Crypto Market Forecast: Week of January 31st 2022

A curated weekly summary of forward-focused crypto news that matters. This week, markets bounce back after a difficult month of January, JPMorgan downgrades its long-term price BTC prediction from US$150,000 to US$38,000 and there are fundamental indications that BTC selling pressure may be exhausted.

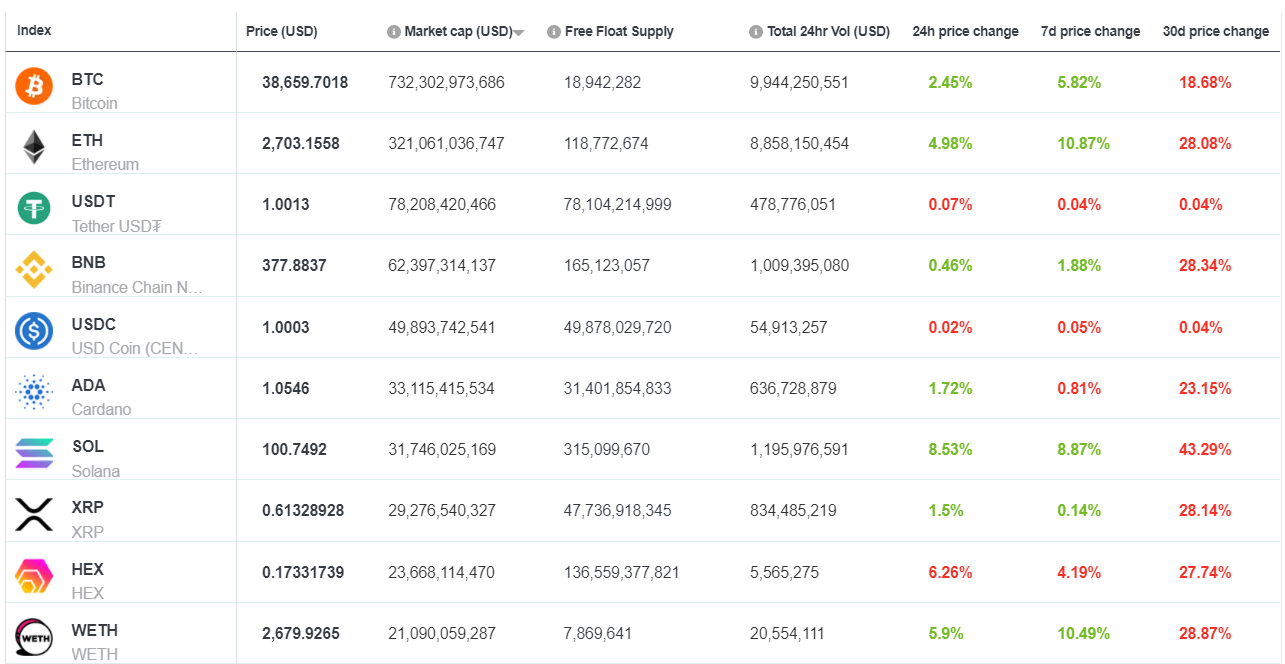

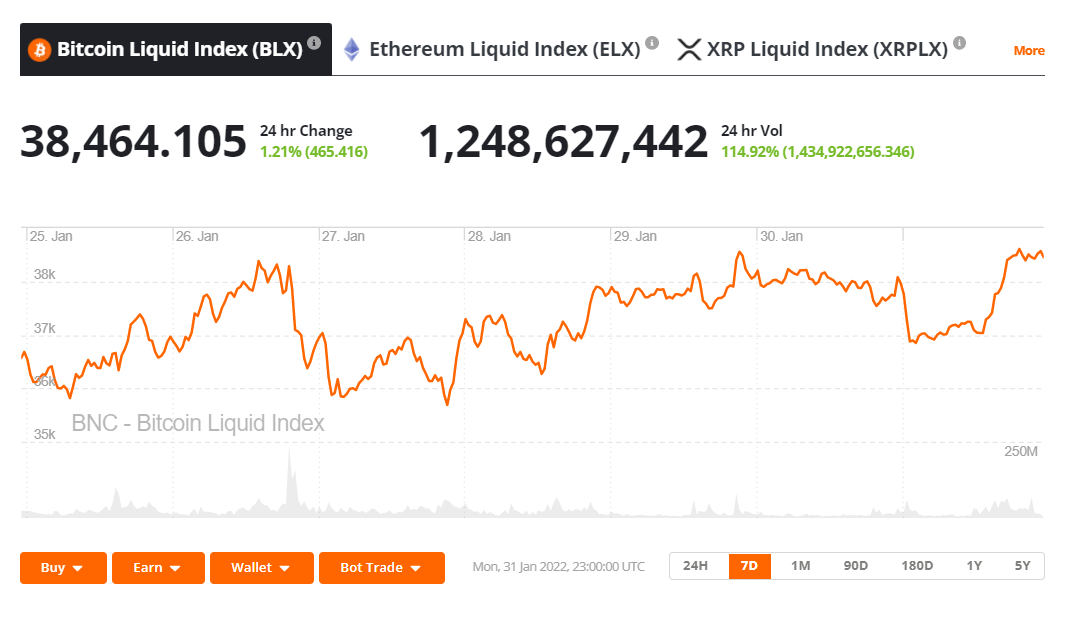

January was difficult for Bitcoin (BTC) and digital assets but the month closed positively with the market enjoying healthy gains in the last week. BTC ended the week up ~8% and close to the US$39,000 price level. The second and third largest assets on the Brave New Coin market cap table, Ethereum (ETH), and Binance-coin (BNB), are up ~14% and ~6%.

Last week, Investment Banking giant JPMorgan sharply adjusted its long-term bitcoin price prediction. In November when the price of BTC pushed past the US$60,000 price level, the bank set a target Bitcoin price of US$146,000. It now believes that US$38,000 is a more accurate price target. The key factor driving the downgraded estimate is the volatility of bitcoin markets.

The bank said “Our previous projection that the bitcoin to gold volatility ratio will fall to around 2x later this year seems unrealistic. Our fair value for bitcoin based on a volatility ratio of bitcoin to gold of around 4x would be 1/4th of $150,000, or $38,000.”

The US$150,000 target from JPMorgan was built on a belief that the price correlations of bitcoin and gold, a noted safe-haven asset, would converge. This convergence would lead to an equalization of the two assets in institutional investors’ portfolios.

Throughout 2021, bitcoin’s popularity grew amongst institutions as it showed an ability to maintain healthy and uncorrelated returns versus other asset classes. In recent months, however, it has lost value in step with traditional risk asset classes like equities. Across both BTC and equities, sell-offs have been sharp and connected to global central bank decisions surrounding a switch to interest rates hikes and monetary tightening to combat growing inflation concerns.

The sharpness of the crypto correction and shifting correlation narratives, in JPMorgan’s view, is the reason why institutional adoption will slow down. “The biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” the bank explained.

In January, BTC’s correlation with gold has dropped while its correlation with the S&P500 and Nasdaq indices has reached historical highs. There is no guarantee that this relationship will continue. If BTC and digital assets again decouple from traditional risk assets as they did in 2021, JPMorgan will likely re-explore its long-term BTC price predictions and set higher targets.

