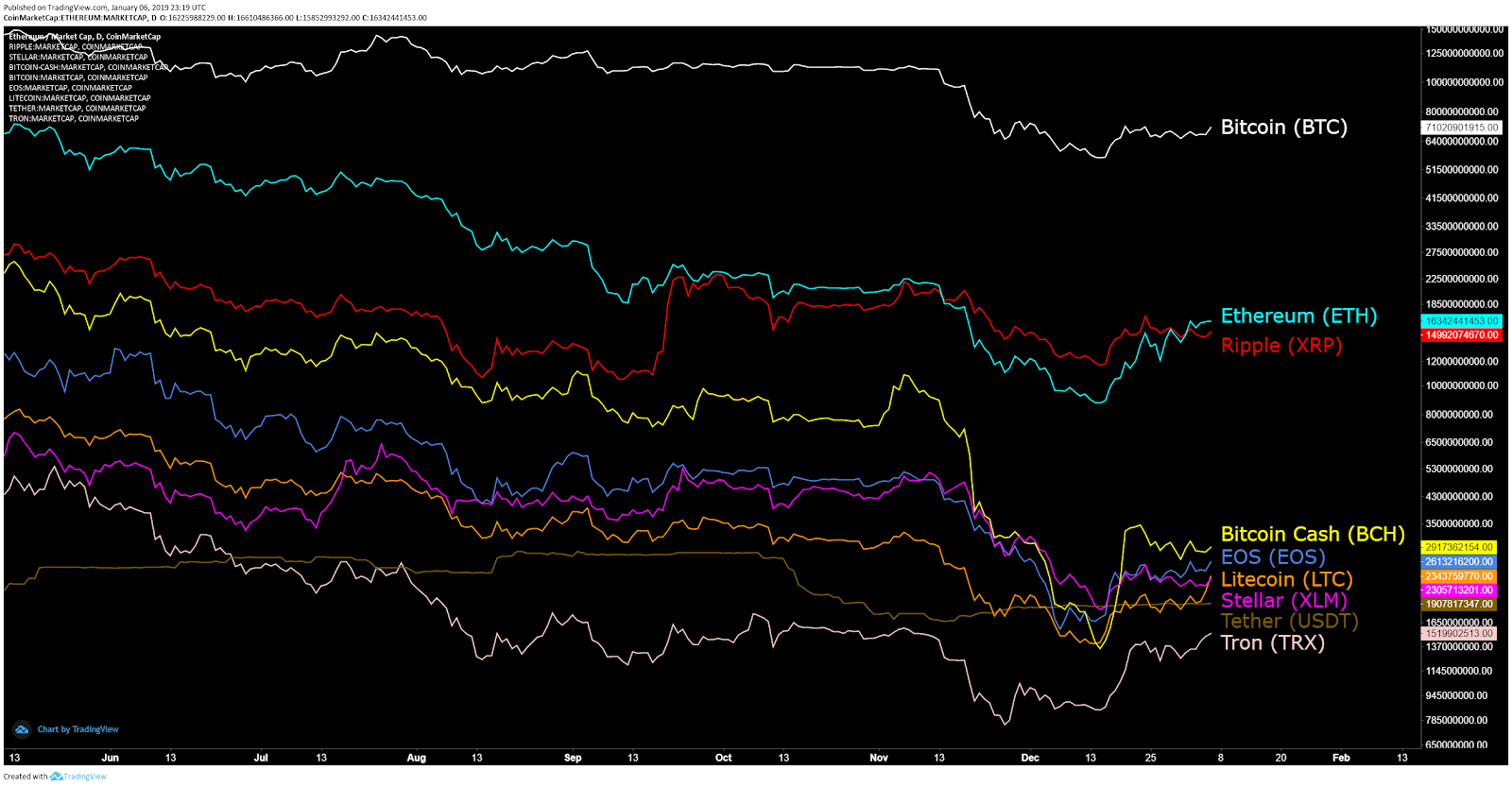

The total market cap for all cryptocurrencies at the end of Q4 stood at ~US$130 billion. The middle and end of Q4 was marked with a violent drop in all cryptocurrencies. Bitcoin dominance, which can be used as a market wide confidence index, held steady at around 50% throughout most of the quarter. As ICOs or coins are continually added to the ecosphere, Bitcoin is unlikely to ever return to >80% market cap dominance.

