Bitcoin Price Analysis: Institutional Blockchains

Last week there were several events geared towards the current [financial](http://www.americanbanker.com/conferences/digitalcurrencies/) and [technology](http://lmhq.nyc/events/microsoft-and-mit-media-lab-invite-you-blockchain-social-good) sectors, providing a full introduction to how Blockchain technology will be revolutionizing their industries.

Market Thoughts

Last week there were several events geared towards the current financial and technology sectors, providing a full introduction to how Blockchain technology will be revolutionizing their industries.

Attending one of the events, and talking to people about the other, it is pretty clear that the current establishment is very interested in Blockchain technology. However, bitcoin appears to be dismissed, a nuisance that is holding the industry back.

For legacy institutions bitcoin introduces avoidable legal risk. While Know Your Customer (KYC) and Anti Money Laundering (AML) compliance costs and frameworks are well established in the finance and technology sectors, the risk versus reward for including bitcoin will undoubtedly be perceived as inappropriate.

The risks compound when we introduce the digital currencies volatility. Although more stable over the past few months, the price swings in bitcoin have been relatively monumental in comparison to any fiat currency. Taking volatility into account, and adjusting any equations along the way, is clearly a challenge that few establishment players will tackle.

The overriding feature of bitcoin, that institutions will always avoid, is its decentralised nature. The entire concept of a consensus driven distributed leger, where the rules of the network are decided by anyone other than trusted business partners, introduces yet more facets to the risk profile which large incumbents need to factor in.

This is where most should come to a realization that if the current industries were to adopt this technology, Bitcoin would not even be in consideration. What these large industry participants are really looking for is cost savings and speed increases only, and everything else that Bitcoin brings to the table just gets in the way.

This should not come as a shock. While industries often adopt competing solutions that provide increased profit margins, efficiencies, and scalability, very few are nimble enough to adopt a solution that has the potential to make their underlying business redundant.

It’s equivalent to the publishing industry embracing the parts of the internet that allow them to communicate faster, and provide access to larger markets, but not the ability to self publish.

As with the Internet, you can’t put the genie back in the bottle, or restrict development in areas that compete with your business. Even though bitcoinless Blockchain technology will continue to be developed and adopted, the public decentralized leger for which bitcoins are the financial backbone will also continue to grow.

What is more likely to happen is a similar paradigm to today’s internet. There is more information on firewalled corporate intranet servers, but only when they are all theoretically combined. No single intranet database will ever outgrow the current public Internet.

In the Blockchain space, parts of the economy will have their own proprietary blockchains between certain sectors similar in nature. While together they may be bigger than the public ledger of the Bitcoin Blockchain, the public, open, and multi functional Bitcoin network will remain the single biggest entity.

Market Outlook

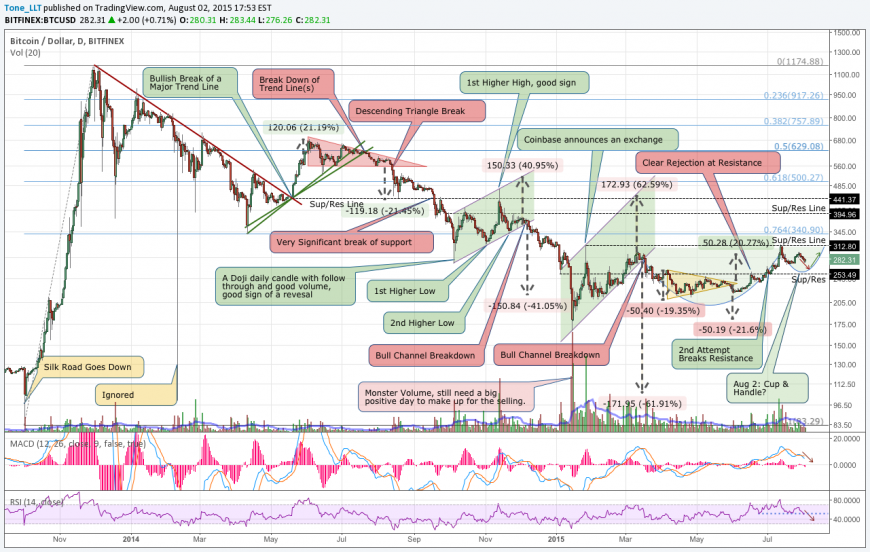

The technical picture remains generally Bullish, but the inability to cross back over the $300 mark could present a problem.

Bitcoin turned a bit prematurely from the low $270’s and quickly headed back for $300. The good news was that the closer we were to $300 as it turned, the higher the chances of going back over this hurdle. The bad however, is that we turned a bit too early and continue to remain in a slightly overbought condition, that may have both longs and shorts a bit trapped. This all stems from the 40+ percent rise, in less than a month, which started on June 16. Looking back at the history of Bitcoin you can say that this move is not as major as the moves earlier in the year, but what people need to realize is that 6 months in the Bitcoin world is 5+ years in other markets. During the last 6 months alone there has been an additional 600,000+ bitcoins added to the market, exchanges are evolving, and there is now better access to bitcoin in general. As we move forward this evolution will drive adoption, providing a larger market with less volatility.

In the current outlook you can also see a possible Cup and Handle pattern, even though the bottom of the cup will not be coming into contact with the price. On the momentum side we continue to see signs that there is some more room to the downside, as the overbought condition continues to be worked off.

The more detailed Daily Chart is now reserved for subscribers to BraveNewCoin Traders Report, which outlines short-term, intermediate-term and long-term viewpoints. It also breaks down all the relevant weekly news and its influence on bitcoin’s price. The reports are free for a limited time.

Final Thoughts

In light of the status quo slowly falling in love with some parts of the latest technology, we expect an eventual push towards more privacy for the consumer. Bitcoin will play a vital role in this transition as it will not only introduce the users of this asset to some aspects of financial privacy and responsibility, but also the fact that many Internet initiatives would not have been possible were it not for bitcoin the currency. It would have been impossible to go after the established giants like Facebook, Youtube and even Amazon without a revolutionary payment method with inherent revenue sharing ability. Bitcoin may also become the way current disruptors like Uber and AirBnB survive and grow, as they are still dependent on third party payment systems that can easily be withdrawn, as we saw with Backpage recently.

This article was completed on Thursday Aug 2 6:00 pm ET, when BraveNewCoins Index showed Bitcoin price at $280 USD. Tone Vays will be a speaker at the upcoming Inside Bitcoins San Diego Conference Dec 11-14.

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general (but especially Bitcoin) is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today