The bank’s view on Ether is different. ETH derives most of its value as a “decentralized application currency rather than a form of digital gold,” JPMorgan says.

It suggests that the biggest barrier to the network’s growth is its declining share of the Decentralized Finance (DeFi) and Non-fungible Token (NFT) market due to the growth of competitor platforms like Solana and Avalanche. Despite this, JPMorgan’s assessment is that the correlation between Bitcoin and Ethereum remains objectively high with the 60-day Pearson correlation coefficient between the two assets currently sitting at ~0.85.

Crypto news for the week ahead

__3rd and 4th February- Release of January US unemployment data __

This week we are set to get solid insights into the state of the world’s largest economy. Labour market data will indicate how many new jobs are being created in the US and whether the COVID-19 pandemic still has a chokehold on production. Weak job data coupled with the current environment of high inflation would leave central bankers with difficult decisions surrounding rate hikes and may create uncertainty amongst investors.

7th-9th February- Public Bitcoin bridge launch on Harmony network

Harmony, an Ethereum scaling network is set to finalize the public launch of a Bitcoin Bridge this week. The bridge will allow Harmony users to use native Bitcoin within Harmony’s DeFi ecosystem, while transaction fees and speeds will still be based on Harmony’s capabilities. Harmony’s native token, ONE, has dropped by ~10% in the last week, suggesting the implications of the new bridge may have already been priced in.

Top 10 Crypto Summary

The majority of large cap crypto assets enjoyed a period of recovery in the last week after what has been a difficult January. Ether was the strongest performer in the top 10. The network’s NFT sector continues to be popular and is attracting large transactions. On January 30th, an item from the Bored Ape Yacht Club (BAYC) sold for a staggering 1080.69 ETH or ~US$2.92 million on emerging NFT marketplace LooksRare.

Bitcoin Price Chart

There are emerging fundamental indications that Bitcoin’s difficult start to the year may be set to reverse. Market data provider Glassnode reported today that the amount of BTC on exchanges is hitting multi-year lows. A surprising pattern given the recent bearish price action. During bear markets traders generally put more BTC on exchanges in preparation to sell. This new pattern suggests seller exhaustion from BTC holders.

Don’t miss out – Find out more today