Crypto Market Forecast: Week of August 15th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, asset management giant BlackRock announces the launch of a new Bitcoin trust, the US Treasury Department sanctions Tornado Cash, and Ethereum gears up for the Merge.

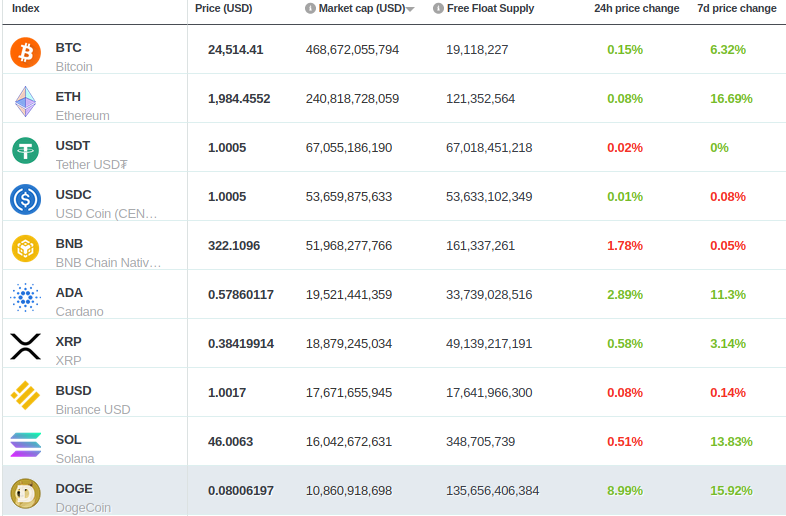

The Bitcoin price climbed over 6% this past week and currently sits at just over ~US$24K. The Ethereum price jumped by nearly 17% over the same period and currently at just under US$2K. This hike follows the successful Goerli testnet move from proof-of-work to proof-of-stake. Binance-coin (BNB) remains flat at ~US$322.

Last week, New York-based asset manager BlackRock Inc. announced it will be offering spot bitcoin private trusts to its institutional customers, citing “substantial interest from some institutional clients… [despite] the steep downturn in the digital asset market”.

BlackRock’s announcement follows another piece of bullish news from the previous week: Its partnership with Coinbase to enable institutional traders to track the status of their Bitcoin investments alongside traditional portfolios.

The US Treasury Department has sanctioned the Ethereum blockchain virtual currency mixing smart contract Tornado Cash, citing its alleged connection to North Korean hacker organization Lazarus Group. Following the sanction, Tornado Cash’s Github account was suspended; Circle blacklisted USDC addresses associated with the mixing service, and Dutch authorities arrested one of its suspected developers in Amsterdam — later confirmed to be 29-year-old Alexey Pertsev. Pertsev’s arrest follows that of Roman Sterlingov, who US authorities allege assisted in money laundering through Bitcoin Fog in 2021.

Wall Street traders who specialize in bankruptcy claims are offering customers whose funds are locked with failed lending platforms Voyager Digital and Celsius Network a way to recover some of their lost funds — albeit for a large percentage of their holdings. Bloomberg estimated the rates to be “at something like a 75% discount”.

Voyager filed for bankruptcy in July after “significant exposure” to Three Arrows Capital (3AC). Celsius filed for bankruptcy thereafter and allegedly had heavy exposure to the now failed Terra/LUNA assets.

Rumours abound relating to a supposed deal being negotiated by FTX founder Sam Bankman-Fried and Tron’s Justin Sun to buy a majority stake in Huobi Global. Details remain scant at this time, however, with Sun issuing a ‘sort of, but not really’ denial on Twitter.

Crypto news for the weeks ahead

August 28th

Yield, denominated in EOS, to be launched for DeFi dApps by the EOS Network based on total value locked (TVL).

Week of September 19th (or even earlier?)

The Ethereum blockchain is now scheduled to launch its long-awaited proof-of-stake (PoS) “Merge” during the week of 19 September. However, others predict the transition will happen ahead of schedule, as soon as 15 September.

August 17th

An account of the July debate between the powers that control interest rates in the United States is set to be released this Wednesday. The Federal Open Market Committee minutes may offer some insight into whether the Fed is leaning towards sharper interest rate hikes in the near future and may affect the prices in risk asset markets.

Top 10 Crypto Summary

A bullish week across the board for all assets, excluding stablecoins and Binance-coin (BNB), in the Brave New Coin top-ten market cap assets. Ether (ETH) led the surge with a near-17% spike following the successful Goerli testnet move from proof-of-work to proof-of-stake. The Goerli move was the final public testnet transition scheduled before the upcoming (mainnet) “Merge” is to take place in which the Ethereum blockchain will officially transition to proof-of-stake. Solana’s (SOL) recovery follows a sharp drop over the previous week following a hack affecting ~8,000 of its wallets.

Ethereum Price Chart

With Bitcoin trending steadily Glassnode’s special report this week focussed more on the surge in the Ethereum price given its upcoming transition to proof-of-stake. The report noted that traders are betting big with call options for a “sell the news” event — but with “huge amounts” of put options in place, post-merge: “speculating into it [but] hedged on the other side”. By contrast, the spot market for ETH is “lackluster” (unimpressive) when compared to the call options in place.

Don’t miss out – Find out more today