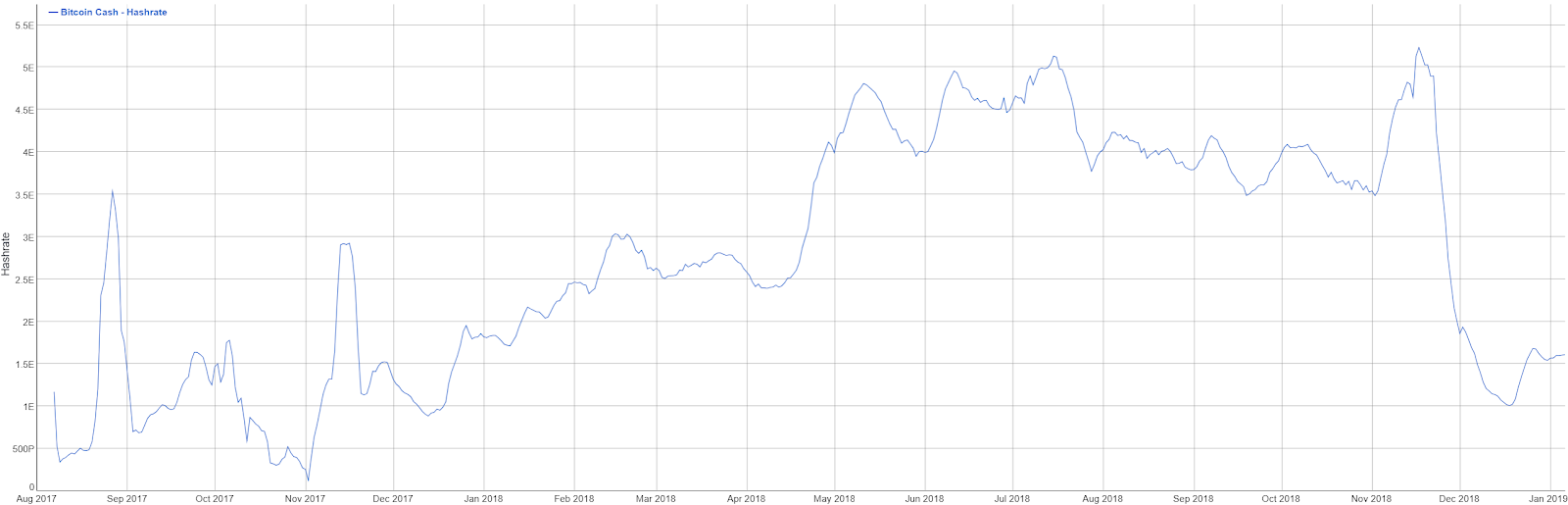

Bitcoin Cash saw the biggest decline in market share during the quarter, thanks to a civil war which split the coin into Bitcoin-ABC and Bitcoin-SV on November 15th. Roger Ver, of bitcoin.com and Jihan Wu, of Bitmain, are firmly in the Bitcoin Cash ABC faction, which introduced a new scaling solution, Canonical Transaction Ordering (CTOR), as well as a few new opcodes. Craig Wright and Calvin Ayre are in the Bitcoin Cash SV faction, which increased the block size from 32MB to 128MB and also reintroduced several opcodes.

