Bitcoin Price Analysis: Exchanges in Trouble

This was a quiet week for news, with many articles still focusing on predictions for next year. Perhaps the most interesting topics is [Cryptsy](https://www.cryptsy.com/), one of the oldest Alt-Coin exchanges.

This was a quiet week for news, with many articles still focusing on predictions for next year. Perhaps the most interesting topics is Cryptsy, one of the oldest Alt-Coin exchanges. Rumors around the blogosphere have been skeptical of Cryptsy for some time now, with people complaining about withdrawal delays and concerns over a possible SEC investigation.

We have mentioned the allegation of an SEC investigation before, which is adamantly denied by Cryptsy, but let’s take this opportunity to analyze what such an event would do to the price of Bitcoin.

- We can clearly see that the gap between the market cap of Bitcoin and Alt-Coins has been steadily increasing over the past few years.

- Miners tend to focus on Alt-Coins so they can earn a better return than mining Bitcoin, although they tend to sell for bitcoin in the end.

- There are still some speculators and active traders left in Alt-Coins, but that trend is starting to wear off. With regulators starting to take more of an interest in the Bitcoin space, their numbers may be decreasing.

The end result will most likely be positive for Bitcoin. In order for traders to get out of this game of Alt-Coins, value will be converted into Bitcoin, which provides better off-ramps. We now need to watch what may be the final chapter in Alt-Coin exchanges. If they go quietly into the night, and without running away with anyone’s bitcoins, it will be a positive development for the ecosystem. On the other hand, if the regulatory hammer comes down, or there is long term withdrawal freeze and people start to question the return of their capital, then we would have a negative situation for confidence as panic sets in.

Let’s also talk about news outside of the Bitcoin space, that will not only affect our industry but most likely all technology companies. The Dutch Government has stated publicly that they are taking a stand against backdoors to digital content, and seem to be in favor of encryption. This could go a long way for technology companies and entrepreneurs setting up their operations in the country, but they would still have to deal with some of the most powerful nations in the world having the complete opposite view.

One of those countries happens to be around the corner, with the UK Prime Minister David Cameron stating that encryption should be banned. This will be a pivotal debate, bringing Bitcoin front and center. In addition, the United Kingdom has been very aggressive in attempts to go after citizens that may potentially owe taxes. Just like the US and most of Europe, the plan is to have the ability to confiscate money directly out of people’s banks accounts. These developments will highlight the use cases for Bitcoin as well, so the more headlines highlighting the freedom or restriction of technology or the savings of money at a bank, the better the chances of re-capturing those all time highs for Bitcoin.

Finally, we should mention another US state looking to tackle regulations on Crypto Currencies. While the measure is technically postponed, it looks like the plan is to classify Bitcoin as Money. It would be hard to say what that means as it will most likely clash with the federal regulations – that are also attempting to classify Bitcoin in multiple ways. For now, this is just one more regulatory aspect to keep an eye on, but should not have any direct effect on the price.

Last week I talked at length about what I am expecting from the price over the next year. Today I will just stick to the shorter time period.

