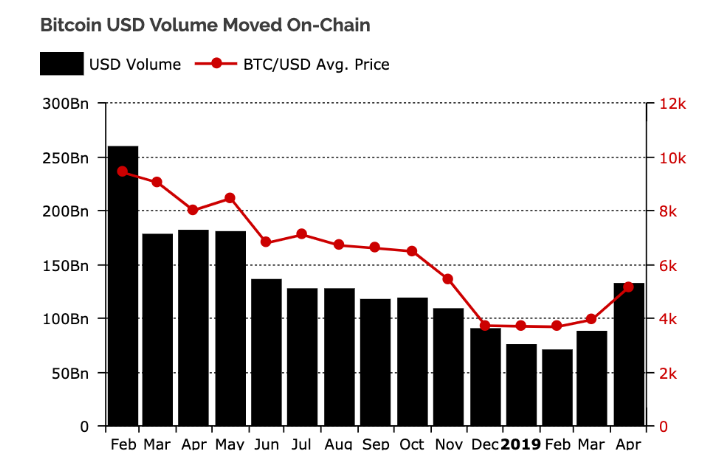

Higher fees follow rising Bitcoin volumes

Bitcoin’s April rally helped push on-chain volume to a 10 month high, but despite the progress of scaling solutions, bitcoin transaction fees increased by almost 200%. What are the implications?

Bitcoin on-chain volume rose in three consecutive months to reach a ten month high of over $130 billion in the month of April, reports Diar. In April the price of bitcoin increased by 28 percent as market sentiment improved following a long bear market.

Source: Bitcoin volume moved on-chain, Diar

This surge in network activity is also reflected in the number of transactions made. On the busiest days in April, the Bitcoin blockchain processed around 400,000 transactions. In the first week of May, this increased to 450,000 transactions per day, a number that approaches the all time high of 490,000 transactions processed on the busiest day of December 2017. At the time, bitcoin was generating mainstream press coverage and a wave of new buyers entered the market, sending the price parabolic and pushing fees to unprecedented levels.

Source: blockchain.com

A key factor in the rise in on-chain transactions per day from October 2018 to March 2019 can be attributed to VeriBlock (VBK), which secures other blockchains through the “Proof of Proof” (PoP) consensus mechanism. VBK transactions currently account for 15% of total BTC on-chain transactions.

More volume, higher fees

Following an 18 month bear market, market sentiment has improved and long term investors have begun to accumulate Bitcoin in anticipation of a new bull market. This is reflected by the recent surge in network activity and has been accompanied by another rise in transaction fees. Diar reports that average transaction fees increased by 200% in April versus March. Scaling solutions are underway but will fees stay manageable?

Source: blockchain.com

As more participants make a bitcoin transaction, all users compete with each other to have their transactions processed by miners. Fees increase as users are prepared to pay higher fees to incentivize miners to prioritize their transactions over others.

Those transactions attached to the lowest fees are left in the Mempool (Memory Pool)— a sort of waiting room for transactions that don’t have the requisite fees to be processed immediately. During the month of April, the number of transactions in the Mempool spiked, and so did the average transaction fee, which hit its highest level in nearly a year at $2.1, after sitting at around $0.40 over the last six months, according to data from Bitinfocharts.

Total transaction fees made across the network tell a similar story. The single day when the most transaction fees were paid was April 4th, when 154 BTC (~$770,000 at the time) was paid — an almost 10x increase from the roughly 15 – 30 BTC that was paid each day during the first three months of 2019.

This correlation between high levels of participation in the market and high fees suggests that the low cost of transaction fees during 2018 was not due to the success of scaling solutions, but simply due to a drop in the number of daily transactions.

Slow to scale?

When bitcoin briefly reached $20,000 at the peak of bitcoin’s late 2017 bull run, the near half a million daily transactions on the network paid an average fee of $55, compared with the 400,000 transactions on the busiest day in April that paid an average fee of $2.1.

Taken in isolation, these statistics show that despite a similar number of users on the network, today’s transaction fees remain low, suggesting that network capacity has increased and that the correlation between high fees and high levels of network activity is weakening.

Since the last bitcoin market cycle, scaling solutions have continued to develop. Bitcoin’s second layer scaling solution, the Lightning Network, has seen significant growth. According to bitcoin analytics site p2sh, the amount of bitcoin sent through lightning channels has surged from 20 BTC this time last year, to over 1000 BTC at present. While the Lightning Network is growing faster than many expected, recent reports suggest it may be several years before the network is ready for mainstream users.

The Segregated Witness, or SegWit, scaling solution which opens up extra space on the blockchain to increase capacity, was activated on August 23, 2017. It was used on around 12 percent of transactions by December 2017, but is now used on over 40 percent of all transactions. Diar estimates that, “at current SegWit usage levels, fees could go up as high as 300% should on-chain movement resemble that seen in at the end of 2017.”

However, a fee increase of this magnitude would remain 55% cheaper than those seen in December 2018. This suggests that SegWit is working as intended and it will continue to suppress fees as more wallet services and exchanges implement the scaling solution. With the Bitcoin network once again close to capacity, higher fees are inevitable when a new bull market emerges. A sudden positive news event (such as an ETF announcement) has the potential to create a sudden surge in transactions and higher fees as traders seek to profit on the news cycle and new buyers enter the market.

Further complicating the Bitcoin fee market is the wide variety of mechanisms used to estimate bitcoin transaction fees. Many exchanges and wallet providers don’t allow users to set their own fees, and sometimes default to higher fee settings in order to get transactions processed faster. Technical users are able to use advanced wallets such as the Bitcoin Core wallet, which offers a variety of fee settings. Advanced wallets aren’t recommended for new users however. This has led to the current environment where network capacity has increased, but many wallets and exchanges have failed to adjust the mechanisms used for estimating fees, and are therefore responsible for users overpaying fees.

“Fees aren’t high, fee estimators” are, suggest BitConsultants, pointing out a discrepancy between the amount of bitcoin that is needed to efficiently process a transaction on the network, and the amount of bitcoin that is paid to process that transaction.

Don’t miss out – Find out more today