Bitcoin price analysis: Nov 19 – Bitcoin in traditional finance

More and more traditional institutions are coming to the realization that the [Blockchain can solve many of their inefficiencies](news/leading-clearing-houses-join-london-stock-exchange-in-exploring-the-blockchain/).

More and more traditional institutions are coming to the realization that the Blockchain can solve many of their inefficiencies. Of course, in this context we are not talking about the Bitcoin Blockchain but the technology behind it, which would allow for things like instant transactions and settlements between these institutions.

The questions that a lot of people are now asking is: What does this mean for Bitcoin’s future? It honestly depends on who you ask. According to Jamie Dimon, the CEO of JPMorgan Chase, Bitcoin will not survive, but it’s the underlying technology that’s the real innovation. If you ask the original promoters and users of Bitcoin however, the answer is quite different.

Bitcoin created an environment where something of value can now be transferred over the internet, as was famously predicted by the Nobel Prize winning economist Milton Friedman in 1999 – 7 years before his death, and 10 years before the first Bitcoin transaction. These two dynamics are very different, and Bitcoin believers should not be worried about traditional institutions taking over, or changing, the original use case of the Bitcoin Blockchain.

The success of the use cases of this underlying technology will only strengthen the confidence in the Bitcoin Blockchain and with the rise in confidence there usually comes a rise in the price.

Besides private financial institutions looking to utilize the aspects of Bitcoin’s technology for their benefit, Central Banking institutions are also looking to utilize what they deem valuable. We recently learned that the Bank of Canada views the power of Bitcoin as a possible tool to move away from physical cash.

As explained by the Deputy Governor Carolyn Wilkins, there may come a time where the bank needs to apply negative interest rates on deposits, and having physical cash presents a bit of a problem. In Regions where a negative rate has been implemented, like Sweden, there are reports of people hiding cash at home, avoiding the charge for holding funds in the bank, and negating the effect of implementing the negative rate.

Another reason for the elimination of physical cash that is mentioned in the article is that “it has the added advantage of taxing illicit activities.” This is a very important point, and not mentioned enough in financial reporting. This is perhaps the biggest reason to eliminate cash, and if Bitcoin helps Governments and the Central Banks get there, they will be all for it, for the time being.

However, a day will most likely come when the identities of Bitcoin holders will need to be known, otherwise these initiatives will not achieve their goal, as Bitcoin will become the asset people hold just like the cash hidden in Swedish homes. The fact that it is the only asset, if properly secured, that cannot be confiscated by any means, may just become the ‘killer app’ some are saying Bitcoin needs to reach the next level of adoption.

Market Outlook

To gauge the current confidence level in a Bitcoin based digital world, we examine the price to see where it might be headed next.

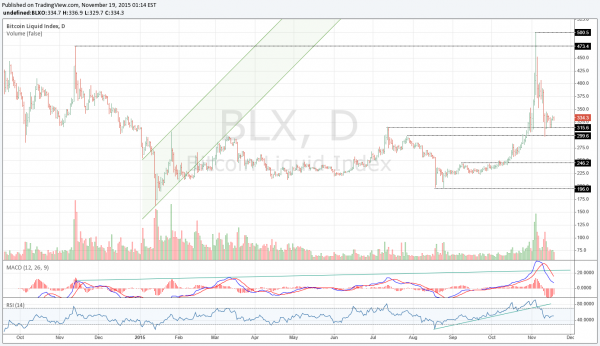

This is the daily chart of the BNC Liquid Index (BLX). It shows that we have fallen from the recent exponential rise in price, and are currently still sitting above two important support levels. The Momentum indicators have fallen from their overbought conditions, and are starting to approach standard levels. Volume has also tapered off, and it is now becoming clear that the recent rise in prices was a lot more hype than real adoption.

More detailed explanations of the Short, Medium and Long-Term outlooks for technical charts are available in the BNC. Weekly Traders Report. We also break down all the relevant weekly news, it’s influence on Bitcoin’s price, and general standing within the financial ecosystem.

Final Thoughts

Without physical cash, there would no longer be a need for ATM machines. More importantly, it eliminates a potential ‘bank run‘. The lines of people stretching around the block will only be seen in historic pictures of the Great Depression, or more recently the Greek banking shutdown. In the case of Greece, the maximum amount to withdraw was 20-60 Euro’s, and that would still be the case in a digital cash society but without the visual effects of a confidence loss in a financial system. Bitcoin’s greatest asset might just be a hedge against these inevitable financial catastrophes.

This article was completed on Wednesday November 18th 11:00 pm ET, when the BNC Liquid Index (BLX) was $333

Tone Vays will be speaking at the following upcoming events:

- MIT CHIEF, Nov 21 – 22

Inside Bitcoins Seoul, South Korea Dec 9 – 11

Inside Bitcoins San Diego, CA Dec 14 – 16

BitPanel, San Francisco Dec 17

TNABC, Miami, FL Jan 24

Anarchapulco, Acapulco, MX Feb 18 – 21

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general, and especially Bitcoin, is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

Don’t miss out – Find out more today