Has Bitcoin bottomed? (“When blood runs in the street”)

After a near 10% drop overnight, it’s the question everyone is asking again — has Bitcoin bottomed? And if not, how will we know when it has? In this article, Digital Capital Management’s Timothy Enneking analyses BTC’s historical peak-to-valley performance and comes up with some answers

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing "when blood runs in the street" – James (mid-19th century) and Nathan (after the battle of Waterloo)). The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members…

In the crypto space, therefore, the question becomes: is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet. The basis for this conclusion is the past behavior of Bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto space – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

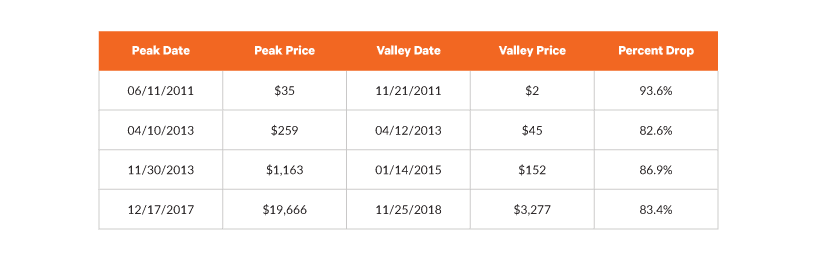

The data set used is all BTC (the usual symbol for Bitcoin) drops of 80% or more. There is a very interesting aspect to historical BTC performance: there are no peak-to-valley drops between 57% and 82% over the life of BTC. Thus, it becomes quite easy to narrow the data down since a drop of 50% is fundamentally and qualitatively different from a drop of more than 80%. Which leaves us with four instances: a bit too few in an ideal world, but enough, at least in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the heretofore third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239. If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be ten months without the unusual 2013 drop which saw a peak-to-valley duration of two days). This reinforces the conclusion that another bottom is probably close in terms of timing.

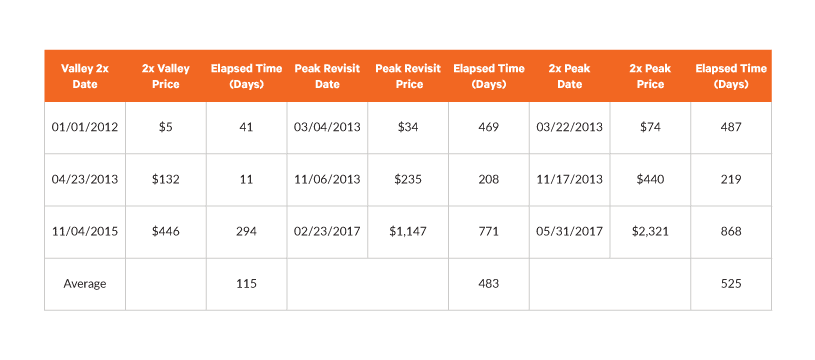

Then, once crypto markets hit bottom, how long does a recovery generally take? We see those data below:

So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months.

Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly. As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around.

So, are we at the bottom? Further analysis is required to determine that. Let’s call it "spike analysis". BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Its tops and bottoms are more violent. And that "violence" can be measured.

For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40% from the immediately surrounding prices. For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500%) shortly thereafter, was actually nearly 10% with an almost immediate recovery. The total drop was also the largest drop in Bitcoin history in percentage terms at 93.6%

*November 2011

*

The next peak, in April 2013 was even more dramatic, with a jump of 25-40% depending on what one chooses as the starting point.

April 2013

Stunningly, the next valley was put in two days later. For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis. Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc (good fuel for another article, but too much to address here).

Again, depending on what one chooses as a baseline, the drop here was about 20%. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds). This is now the fourth largest drop in BTC history, having just been displaced by the current one.

The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8% increase and, second, there was a clear double top – although, again, over a very short period of time.

November 2013

The next valley was just over one year later, in January 2015. This time the drop was about 15% and was very clear. The total peak-to-valley drop, at 86.9%, remains the second-largest in Bitcoin history.

January 2015

The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12% peak and was extremely clear.

December 2017

Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a "violent" bottom put in – in fact, the opposite is true.

Current

Of course, a "violent bottom" is simply another way of saying "capitulation". That concept has become so well known that many people, including authors of articles similar to this, are asking "have we seen capitulation yet?". My favorite recent quote in this regard is "point of apparent capitulation" – which appeared about $1,000 ago.

Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether "that move down" was capitulation or not, it wasn’t. So where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around 2,800. However, I suspect that the odds are higher that the BTC price will test 2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time.

One further point I would like to make is to address the question which "crypto folk" never ask, but which "fiat folk" do: can the Bitcoin price drop to zero? I remember almost six years ago when I first heard of Bitcoin and crypto currencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on "crypto currencies" that trade) and Bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system.

Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much "skin in the game", and too many advantages for the trading token ecosystem to utterly collapse. The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buying Bitcoin and other tokens which trade.

From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop.

About the author: Timothy Enneking is the founder and the primary Principal of Digital Capital Management. Prior to founding DCM, he was the founder and investment manager for the Crypto Currency Fund ("CCF"), one of the world’s first private funds focused on cryptocurrencies.

Don’t miss out – Find out more today