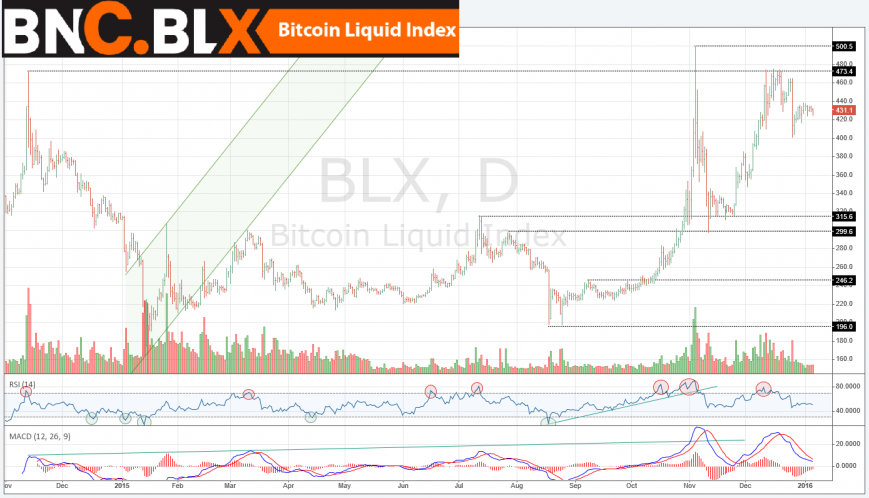

Looking at the daily chart above, displaying the BNC Liquid Index (BLX), the price has been consolidating in the $430 range for another week. The Bear Flag is coming to a conclusion, and if it plays out as expected, we are on the verge of a $20-30 drop. I am also waiting for the RSI indicator to touch the oversold 30 level. Over the last year, the RSI has been consistently swinging from overbought (above 70 circled Red) to oversold (below 30 circled Green). We will continue to be either Bearish or Neutral until we see this momentum indicator come back down, and work off its overbought condition. This can of course happen at any price, but the ideal range for a pull back would be in the $300-350 zone. In addition, we have the down trending MACD coming down to the 0 level. Traders also have to keep in mind that if we use the closing prices, and remove the intra-day spikes above $450, there is very clear divergence between the price and the momentum indicators.

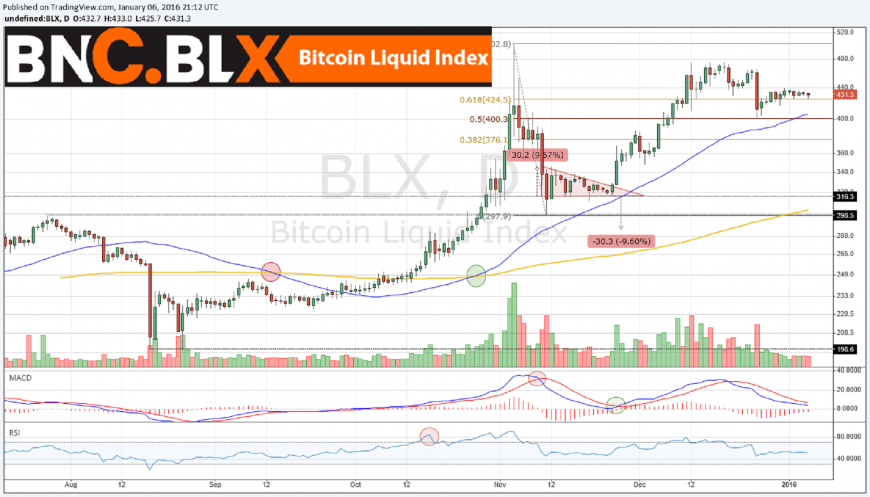

Here is a zoomed in version of the same daily chart. It shows a breakout from the Descending Triangle in the non-conventional direction. We are now right on top of the 61.8% Fibonacci line as we continue to shrink the gap with the 50-day Simple Moving Average (SMA). We are expecting to touch the 50-day SMA over the next few weeks. It will be interesting to see is what happens the moment they come together. A break below the average could send prices quickly down as low as the 200-day SMA, a strong bounce off of this average can take us back up to last year’s highs around $500. I will be watching this interaction very carefully in the coming weeks.

The more detailed explanations of the Short, Medium and Long-Term outlooks of technical charts are reserved for subscribers to the BraveNewCoin Traders Report. It also breaks down all the relevant weekly news and their influence on Bitcoin’s price and general standing within the financial ecosystem. For traders looking use the BNC Liquid Index for long term charting, it is available on Trading View updated Daily.

Final Thoughts

As a closing thought, we have not mentioned the price of individual Alt-Coins in a while. As mentioned above, we expect all Alt-Coins to take a hit as issues with Alt-Coin exchanges continue to progress. I’ve been talking about a possible sustained bounce in DASH at the $2 mark. We came up just short of the $2 target as the low was made at the $2.08 mark, but the bounce has been strong. Just last week we broke $3.5 and are currently consolidating around $3.30. The most likely scenario from here is a pull back to the $3.00 area, but it is also very likely that the high for this one is not yet in place. A strong bounce of the $3 area could send it back to last week’s highs.

Ethereum is another interesting alternative. It has been consolidating for some time around the $1 mark, and there continues to be hype around the project. While the price can break out either way, I’m not very optimistic on the long term success of the project at the moment, so I would lean towards the downside here. Keep an eye on the interaction with the $1 resistance mark carefully before making any speculative decisions.

This article was completed on Tuesday January 6th 7:00 pm ET, when the BNC Liquid Index (BLX) was $430

Tone Vays will be speaking at the following upcoming events:

TNABC, Miami, FL Jan 21 – 22

Anarchapulco, Acapulco, MX Feb 18 – 21

Hoftra University, Long Island, NY Mar 3

Blockchain Conference, San Francisco, CA Mar 7

CMU Summit at Carnegie Mellon University, Pittsburgh PA, Apr 10

Inside Bitcoins, NYC Apr 11 – 12

Inside Bitcoins, HK May 24 – 25

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today