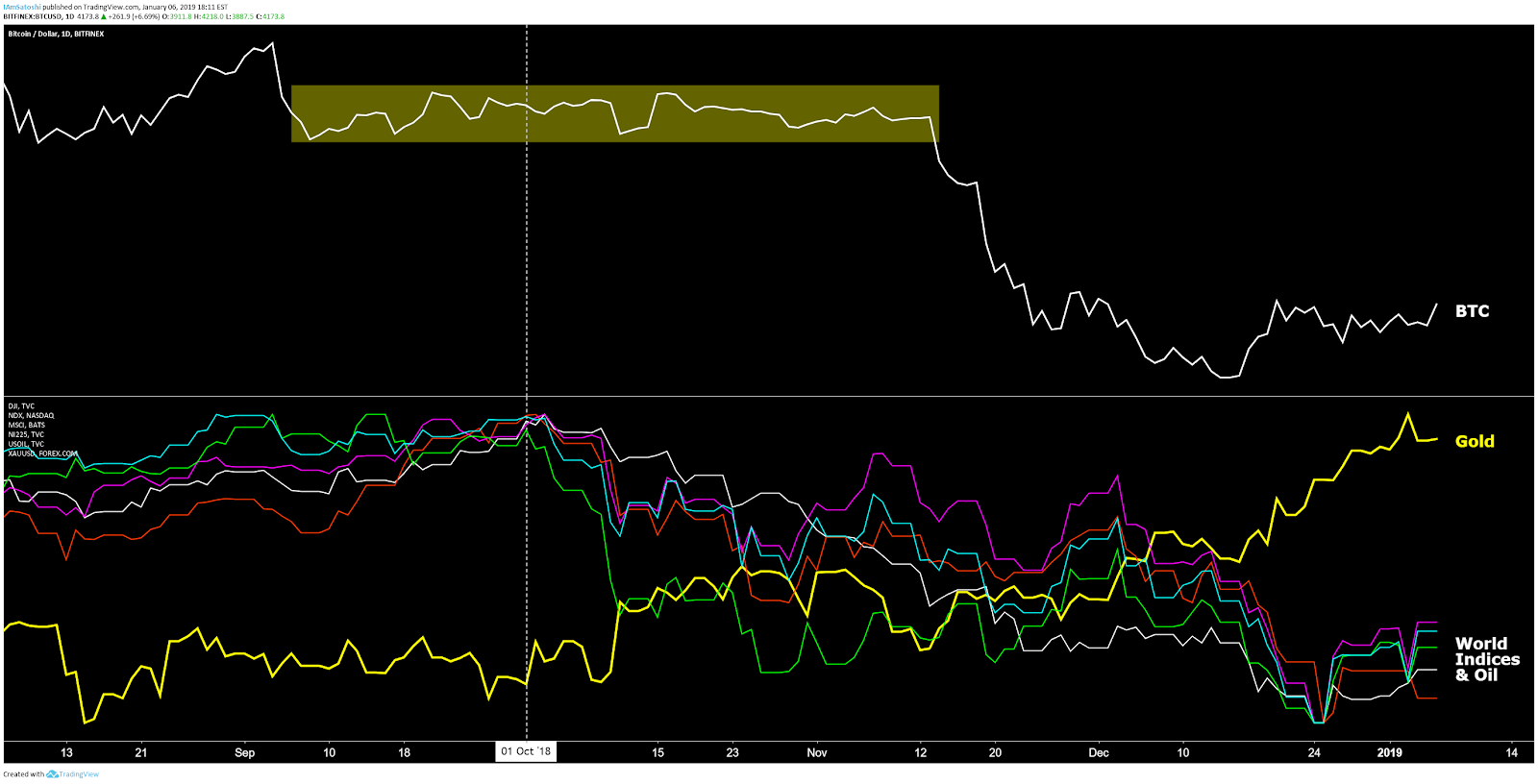

Until mid-November, Bitcoin had been held to a tight price range. This occurred in the setting of a declining legacy market, which includes the world indices and oil prices. A well-known risk-off asset, Gold, rose dramatically in price throughout Q4. Despite gaining the moniker of "digital gold", Bitcoin correlated heavily with declines in traditional markets towards the end of the quarter. The correlation signifies that cryptocurrencies currently benefit more from a risk-on environment than a risk-off environment.

