Segwit2X — Forked from the get-go?

Announced on May 23rd, The New York Agreement (NYA) is the contract between the Bitcoin miners who represent the majority of Bitcoin’s hashing power, and a group of over 50 other businesses, to implement the Bitcoin software upgrade Segwit2x.

While it’s no secret that the NYA isn’t loved by everyone in the Bitcoin community, a series of events on October 24th left many wondering if the agreement might unravel entirely — leaving the project with no path forward to achieve its goal of upgrading Bitcoin and increasing its block size.

Announced on May 23rd, The New York Agreement (NYA) is the contract between the Bitcoin miners who represent the majority of Bitcoin’s hashing power, and a group of over 50 other businesses, to implement the Bitcoin software upgrade Segwit2x.

While it’s no secret that the NYA isn’t loved by everyone in the Bitcoin community, a series of events on October 24th left many wondering if the agreement might unravel entirely — leaving the project with no path forward to achieve its goal of upgrading Bitcoin and increasing its block size.

The troubles started on Monday morning with a blog post from NYA signatory and major backer Coinbase announcing how they and their subsidiary exchange GDAX would name the split blockchains resulting from the Segwit2x Bitcoin hard fork. “Following the fork,” said Coinbase communications director David Farmer, “Coinbase will continue referring to the current Bitcoin blockchain as Bitcoin (BTC) and the forked blockchain as Bitcoin2x (B2X).”

Bitfinex and a few exchanges that did not sign the NYA had previously announced similar naming conventions, while others have said they would not support the Segwit2x altcoin in any way. However, among those who signed the NYA, Coinbase currently claims 11.4 million Bitcoin-using customers — easily making it one of the most powerful signatories and an influential precedent-setter.

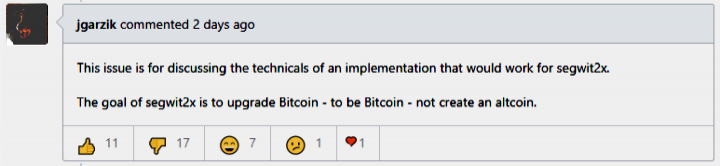

What made this announcement particularly important, however, is that by declaring in its naming scheme that the existing Bitcoin blockchain would remain BTC, Coinbase was essentially extinguishing any hope that the Segwit2x blockchain would be an upgrade replacement for the existing blockchain, and in doing so were positioning Segwit2x as just another dividend altcoin like bitcoin cash (BCH) or bitcoin gold (BTG). Segwit2x’s lead developer, Jeff Garzik himself stated on the Segwit2x development project that this was never the goal of the NYA.

For added context, it’s worth pointing out that the root of the NYA’s problems began much earlier. From the very start there were no Bitcoin Core developers who supported the Segwit2x fork, mainly because they claimed that the plan was too rushed and risky for a system that protects tens of billions of dollars worth of value.

Since May, nine NYA signatories have also dropped out for similar reasons — while others have moved over to support the bitcoin cash altcoin. Then on 11 October, the independently-operated Bitcoin.org website where Bitcoin’s primary software is distributed from issued a warning to all Bitcoin users that the fork could cause a major disruption and potentially put bitcoin holders’ investments at risk.

“bitcoin faces existential threats from forks, developer drama and so on. Knowing what we know and having a clean sheet of paper, we asked what would we build and the answer is this."

— — Jeff Garzik, CEO of Bloq and Metronome

Fast forward to Monday, and things got even more interesting. Soon after the Coinbase announcement, news broke that Garzik had been working on a competing cryptocurrency called Metronome during the time he has been working on Segwit2x. Garzik says he plans to release Metronome in December via an ICO sale because “bitcoin faces existential threats from forks, developer drama and so on. Knowing what we know and having a clean sheet of paper, we asked what would we build and the answer is this.”

Soon after this, Coinbase founder and CEO Brian Armstrong had second thoughts about his communications director’s explicit announcement the day before, tweeting: “Apologies our initial post was not as clear as it could have been about what happens after the fork … we’ll call the chain with the most accumulated difficulty bitcoin. Important for us to remain neutral and let the market decide.”

If one were to ask the community as a whole what it wants, there’s clearly no consensus over what should determine which blockchain becomes the ‘real’ Bitcoin after the fork. Many feel, for example, that Bitcoin is inherently tied to the core development team, since they designed the software and work hard to keep it updated. Others believe that it is the software client located in the Bitcoin directory at Github, which is how most open source projects define ownership.

Another position promoted by some outspoken bitcoin miners and many NYA signatories, is that the name Bitcoin is the ‘prize’ awarded to the blockchain that accumulates the majority of mining hashpower. This opinion is echoed by many Bitcoin business executives that are Segwit2x supporters, including Shapeshift CEO Erik Voorhees. “It will be Bitcoin if it earns the highest hash power and highest price,” he says. “The title will be bestowed in the marketplace, derived from its constituent pieces of miner, economic, and user support.”

Initially, the signatories of the NYA agreed on a plan that would have included over 95 percent of the Bitcoin mining hashrate. However, with recent events that number has slipped noticeably. Major mining pool F2Pool, currently responsible for 7.3% of bitcoin’s total hashrate, dropped out of the NYA at the end of August.

Further, over 3,000 miners moved from other pools to join the Slush Pool last week, which is the only major pool that lets individual miners decide for themselves which fork they’d like to support. The move saw Slush Pool rise to become the 5th largest pool with 8.5% of the total Bitcoin hashrate — and only 6% of its miners are signaling for Segwit2x, with 75% signaling for the legacy chain.

So what does this mean? Added together, that makes at least 14% who will definitely be mining for legacy Bitcoin, while the Segwit2x chain is likely to have 78% — minus those mining for bitcoin cash (a number that infamously varies day by day). Another 9% are undeclared. As a result, with 14% or more of the mining hashrate, legacy Bitcoin’s blockchain isn’t necessarily doomed. It will still likely result in slower transactions and higher fees at the time of the fork, but it may well hold its value long enough to convince the miners to come back.

Certainly this the view of many current Bitcoin holders — as was evidenced by the price on Bitfinex and a few other exchanges that began trading futures tokens based on the Segwit2x chain split — allowing bitcoin holders to speculate on the eventual price of the two coins. The result? At press time, Bitfinex lists the token that represents Segwit2x trading for only 14% of the price of the corresponding Bitcoin token. At OKEx, the Segwit2x’s futures token is trading slightly lower at 13%. For those who believe the market is the ultimate decider of which coin is the real bitcoin, the answer is already clear.

“We will not actively fork away from what we view as ‘bitcoin’, which is the chain that is supported by the current Core dev team."

— — Bitwala public statement on Segwit2x

Last but not least, it would be foolhardy to overlook the exchanges, since a unified position between them would drive some certainty into the marketplace. Unfortunately, that won’t be happening anytime soon because at least 10 exchanges including the popular derivatives exchange BitMex, have declared that they will maintain legacy Bitcoin as BTC on their platforms. A statement on the matter from Bitwala is typical of the sentiment of many exchanges: "We will not actively fork away from what we view as ‘bitcoin’, which is the chain that is supported by the current Core dev team."

At the time of writing, the hard fork for Segwit2x is still projected to occur on November 16. Unless enough NYA signers back down in time cancelling the fork entirely, we may see bitcoin’s first contentious hard fork at that time.

Don’t miss out – Find out more today