Terra’s Do Kwon Found Liable In Fraud Case

A US court has found Terraform Labs PTE Ltd. and its founder Do Kwon liable for defrauding investors in a multi-billion dollar crypto asset securities case.

After a rigorous nine-day trial, a jury in the United States District Court for the Southern District of New York has delivered a verdict in the fraud case that arguably was the trigger for a string of massive crypto failures in 2022 and 2023 : Terraform Labs PTE Ltd. and its former CEO, Do Kwon, have been found liable for defrauding investors in crypto asset securities.

Background

The case centered around Terraform Labs’ alleged unlawful offering and sale of crypto asset securities, a violation of the registration provisions outlined in the Securities Act of 1933. The court’s previous ruling had already established the company’s wrongdoing. The jury held Terraform Labs and Do Kwon accountable for their actions. Their deceptive practices misled investors on multiple fronts:

- Stability of Crypto Asset Security:

- Terraform Labs falsely portrayed the stability of their crypto asset security, Terra USD. Investors were led to believe it was a safe investment, only to suffer devastating losses.

- Algorithmic Stablecoin Misrepresentation:

- The defendants further misled investors by misrepresenting Terra USD as an algorithmic stablecoin. In reality, its stability was questionable, causing significant market value erosion almost overnight.

- Blockchain Payment Application Deception:

- Terraform Labs also obfuscated whether a popular payment application utilized their blockchain for processing and settling payments.

Gurbir S. Grewal, Director of the SEC Division of Enforcement, expressed satisfaction with the jury’s verdict – emphasizing the real-world consequences of non-compliance in the crypto markets. “We are pleased with today’s jury verdict holding Terraform Labs and Do Kwon liable for a massive crypto fraud. Through these deceptions, the defendants caused devastating losses for investors and wiped out tens of billions of market value nearly overnight. For all of crypto’s promises, the lack of registration and compliance have very real consequences for real people.

Do Kwon Arrest

Terraform founder Do Kwon has been arrested at an airport in the small Southeastern European country of Montenegro in March 2023. He had been on the run since he vanished from view in September 2022. He was the subject of an Interpol Red Notice arrest warrant issued by his home country South Korea which issued an arrest warrant for Kwon last September.

He is currently on bail in Montenegro as the country’s Supreme Court deliberates over competing extradition requests from the U.S. and South Korea. Both nations are seeking to prosecute Kwon on criminal charges related to the $40 billion collapse of the Terra ecosystem in May 2022.

Following the collapse, Kwon evaded authorities for months until his arrest in Montenegro for using false travel documents. Although initially sentenced to four months in prison, he remained incarcerated beyond this period. Upon release, Kwon has been placed in a shelter for foreigners, and his passport has been confiscated to prevent him from leaving Montenegro. The Supreme Court is currently considering whether to extradite him to South Korea or the U.S., but no decision timeline has been provided

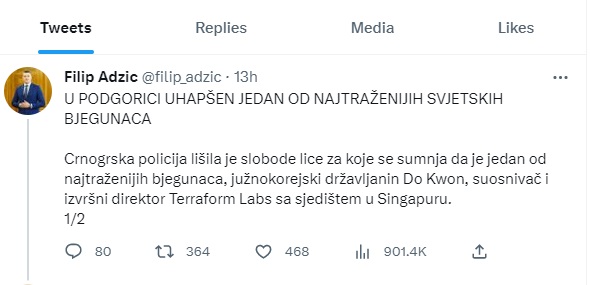

His initial arrest took place at the airport of Monetenegro’s largest city Podgorica and was first annouced on Twitter by Montenegro’s Interior Minister Filip Adzic.

Kwon is also being sought by US authorities after the SEC brought fraud charges against him in February. In its charges the SEC says from April 2018 until they crashed in May 2022, Terraform and Kwon raised billions of dollars from investors by offering and selling an inter-connected suite of crypto asset securities, many in unregistered transactions. The assets included Terra USD (UST), a crypto asset security referred to as an “algorithmic stablecoin” that supposedly maintained its peg to the U.S. dollar by being interchangeable for another of the Kwon’s crypto asset securities, LUNA.

The SEC’s complaint alleges that Terraform and Kwon marketed crypto asset securities to investors seeking to earn a profit, and repeatedly claimed the tokens would increase in value. For example, they touted and marketed UST as a “yield-bearing” stablecoin, which was advertised as paying as much as 20 percent interest through the Anchor Protocol.

The SEC’s complaint also alleges that, while marketing the LUNA token, Terraform and Kwon repeatedly misled and deceived investors that a popular Korean mobile payment application used the Terra blockchain to settle transactions that would accrue value to LUNA. Meanwhile, Terraform and Kwon also allegedly misled investors about the stability of UST. In May 2022, UST depegged from the U.S. dollar, and the price of it and the LUNA token fell to near zero.

SEC Chair Gary Gensler alleges that Kwon committed fraud by “repeating false and misleading statements to build trust” then caused devastating investor losses. “We allege that Terraform and Do Kwon failed to provide the public with full, fair, and truthful disclosure as required for a host of crypto asset securities, most notably for LUNA and Terra USD,” he says.

Gurbir Grewal, the director of the SEC’s Division of Enforcement said at the time that far from being a stable decentralized finance project, Kwon and Terraform Labs were instead operating a simple fraud.

“Today’s action not only holds the defendants accountable for their roles in Terra’s collapse, but once again highlights that we look to the economic realities of an offering, not the labels put on it.” As alleged in the complaint, Grewal says the Terraform ecosystem was “neither decentralized, nor finance. It was simply a fraud propped up by a so-called algorithmic “stablecoin” – the price of which was controlled by the defendants, not any code.”

Don’t miss out – Find out more today