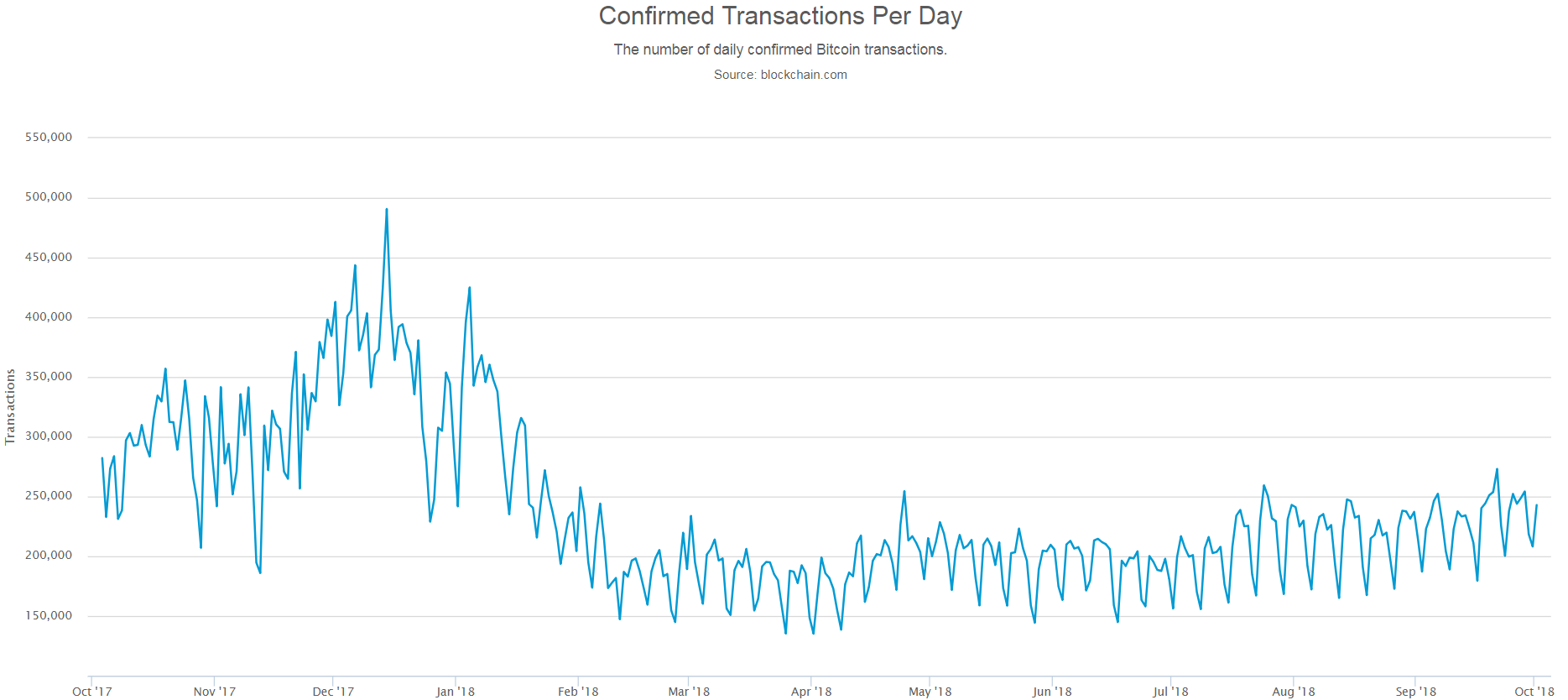

Hash rates drop while transactions per day maintain course

Transactions per day for the top cryptocurrencies and assets varied wildly throughout the quarter. EOS and TRX, where transaction costs are free, took the top spots, ending the quarter with rising transactions per day at 5.7 million and 2.4 million respectively. BTC, ETH, LTC, and USDT transactions per day in Q4 were essentially flat, while XLM’s transactions per day varied wildly. BCH saw a significant decline in transactions per day post the BCH-ABC and BCH-SV fork.

Source: Coinmetrics.io

Several large protocol upgrades were tested and implemented throughout Q4. On October 18th, Monero completed a hard fork to implement Bulletproofs, which reduced transaction size by 80% and has brought average transaction fees down to US$0.0093. Monero transaction fees are lower than that of Zcash, which does not offer equally robust privacy features. On October 29th, Zcash released the Sapling upgrade which enhanced transaction efficiency and scalability for shielded addresses. The Ethereum Constantinople hard fork, which was originally slated for Q4, was pushed back to mid-January. The protocol change will reduce the block reward to 2 ETH/block and decrease annual inflation to 4.7% from 7.4%.

