Bitcoin Price Analysis — The trend is still your friend

After a strong rejection at US$6200, the Bitcoin price is up 11% from the week's lows, now with a market capitalization of just under US$100 billion. As the age of the Bitcoin fork is being thrust upon us all, with Bitcoin Cash, Bitcoin Gold, and on November 16th,SegWit2x, the fundamentals surrounding these forks are murky at best and a disaster at worst.

Bitcoin Price Analysis – Volatility reigns

Bitcoin has been extremely volatile over the past week, now recovering after violent 4% and 8% pullbacks. The market cap for the top cryptocurrency now stands at US$94 billion and flirting with another all-time-high.

Private Instant Verified Transaction(X) Price Analysis

Private Instant Verified Transaction(X) (PIVX) currently has a market cap of US$202 million. The asset spiked in February of this year, yielding a 72x return. PIVX is a fork created from Bitcoin and DASH, originally released as Darknet in February 2016 and later rebranded. The main goals and benefits of PIVX are similar to DASH, instant private transactions with a decentralized, community-driven governance model. This is achieved through a Proof of Stake (PoS) consensus algorithm which also uses Masternodes requiring 10,000 PIVX (US$37,000). There are currently 2,045 PIVX Masternodes which lock up 20,450,000 of the total supply, or about 27%.

Ethereum Price Analysis – Network slowdown precedes fork

Ethereum (ETH) now has a US$28 billion market capitalization, second only to Bitcoin’s US$72 billion. ETH is now the fourth largest digital cryptocurrency or asset by volume, below Bitcoin, Bitcoin Cash, and Ripple. ETH has been in a tight range for the past week with very negligible volatility. A decline in volume and volatility is very likely due to the upcoming Metropolis hard fork, the 3rd of 4 launch stages for Ethereum.

Bitshares Price Analysis – DEX provides silver lining

At USD$203 million, BitShares is the 49th largest cryptocurrency by market capitalization. The asset has fallen sharply over the past 3 months, and now sits at ~11% of its previous June 2017 high.

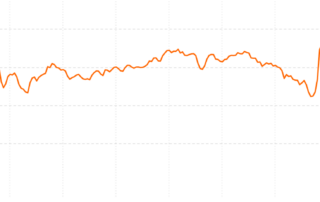

Bitcoin Price Analysis – A perfect storm

Bitcoin has dropped ~USD$400 in the past 24 hours, contributing to a total ~USD$1450 drop over the last seven days. The leading cryptocurrency is down ~US$1150 since its recent high of ~US$4950 on Sept 2nd, or nearly 30%. The lackluster performance can be attributed to both technical and fundamental factors. On September 4th, China announced an outright ban of all ICOs, suggested refunding any collected funds in any ongoing crowd sales, and hinted at the shuttering of exchanges trading ICOs.

Bitcoin Price Analysis – China rocks markets

On Monday, Labor Day in the United States, China announced an outright ban of ICOs and recommended money collected by Chinese ICOs be refunded to investors. Although Bitcoin itself is not directly involved with most ICOs, Bitcoin and cryptocurrencies in general, have benefited from the ICO boon by bringing new eyeballs to the nascent space. While this regulation has almost no effect on Bitcoin directly, new investors are likely to be spooked by the news. China has a history of introducing regulation — often at the peak of large movements in price. In January this year, the People's Bank of China (PBoC) announced regulatory changes on domestic Bitcoin exchanges which sent Bitcoin price tumbling 36% in a week.

Bitcoin Price Analysis – Retesting all time highs

The Bitcoin network and price has been heavily influenced by Bitcoin Cash (BCash) and SegWit activation over the past few weeks. It is no coincidence that BCash was launched to directly compete in this manner. The market has been struggling to continue to price in SegWit, a protocol improvement that lends itself to better network efficiency, and BCash, an attempt at direct competition to Bitcoin. This hypothesis can be evaluated by comparing various network metrics of both Bitcoin and BCash.

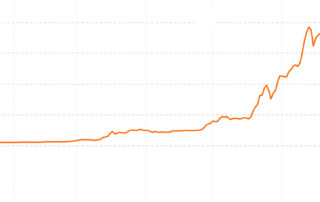

Bitcoin Price Analysis – Uncharted territory

The month of August has been excellent for Bitcoin as it continues to push all-time highs (ATHs). With the Bitcoin Cash split now history, many investors have likely re-entered. Market cap made a new high of $71.6 billion, higher than that of PayPal and approximately the GDP of Oman.

Bitcoin Price Analysis – Consolidation continues

Bitcoin has continued consolidating near all time highs over the past week, with little price action. Hash rate is also essentially unchanged, while SegWit is on track for lock-in and activation sometime later this month. All eyes were on the Bitcoin Cash (BCH) fork of Bitcoin, which occurred on August 1st. It’s had a few issues from the start. Initial hash rate was extremely low. BCH still needs several difficulty adjustments before miners are incentivized to switch from any profitable cryptocurrency.

Bitcoin Price Analysis – Expect volatility

Bitcoin has been on a rollercoaster ride over the past 10 days with multiple deep retracements following almost complete recovery. Price continues to flirt with a new all time high above $3000. In addition, Bitcoin has a chance to break its previous all time high in market capitalization, above $50.4 billion.

Bitcoin Price Analysis – Longstanding support holds

After closing down almost 25% last week, bitcoin has recovered almost 75% of the loss, and is now comfortably back above $2000. The wildly volatile week followed more than 25 days of consolidation. The last consolidation period of this length was in June and July 2016. Both periods resolved with large down days followed by a quick reversal.

Bitcoin Price Analysis – consolidation ending

Bitcoin has essentially remained flat for the week, and it is no coincidence that price action has slowed as a protocol altering event, UASF/BIP148 approaches. The spot price appears stuck in heavy triangular consolidation. Traders will note the descending volume profile, and expect a heavy spike in volume upon resolution of the consolidation.

Bitcoin Price Analysis – SegWit looming

Bitcoin has been ranging over the past week, down $158 or about 5.8%. Hash rate has also decreased slightly, now at 4.8 trillion GH/s. The most pressing matter continues to be the scalability and block size debate.

Bitcoin Price Analysis – Bitcoin erases losses

Bitcoin experienced a 20% down day this week after a bitmain blog post outlining a UASF/BIP148 contingency plan for a hard fork. The spot price has now recovered to previous levels, ending flat on the week.

Bitcoin Price Analysis – Time to sit back

Bitcoin continues its seemingly endless bull rally, gaining an additional 15% this week, closing convincingly above a nasty candle wick at $2745. New all time highs continue to be made week over week, with the spot price having now broken $3000.