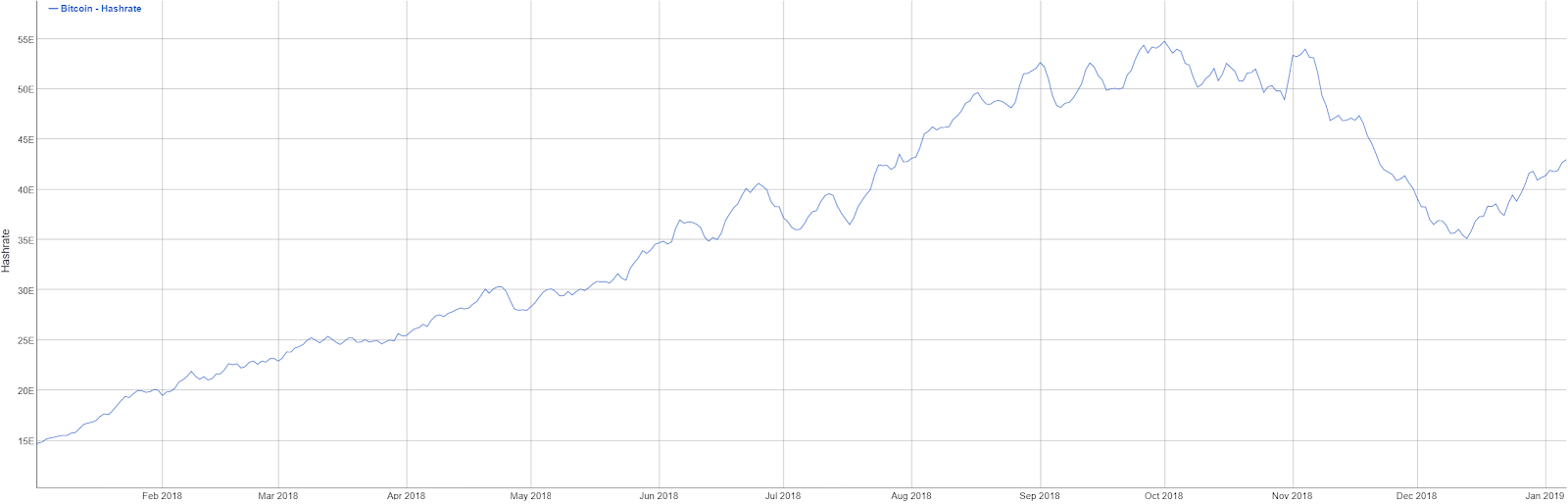

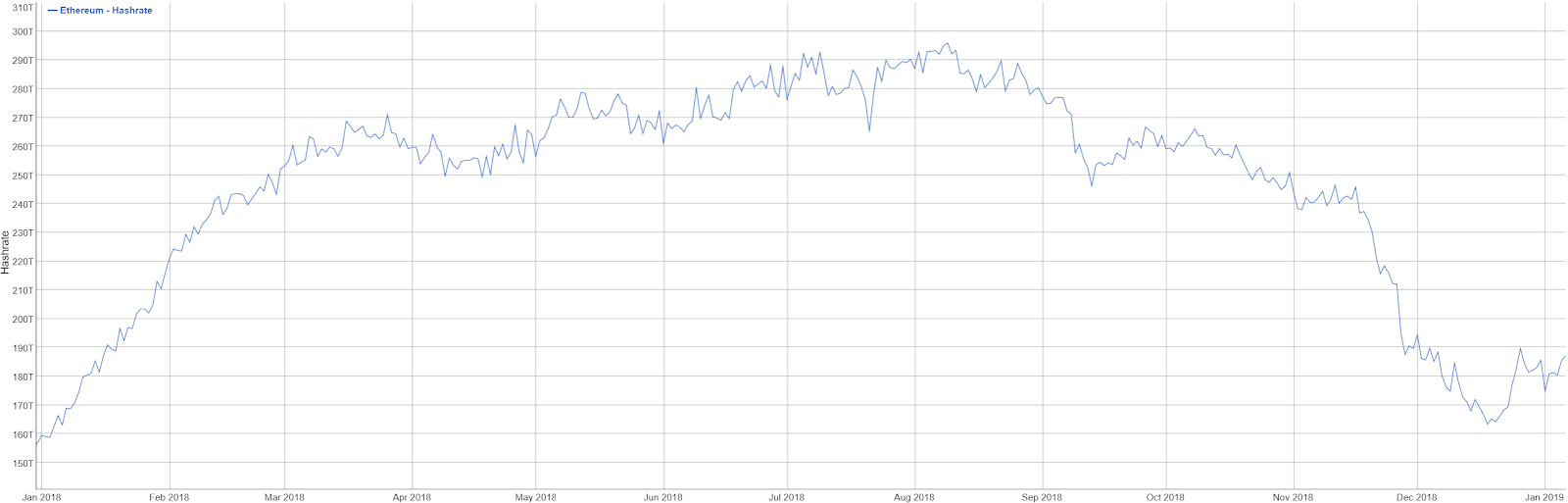

The top Proof of Work coins, Bitcoin, Ethereum, Bitcoin Cash, and Litecoin, all saw significant declines in hashrate throughout the quarter. As prices fell drastically, so did mining profitability. Any miner with inefficient hardware or high electricity costs could no longer afford to continue mining. Since mid-December, hash rates have begun to increase again, with Bitcoin seeing the largest sustained increase.

Source: bitinfocharts.com

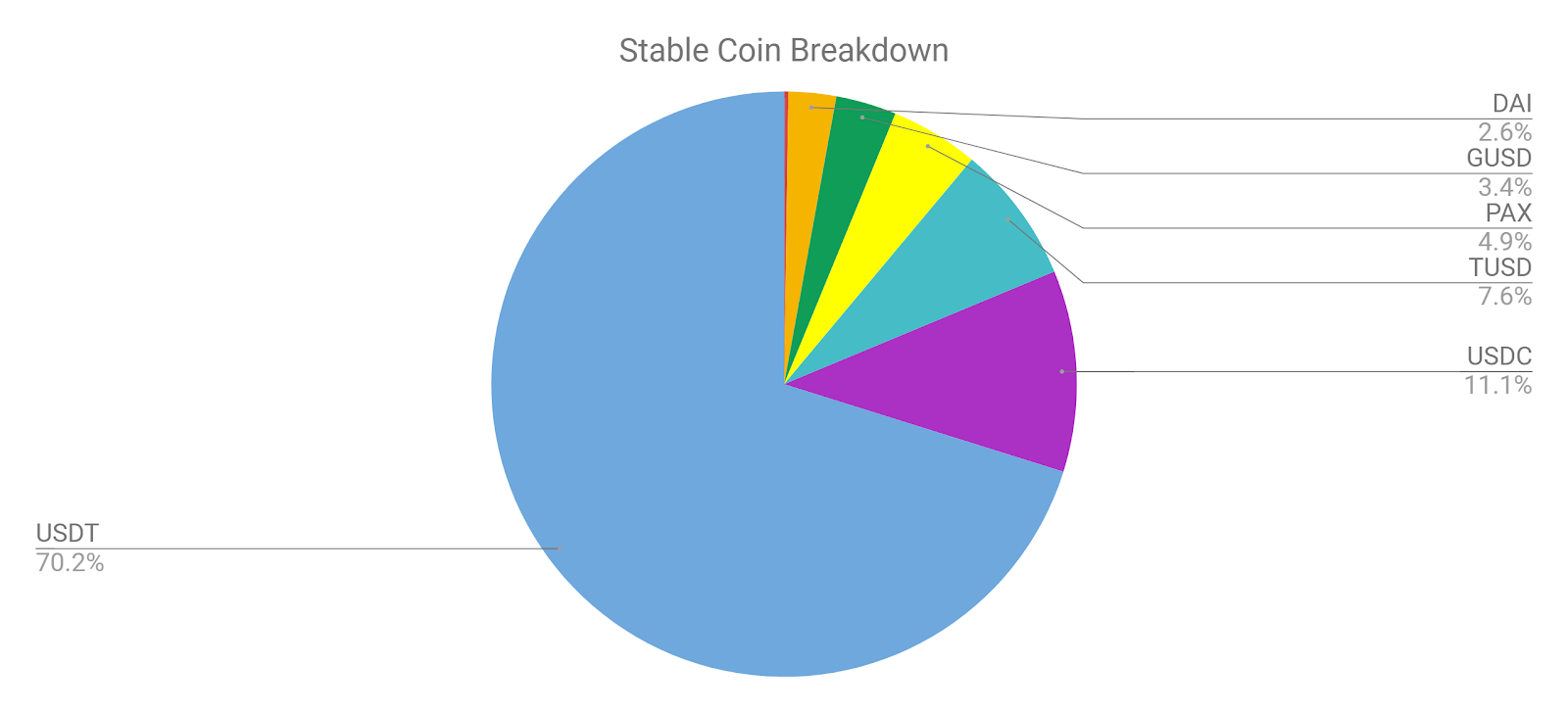

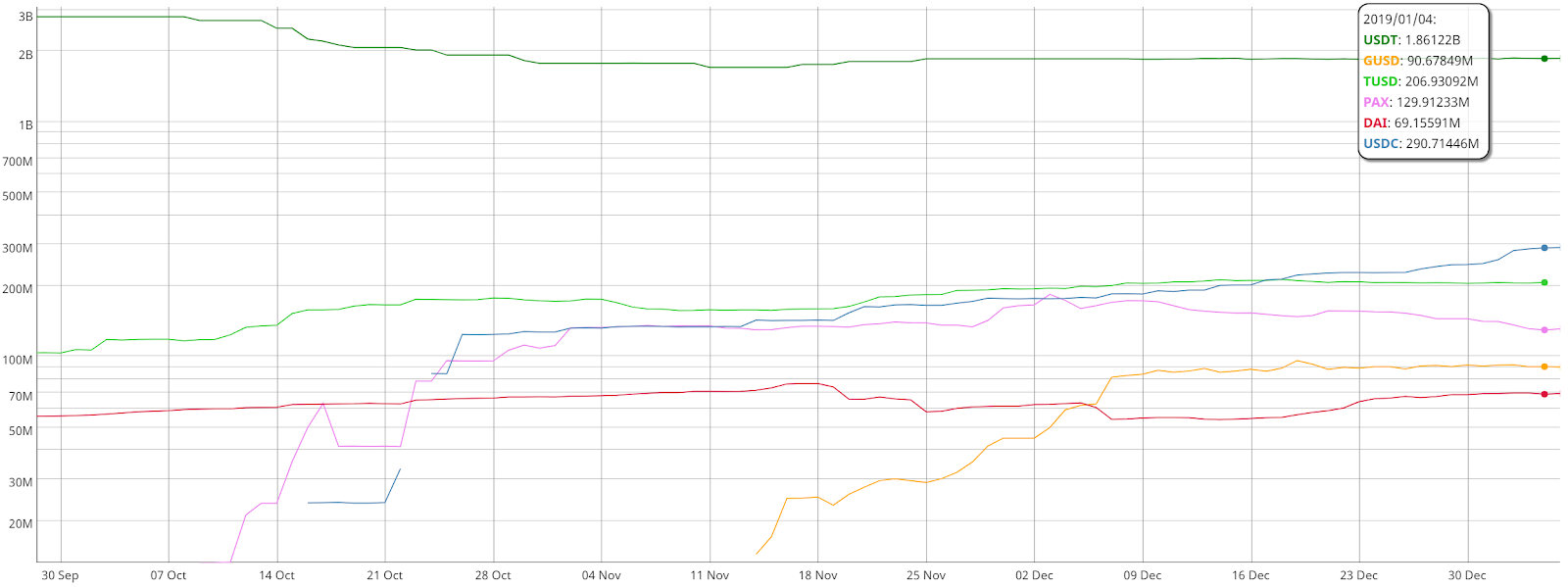

The rise of the stable coins

Stablecoins act as a safe haven asset to shield individuals from market volatility. Creators of stablecoins also benefit from holding vast sums of USD or fiat, which can then collect interest. Tether (USDT), which debuted in October 2014, continues to dominate much of the current crypto landscape with the highest circulating supply of all stablecoins at ~US$1.86 billion. Among competitors, USDC has recently emerged as a forerunner with US$290 million in circulating supply. TUSD and PAX hold US$206 million and US$129 million respectively. GUSD and DAI account for US$90 million and US$70 million respectively. The market rate for BitUSD, a BitShares stable coin, has fluctuated wildly and is currently trading at US$0.83.

Source: Coinmetrics.io

The market rate for USDT throughout Q4 fluctuated wildly, mirroring the slurry of USDT-related news out of Bloomberg. The historic USDT market rate has never been exactly US$1.00. The market rate of USDT has fluctuated during times of excessive volatility, while the 1:1 peg has always been honored by Tether. Currently, since the last Bloomberg article suggesting that USDT did in fact have adequate funds for a 1:1 backing, the market rate for USDT has held above US$1, suggesting that confidence has returned to the product. Despite the fluctuating market rates, total circulating supply of USDT has remained essentially stagnant since November 25th.

ICO inflows decreasing and outflows increasing

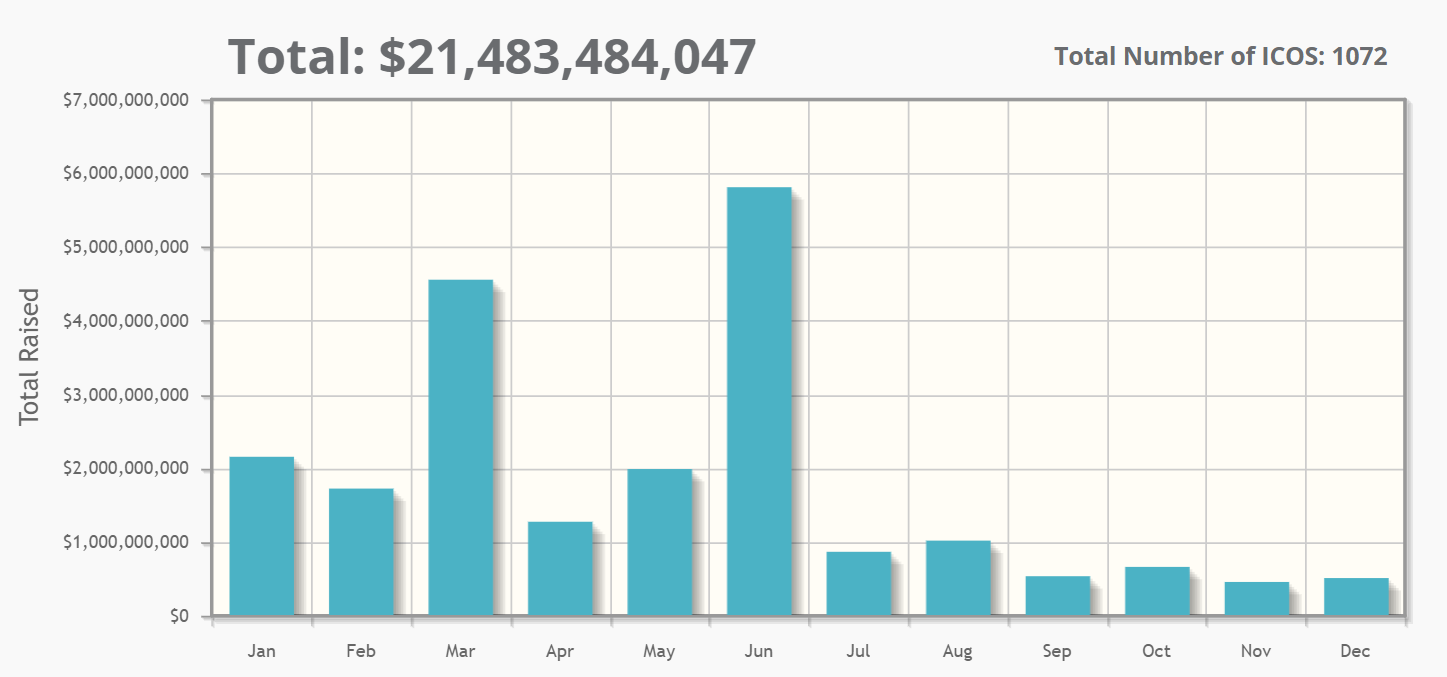

Q4 saw the fewest number of ICOs for the year at 176, raising a total of US$1.611 Billion. ICOs are also increasingly moving away from public sales, for fear of regulatory reproach. The largest raise of the quarter was HetaChain’s $190 million. The project is a business-focused blockchain which uses Byzantine Fault Tolerant delegated Proof of Stake as consensus. Despite the downturn, overall 2018 saw both the highest number of ICOs and the largest USD sum raised compared to previous years.

Source: coinschedule.com

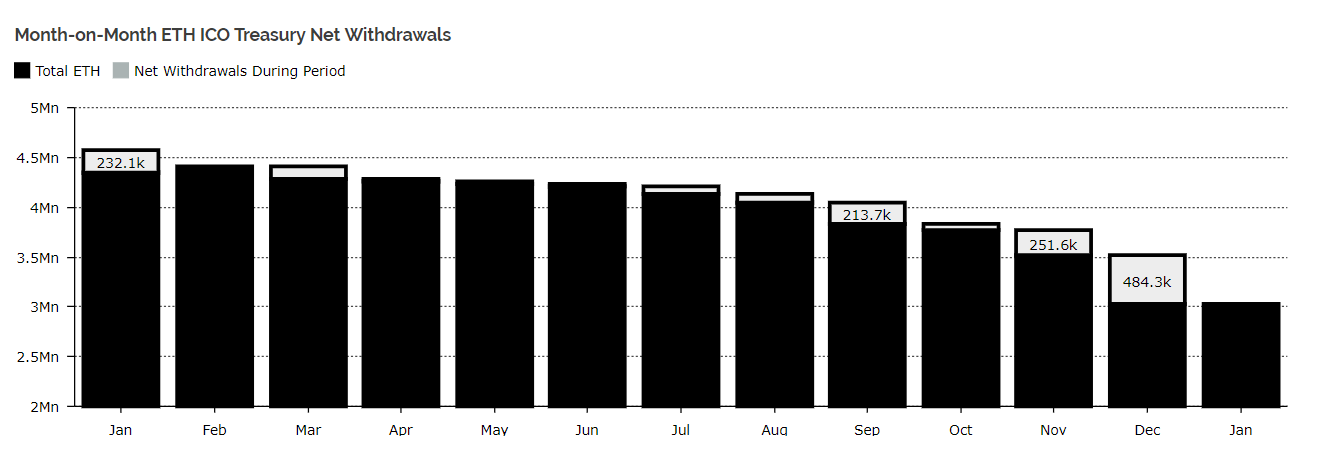

ICO treasury balances continue to shrink, both in USD value and in ETH quantity. December saw the largest outflows of the year at ~484,000 ETH. ICOs and dApps continue to hold ~3 million ETH, or ~2.9% of the circulating ETH supply. In early December, the Kyber Network, a decentralized token swap platform, saw outflows totalling 69,000 ETH, one of the largest of the year. DigixDAO, a project which has attempted to tokenize gold, continues to hold 395,430 ETH, which is valued higher than the market cap of the DigixDAO token.

Source: diar.co/ethereum-ico-treasury-balances/

Exchange changes and market delays

Several retail trading platforms had dramatic changes in Q4. On September 27th, 1broker.com, a popular CFD platform, was seized by the FBI for failing to comply with U.S. KYC/AML requirements. The SEC also alleged that 1Broker founder Patrick Brunner was guilty of failing to register the exchange as a dealer of security-based swaps. In early November, Bitmex, the largest crypto-derivative platform, implemented strict KYC on top of already geo-restricting IP addresses. Coinbase, the most popular onboarding platform in the U.S., added several new coins including ZRX on October 12th, BAT on November 5th and ZEC on November 30th,

Three large market influencers experienced delays in Q4. Bakkt, which raised US$182.5 million from 12 partners and investors in 2018, pushed back its launch date to bring a physically delivered BTC future some time in "early 2019". Bakkt is a subsidiary of the Intercontinental Exchange, which also runs the New York Stock Exchange. A physically delivered BTC future is a contrast to the CME and CBOEs cash-settled futures product. Bitmain, the ASIC miner behemoth, continued to run into trouble in Q4 with dwindling cash on hand as well as releasing staff and experiencing a C-suite management change. Bitmain had plans to IPO through Hong Kong’s HKEX, but that has been delayed too. Finally, on December 6th, the U.S. SEC again delayed its decision on the VanEck-SolidX Bitcoin ETF with the next deadline slated for February 27th, 2019. All previous proposals for a bitcoin ETF have been rejected by the SEC.

Don’t miss out – Find out more today